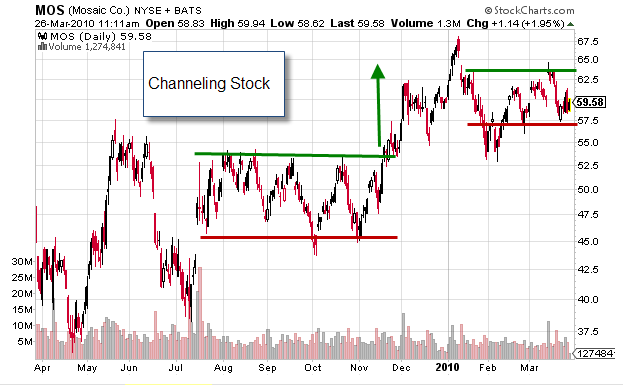

Courtesy of MarketTamer.com

– Stocks will typically channel 65-70% of the time.

– There are essentially three types of channels; Ascending, Descending and Sideways.

– The channel is comprised of two parallel trend lines which define support and resistance.

– The trading opportunity is as a result of buying the bounce off the lower trend line and selling the resistance.

– Channeling stocks as a continuation pattern occur as the stock trends and then consolidates for a period of time, only to eventually break out to resume the prior trend.

– Ascending Channels are usually embedded in a broader downtrend and act as a respite to the primary downtrend.

– Accordingly, Descending Channels are a respite in a broader uptrend and will more often than not resume the initial bullish trend after channeling.

– Sideways Channels are considered consolidations before resuming the original trend.

– The investment community recognizes that stocks neither go directly up nor down without pause.

– A majority of trading activity resides in channels as supply and demand play “tug of war”.

– Eventually traders will push the stock out of the range.

– The quality of the breakout/breakdown move should be measured by the investor participation as evidenced by increased volume.

– The opportunity to make money with channeling stocks are as a result of two approaches: 1) buy on the bounce off of the lower trend line and sell at the top of the channel at resistance and 2) Play the breakout/breakdown out of the channel.