It’s lonely out there in Stock Land today.

It’s lonely out there in Stock Land today.

Everybody’s closed today except Japan and they are so thrilled with 94.5 Yen to the dollar that you can’t figure anthing out by watching their market add another 53 points this morning to finish the day at 11,339 but it was well off the gap up open at 11,400. As I mentioned in the Weekend Wrap-Up, where we discussed our Super-Secret Strategy for making money off this nonsense – just because a rally is totally propped up BS doesn’t mean it isn’t, technically, a rally – does it?

With everyone else closed, the MSCI Asia-Pacific Index hit 19-month highs and copper climbed to $3.62 in overnight trading (when there were no traders) and gold hit $1,130 while oil hovered around $85.50 so we can infer that commodities are very, very popular with vacationing traders. Asian traders were excited about our jobs numbers – obviously they didn’t read my analysis on Friday:

“Overall, we are seeing positive signs about the global economy,” said Hiroaki Muto, a senior economist at Sumitomo Mitsui Asset Management Co., which manages $111 billion. “While developing nations are leading global growth, they are waiting for the U.S. to rebound. Recent reports are suggesting that the U.S. labor market and consumer spending are improving.”

Consumer spending is certainly improving at the Apple Store with 700,000 IPads going out the door in 48 hours, bringing AAPL an estimated $500,000,000 in revenues over the weekend. I was in the NY Apple Store this weekend and there were about 200 IPads on display with lines 3-4 deep of people very patiently waiting considering the average person who touched one held on for a good half hour. Keep in mind that the IPads that are selling now are limited Wi-Fi only models – the good, 3G ones don’t come out for another couple of weeks!

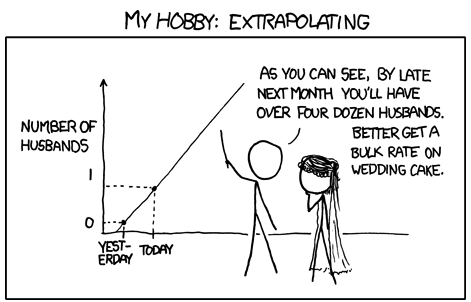

So, based on 2 days of sales, we can project AAPL selling $175Bn worth of IPads this year and that will make AAPL worth about a Trillion dollars, which is very likely to boost the Nasdaq back to 5,000… OK, that may be a bit of an over-statement but we still cannot ignore the Apple effect on the market because it does look like they are going to move a tremendous amount of IPads this year and that will be good for chip makers and glass makers and BBY and App developers and bandwidth providers… Put enough of those things together and you do have a rally!

So, based on 2 days of sales, we can project AAPL selling $175Bn worth of IPads this year and that will make AAPL worth about a Trillion dollars, which is very likely to boost the Nasdaq back to 5,000… OK, that may be a bit of an over-statement but we still cannot ignore the Apple effect on the market because it does look like they are going to move a tremendous amount of IPads this year and that will be good for chip makers and glass makers and BBY and App developers and bandwidth providers… Put enough of those things together and you do have a rally!

We love the IPad because it’s a perfect top 10% product. It’s relatively inexpensive for people earning $100K per year and there’s over 200M of us on the planet so it will be quite a while before we all have IPads (and don’t scoff unless you do not have an IPod), even at the sales rate of 700,000 per weekend. The problem is extrapolating great IPad sales into a positive outlook for the entire economy. Top 10%’ers bought IPhones and IPods during the market crash – what AAPL is very, very good at is identifying their target market – they don’t skimp to make machines for the masses. Apple makes very high-quality stuff for people who don’t expect to even get a discount and, when the tech becomes cheap, THEN they sell them in quantity to the masses.

I think the real impact of the IPad won’t be felt until 2012 when, if the World does not end as forecast, we should be seeing the $199 IPad and Apple will have accomplished what "One Laptop Per Child" has struggled to do for a decade and THEN we will have an explosion of web access and utilization around the World. Yes there are $200 laptops now but quality is still an issue – even to the poor and, just like the fact that there are $2,500 cars – there’s a difference between being able to buy a Tata Nano for $2,500 and a Posrsche Carrera for $2,500. The $200 IPad will be the cheap Porsche of laptops and even the programs are cheap (or free) and that is the real game changer. So congrats to Steve Jobs, who has probably changed the World this weekend – now it’s up to us to invest in the companies that will profit from it….

We’ve been in TTH, VZ and T for quite some time and we don’t mind waiting on VZ and T because they both pay 6% dividends on our long-term positions, we have also been playing GLW because, although they don’t supply IPad glass, the IPad uses 6x more glass than the IPhone and that has to put upward pressure on all pricing, especially for whichever competitors are going to try to play catch-up with their own devices. The same goes for our chip plays and the SOX in general and we’ll be revisiting that group this week as they are going to be some of our top picks to play the Dow over 11,000 (if it holds).

We’ve been in TTH, VZ and T for quite some time and we don’t mind waiting on VZ and T because they both pay 6% dividends on our long-term positions, we have also been playing GLW because, although they don’t supply IPad glass, the IPad uses 6x more glass than the IPhone and that has to put upward pressure on all pricing, especially for whichever competitors are going to try to play catch-up with their own devices. The same goes for our chip plays and the SOX in general and we’ll be revisiting that group this week as they are going to be some of our top picks to play the Dow over 11,000 (if it holds).

