We start out this week with another Long Play for the Week, which was a really successful play for us last week with China Automotive Systems Inc. (CAAS). While we got out for 5%, the trade if you held was worth over 20% from Monday to Friday. I am not sure we have such a gem this week, but I think we have found another profitable trade that we can look to hold up until Thursday.

Long Play of the Week: Mosaic Co. (MOS)

The agriculture sector is one that has been a tough one to work within lately. Yet, fertilizer producers may be on their way back up. Last month in Agrium’s earnings, the company cited their forecast moving forward, commenting that there has been a surge in the demand for potash at the start of 2010 and that strong demand should continue into the spring. Further, Brazil, one of the largest importers of potash, is supposed to rebound. Demand is increasing because food demands are expected to increase as the market recovers. The Agrium calls reiterate a position Mosaic took back in January with their last earnings announcement that fertilizer is back.

The agriculture sector is one that has been a tough one to work within lately. Yet, fertilizer producers may be on their way back up. Last month in Agrium’s earnings, the company cited their forecast moving forward, commenting that there has been a surge in the demand for potash at the start of 2010 and that strong demand should continue into the spring. Further, Brazil, one of the largest importers of potash, is supposed to rebound. Demand is increasing because food demands are expected to increase as the market recovers. The Agrium calls reiterate a position Mosaic took back in January with their last earnings announcement that fertilizer is back.

The rebound in fertilizer has not, however, been priced into Mosaic or any of the fertilizers. The stock is completely flat year-to-date, and it has seen about an 8% drop in the past couple weeks. Yet, as we near the announcement of earnings on Wednesday evening, Mosaic should be moving upwards. The company is expected to more than quadruple its EPS year-over-year with EPS estimate at 0.63 vs. 0.13 one year ago. The company has not seen the type of profit expected this quarter in a couple years, and it would be a great boost to the stock.

So, why pick it up now? Earnings of this sort should be priced into the stock going into the release on Wednesday night. Mosaic has made it no secret that they are expecting a big quarter. Last quarter, the company forecasted pretty strong fertilizer demand moving forward into this year, and the fruits of those demand expectations should be priced into the stock before earnings even hit. This is why we want to get involved now. Investors will be creating quite a buzz (magnified even greater due to the lack of major earnings announcements this week) around Mosaic going into earnings that I think it will be worth 3-4%.

Continuing the revisions in demand and expectations was Potash, a close rival of Mosaic. The company commented just two weeks ago that they were revising their earnings expectations for their coming announcement for Q1 of 2010 by nearly doubling EPS estimates from 0.70 – 1.00 to 1.30 – 1.50. That increase is not something to be taken lightly and shows that food demand is rising and agrobusiness is getting ready for it. The start of that demand increase is a shift in fertilizer demand, which we can see begin to move into the price of Mosaic’s stock price.

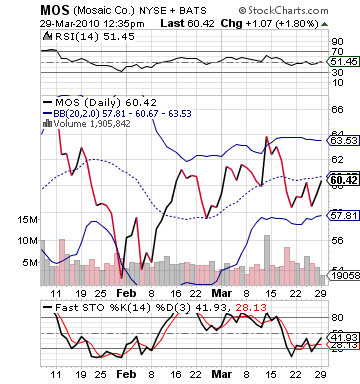

Technically, MOS presents a continued great buy. The stock is undervalued in the short term on Relative Strength Index, meaning it should be moving back up especailly with reason to move up as we enter the earnings season. The stock is oversold, and it has tons of room to the upside towards its upper bollinger band – about 8%. I think we can expect a nice 3-5% over the next few days from this food play.

Good Luck!

Entry: We are looking to get involved from 60.30 – 60.40.

Exit: We want to gain 3-5% and exit no later than the open of Thursday’s market.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau