Did Tom Hoenig take away the punch bowl?

Did Tom Hoenig take away the punch bowl?

According to Business insider: Hoenig, who delivered a powerful speech today in Santa Fe blasting the Fed's ongoing zero interest rate policy, lovingly known as ZIRP. Hoenix acknowledges reasons why the Fed is in no rush to tighten: The job market isn't so hot, the construction business is still horrible, and real estate has yet to come back to life. But what Hoenig gets is that the current regime is a free lunch to Wall Street. Hoenig says:

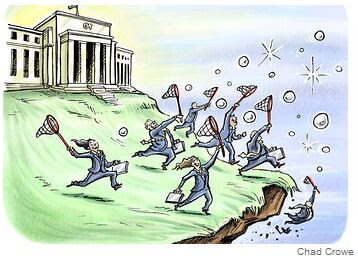

Low rates, over time, systematically contribute to the buildup of financial imbalances by leading and investors to search for yield. The Wall Street Journal article tells a story about the market coming back that also makes my point. The search for yield involves investing in less-liquid assets and using short-term sources of to invest in long-term assets, which are necessarily riskier. Together, these forces lead banks and investors to take on additional risk, increase leverage, and in time bring in growing imbalances, perhaps a bubble and a financial collapse.

I make no pretense that I, or anyone, can reliably identify and “prick” an economic bubble in a timely fashion. However, I am confident that holding rates down at artificially low levels over extended periods encourages bubbles, because it encourages debt over equity and consumption over savings. While we may not know where the bubble will emerge, these conditions left unchanged will invite a credit boom and, inevitably, a bust.

Welcome to the rational World Mr. Hoenig! Is this the little dose of reality the markets needed to hear or will it be just a one-day wonder? This morning we see another 460,000 people lost their jobs last week and I read an article in the WSJ indicating that the "long-term jobless"—people out of work more than six months (27 weeks) — was about 44% of all people unemployed in February. A year ago that number was 24.6%. And youth unemplyment (under 25) is now over 20%. Historically, these are numbers that lead to rioting.

The UK went past 20% a while ago but they have a much more extensive social safety net than we do. Britain will need "drastic" austerity measures to prevent public debt exploding out of control, the Bank for International Settlements (BIS), has declared. Interest payments on the UK's public debt will double from 5pc of GDP to 10pc within a decade under the bank's "baseline scenario" before spiralling upwards to 27pc by 2040 – by far the highest among the OECD club of developed countries. Greece fares better, while Britain's interest burden is far worse than Italy's.

Meanwhile, The cost of insuring against a default on Greek government bonds rose above that for Iceland for the first time, helping push indicators of corporate credit risk to the highest levels in as much as two weeks. Credit-default swaps linked to Greek sovereign debt rose 32 basis points to a record 445.5 today, while Iceland traded at 402 basis points, according to CMA DataVision prices.

Europe is down over 1% across the board (9am), mirroring Asia's performance earlier this morning although the Hang Seng only fell a quarter point but, more tellingly, was unable to get over 22,000. Both the BOE and the ECB voted to hold rates down so it's the same old, same old into the US open and now we can see if the previous highs that we've been watching offer any real support.

Those are: Dow 10,955, S&P 1,180, Nas 2,432, NYSE 7,497 and Russell 693 – At the moment we have gone from expecting a pullback to these levels to now willing to be impressed if they do hold up but, as before, we're not going to start shifting bullish until we break the higher levels we've been watching (and now you all know why I'm so strict about making our levels before we make our new buys!).

March same-store sales should give us a lift but keep in mind that Easter was early this year and they only do same-store sales from the stores that remained open since last year and we've had inflation so this number couldn't possibly be a more misleading indicator of economic health.

Be careful out there!