Former Federal Reserve chairman Alan Greenspan said yesterday on ABC’s “This Week” that the chances the U.S. economy will retrench after recovering from the worst recession since the 1930s “have fallen very significantly in the last two months. There is a momentum building up which is really just beginning and it’s got a way to go.” Greenspan said the U.S. is “on the edge of a significant build-up” in inventories “and that is a self- reinforcing cycle.” Of course, he has been totally and horrifically wrong in the past…

Speaking of people who are horrifically wrong: Tim Geithner has "fixed" the problem of China being declared a currency manipulator in the Treasury’s Report on Global Currency Policies on April 15th and has circumvented the will of Congress, who already voted for sanctions based on the Report – by delaying the Report indefinately! “We are disappointed, but not surprised, by the administration’s decision,” Senator Charles E. Schumer, a New York Democrat, said in an e-mailed statement two days ago. “After five years of stonewalling, punctuated by occasional, but halting action by the Chinese, we have lost faith in bilateral negotiations on this issue.” The move will give China space to relax currency controls “without looking like they’re kowtowing to U.S. pressure,” said David Gilmore, a partner at Foreign Exchange Analytics in Essex, Connecticut.

Speaking of the bottom 90%: More Americans filed for bankruptcy in March than in any other month since personal bankruptcy laws were tightened in Oct. 2005. March saw 6,900 filings per day, a 35% spike from February. Federal courts reported over 158,000 bankruptcy filings in March and filings were up 19 percent over March 2009. The previous record over the last five years was 133,000 in October.

Speaking of the bottom 90%: More Americans filed for bankruptcy in March than in any other month since personal bankruptcy laws were tightened in Oct. 2005. March saw 6,900 filings per day, a 35% spike from February. Federal courts reported over 158,000 bankruptcy filings in March and filings were up 19 percent over March 2009. The previous record over the last five years was 133,000 in October.

“Fewer people are trying to save their homes,” Katherine M. Porter, a University of Iowa law professor and bankruptcy expert, said. “They realize their payments are not affordable, and bankruptcy judges do not have the power to adjust the mortgages to make them more affordable. To file Chapter 13, you need ongoing income, and to the extent we have more people who are unemployed, they can’t use Chapter 13 because they don’t have that income to pay into the plan,” she said.

Let’s figure the average person who declares bankruptcy owes $30,000 in debts (one would assume it’s more than a year’s salary). That’s $4.7Bn a month in defaults! You would think that’s going to impact someone’s earnings but, fortunately, US Banks don’t have to declare any asset impaired until they sell it so we can keep pretending none of this stuff matters for a long, long time – just like we pretend to get tough on China for depressing their currency and costing millions of Americans their jobs – leading them to Bankruptcy Court in the first place… The European Commission is about to start its first investigation into Chinese subsidies, a probe that could potentially see a slew of new tariffs against Chinese firms that export to Europe.

In its annual report, the American Chamber of Commerce in China calls out Beijing for "a mounting number of policy challenges, ranging from the inconsistent enforcement of laws, to China’s discriminatory domestic innovation policies and regulations that limit market access into sectors that had been increasingly open to foreign investment." I don’t know about you, but I’m beginning to feel there’s some sort of pattern here… A top Chinese government economist says the U.S. decision to delay a report that might have labeled China a "currency manipulator" is a "positive signal" but a yuan adjustment is unlikely in the near-term. "We need to see whether China’s export recovery will be sustained and need to see whether companies can cope with a stronger yuan," he says.

The U.S. office vacancy rate rose to 17.2% in Q1, up 0.2% from Q4 and up 2% from a year ago. Average net rents fell 0.8% vs. 7.4% in the year-ago quarter. "As labor markets stabilize, we expect occupancies and rents to require another 12 to 18 months before showing signs of improvement," the report’s director says. We like shorting CRE but CRE short positions don’t like us as no amount of bad news seems to affect that sector. Here’s a report that says office vacancy is 2% WORSE than Q1 of last year, when IYR was below 20 – now it’s at 50 – Imagine how high they will go when things stop going down!

The U.S. office vacancy rate rose to 17.2% in Q1, up 0.2% from Q4 and up 2% from a year ago. Average net rents fell 0.8% vs. 7.4% in the year-ago quarter. "As labor markets stabilize, we expect occupancies and rents to require another 12 to 18 months before showing signs of improvement," the report’s director says. We like shorting CRE but CRE short positions don’t like us as no amount of bad news seems to affect that sector. Here’s a report that says office vacancy is 2% WORSE than Q1 of last year, when IYR was below 20 – now it’s at 50 – Imagine how high they will go when things stop going down!

We are long on individual builders but it seems very unlikely that the entire sector is in recovery so we’ll be looking forward to some spectacular failures down the road. I’ve decided that I’m willing to call the recession over when they finally open New Jersey’s Xanadu Super Mall – now in year 3 of delays. Fill that up and I’ll be willing to believe anything is possible!

We’re still waiting to see our breakout levels broken and held this week and today will be interesting as there’s no EU trading to move us one way or the other so it’s all up to the US trade-bots today and we are still sitting in cash and watching the fun in what should be yet another low-volume day.