For those new to Pharmboy’s TA Book, previous chapters are:

1. Understanding Market Cycles: The Art of Market Timing (Chp. 1),

2. Dow’s Theory of Markets (Chp. 2),

3 & 4. Fundamental vs. Technical Analysis and Types of Technical Trading (Chps. 3 & 4).

5. Stock Charting Basics: How to Read & Understand Stock Charts (Chp. 5 here.)

All caught up? Here’s Chapter 6:

Using Moving Averages for Long and Short Trades

The use of moving averages (MA) are a mandatory requirement for technical trading. They are a favorite indicator of chartists. Chartists do not consider a trade without looking at the relevant MAs. A MA is the average value of a stock’s price over a certain length of time. There are several uses for MAs:

- To determine momentum

- To show “invisible” support and resistance

- To give traders a head start in placing high-probability trades

- To signal warning of a breakdown

- To support the consensus of other technical indicators

All MAs are lagging indicators, meaning that they will react to price, and not foreshadow it. Moving averages work in trending stocks and do not work well when a stock is in a neutral trading range. Merck (MRK) is an example of a stock that has been trending up since May (Figure 23) and the 50 and 200d MA crossed over in July. Notice how the 50d MA acts as support for the uptrend:

.png)

There are many types of MAs (simple, exponential, variable, linearly-weighted), but only will the two most widely used will be discussed: the simple (SMA) and exponential (EMA) moving averages.

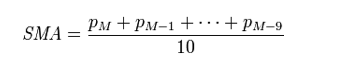

The SMA is calculated by taking the average price of a stock over a certain period of time giving equal weight to each day.

The EMA is calculated as either percent-based or period-based. The exact mathematical formula will not be covered, but the EMA cuts down the lag time by distributing more weight to recent prices and less weight to older prices. The shorter the EMA (in days), the more weight is designated to the most recent price. Therefore, the EMA is almost always closer to the current price than the SMA.

Which one is more useful? The determining factor is small, but there are large differences once a stock becomes more volatile. The EMA should be used for day/swing trading. The short time frames are factored into the EMA. The SMA is a better indicator if the holding period is several weeks because theEMA is too sensitive to small changes and will give false signals, which makes it less effective for longer periods. If a moving average does not provide accurate support or resistance guidance, then there is no point in using it. Not all stocks follow the same moving averages.

Here is a sample guideline for which MA’s to use:

Long (buy) or Short (sell) trades:

- 10 or 15-day SMA (short-term)

- 20-day SMA (short-term)

- 50-day SMA (intermediate-term)

- 200-daySMA (long-term)

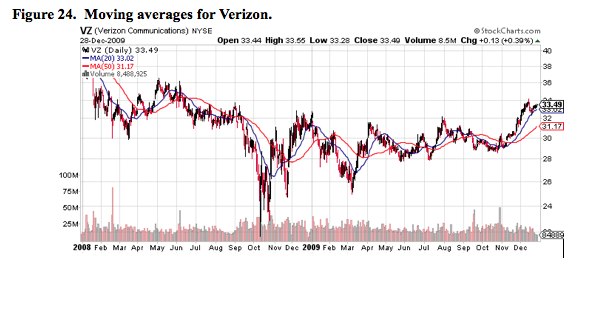

The key point is to make sure the moving averages actually guide a stock. Take a look at Verizon (VZ) in Figure 24 and see how the 20 and 50-day SMA guides the stock almost perfectly. The bottom line: if a stock is about to meet a MA that the stock has used in the past, then there is a very high chance that the stock will react to the MA.

Besides using MAs as support or resistance, MA crossovers can be employed. Many times, when an MA “crosses over” another, that movement generates a buy or sell signal (as with MRK). The most accurate signals come from shorter time frames because remember, MA’s are lagging indicators.

NOTE: When a shorter period MA crosses above a longer period MA, that is considered bullish. When a shorter period MA crosses below a longer period MA, that is considered bearish.

Crash prevention: Here is a recent example of how the 200-day SMA provided early warning to investors/traders that the stock market (The Dow) was about to enter into a downtrend (Figure 25):

.png)