Good morning and happy Thursday. The market is looking good today, but we did not get good news out of Mosaic last night on earnings. The company reported earnings below estimates with an EPS of 0.50 vs. the 0.62 estimate. I guess the company’s ambitions were a bit too high. The stock is going to open down slightly. I would actually be willing to hold for a few minutes to see if it can rise simply on a market rise. It is only down 1%, and we may be able to get closer to break even. If it starts to drop though, get rid of it. Yesterday’s trade on DUG did not amount to much either. We got into DUG at 12.24. The ETF did not have much movement throughout the day, and we made a penny at the end of the day. Nothing too special.

So, a couple of pretty boring trades in DUG and MOS. I have a Buy Pick today that may be a bit more spectacular.

Buy Pick of the Day: Penske Automotive Group Inc. (PAG)

Buy Pick of the Day: Penske Automotive Group Inc. (PAG)

Analysis: The Penske Automotive Group is a auto dealer throughout the USA and UK who sells new and used cars and auto parts. They have 160 franchises in the USA and 150 in the UK. The auto dealer has been in a bit of a free fall late and has been presented with quite the catalyst to get it moving today. In the pre-market this morning, PAG’s competitor CarMax Inc. (KMX) reported brilliant earnings that beat estimates by over 30% reporting an EPS of 0.33 vs. the expected 0.25. Those earnings have managed to send the stock up over 7% in pre-market trading. The company doubled its profit from one year ago, higher revenues than expected, and a bright future that involves building more new stores all bode well for KMX.

From Marketwatch: "The company also said it will resume store growth based on improvements in its sales and profit and the increasing stability in the credit markets. Capital spending will increase to about $90 million in fiscal 2011 from $22.4 million last year."

All looks for KMX. The stock, however, has already had its movement. PAG, though, has not. The company should benefit significantly from KMX’s very positive earnings as it showed a country wide recovery in the auto sales industry that is not just specific to CarMax. Further, PAG just received an upgrade from the S&P yesterday that raised its outlook on the company. Yet, the upgrade, coming in the afternoon, did little to move the stock. We have to think an upgrade will get priced into this stock at some point, especially considering its recent history.

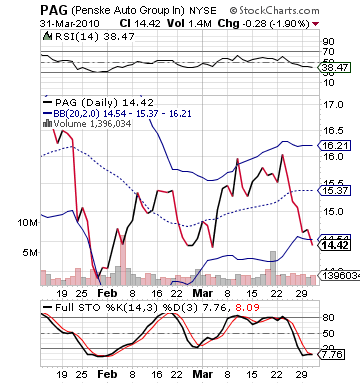

Over the the past couple weeks, PAG has dropped around 10% from a March high, which makes it an even more attractive play along with the KMX earnings. The stock is undervalued, oversold, and near its lower bollinger band. It has a dual combination reason for buyers to enter this stock, and I fully believe that they will begin to make the move into the stock today as you should.

2-3% on this one is entirely plausible. We want to get in early, so if it opens above my range don’t hesitate to buy into it, as long as it is not too overvalued already. The stock does not trade in pre-market, so I am only estimating where I tihnk it may open and what we should do as far as positioning ourselves.

Entry: We are looking to get involved at 14.50 – 14.60.

Exit: We are looking for 2-3% gain on the day.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau