Introduction by Ilene

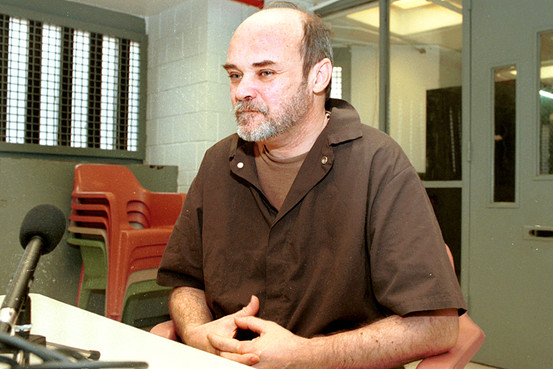

You may be wondering why Chopshop is referencing Martin Armstrong’s writings, given Marty’s extended stay in maximum security prison. Chopshop contends that Martin’s cyclic modeling is genius and ought to supersede whatever opinion one has of Armstrong’s case.

You may be wondering why Chopshop is referencing Martin Armstrong’s writings, given Marty’s extended stay in maximum security prison. Chopshop contends that Martin’s cyclic modeling is genius and ought to supersede whatever opinion one has of Armstrong’s case.

Armstrong is a gold-to-$5,000 guy. Chopshop agrees that one day gold will likely reach those dollar-denominated "values", but believes that gold will likely digest its 400% gain of the past decade over the next few years before ‘going for the gusto.’

Chopshop and Fibozachi have remained steadfast in calling for first targets of 81 and 84 on the US dollar since they nailed its bottom on December 3rd. (See also this and this.) They believe we are at a juncture within the credit crisis where "gold is much more likely to take a $350 John Edwards-style haircut before reaching $1450 and beyond."

Back to Armstrong, whose proclivity for gold stems "not from an ill-conceived loathing of the dollar but from an impeccably nuanced study of history’s mosaic. Chopshop thinks Armstrong’s work can be appreciated by all, "not only because of Marty’s historical breadth but also because his forecasts are predicated upon explicit methodology."

So I asked Chopshop why Martin was in prison, and, for the first time he paused, answering a few seconds later that the reason is because Martin didn’t "obey the rules of Fight Club" ~ you don’t talk about Fight Club and you don’t talk about the alleged collusion of broker/dealers, investment banks, hedge funds and nation-states publicly when "they" are who you consult / manage money for. Armstrong spoke to the manipulation of silver futures by JPM, named Warren Buffett as a mystery $2 billion futures participant of "the Club" and, ultimately, spoke to alleged cabals operating from within, yet behind, financial markets. Marty spoke about the game being rigged by the Club, being anything but a random walk. Is such the reason for his incarceration with extreme prejudice; not his Pi cycles, public-private pendulum or other brilliant work within cyclic periodicity? So basically, he’s in the hole on trumped up charges.

The long and short of it, according to Chop’s opinion, is that Martin is a political prisoner and cyclic genius who speaks to the intermediate and long-term horizon with probabilistic prescience. He’s not selling anything and not offering actionable advice. He’s focused solely on finding robust patterns within his models and across history. Marty has a nearly unparalleled understanding of socio-economic history … hopefully, he’ll be allowed to continue to share his thoughts with us.

Armstrong Economics: Entering Phase II of The Debt Crisis

Courtesy of Chopshop at Fibozachi

In succinct synopsis of what lays just over the horizon ~ "the cycle of economic implosion" ~ for the ill-conceived amalgam known *today* as the European Union, phinance’s phavorite political prisoner, Martin Armstrong, cautions that:

- – "the EU is in dire position", on the precipice of shattering into default and civil unrest;

- – the sovereign debt crisis materializing across Europe will soon reach US shores;

- – the CFTC will curtail currency speculation by slashing leverage from 100:1 to 10:1, which "can cause a liquidity crisis that backfires, magnifying everything."

Since "debts will never be paid and interest expenditures are the greatest transfer of wealth in history", Armstrong suggests:

- – freezing all national debt;

- – issuing coupons whereby the debt is redeemable for local currency, which may then be invested in domestic debt or equity;

- – each European nation establish an independent currency pegged to the Euro;

- – swapping US debt to coupons that may be spent domestically.

Seeking to impart light from within the dark seclusion of maximum security solitary confinement, Armstrong concludes his (relatively minuscule by Armstrong standards) missive with stern warning.

" Western society is falling apart …. If we do not act, civil unrest will explode. The current choice is DEFAULT or HIGHER TAXES & CIVIL UNREST …. Someone has to step forward to save us or we may be doomed. It’s time to wake up for this is the future of our children and their children at stake. "

http://www.martinarmstrong.org/files/Armstrong-From-the-Hole-3910-1-from-the-Hole.pdf

Just one note of caution for those who may be emotionally inclined to move all-in on gold here because they think ‘the dollar be dead’: any way ya slice it, the United States remains the lender of last resort (at least when the IMF isn’t told to stand in) … and while everyone "knows" that gold is the clear beneficiary of sovereign default concerns, please realize that Uncle Buck ($) sits alone at the head of the table. Worries of US hyperinflation and the death of the dollar are each absurdly premature at this juvenile juncture of the sovereign default crisis; each may occur, in due time, but certainly not before Uncle Sam has finished picking up everyone else’s tab.

See also Martin Armstrong’s Brand New Essay On The Real Story Behind Goldman, Buffett, And The Fed