What was all that worry this week – fuhgeddaboudit!

Nothing white-washes a wall of worry like misdirection. Wave something shiny in front of investors – like gold going over $1,150 an ounce and everything must be fine in the markets. What's funny to a grumpy old fundamentalist like me is that gold is flying while the economy is "great" and the financials are in "great shape" and inflation is "tame" and crises in Greece, California, New York etc., etc. are nothing to worry about. So what exactly is the premise for buying gold?

That's what makes this such an interesting market right now – the doom and gloom crowd are loading up on commodities as they expect the global markets to collapse and nations to either default on their debts, making their fiat currencies worthless or possibly crank up the printing presses and devalue the same fiat currencies while the bulls think none of that stuff matters at all so they are buying commodities because there's going to be this amazing return of demand in sunshine and lollipop land.

We're thrilled to be mainly in cash and watching this nonsense from the sidelines, hanging onto our fiat currency for the moment. Over in our "Chart School" this morning, Pragmatic Capitalist makes the following observation:

We’ve joked about the recent rally and how, if you were new to the market, you might think that there was an SEC ban on all selling. We all know the stats by now. Stocks have risen in 70%+ of all sessions for over double digit gains over the last 2 months. Monday’s are almost guaranteed 1% rallies. Volume is always low. Declines are never more than 0.2%. But this all pales in comparison to what has happened in the banking sector. The banks have rallied a jaw-dropping 83% of the time during the recent rally. Out of the 41 previous sessions just 7 of them have been to the downside and just 3 of those were 1% declines. Over the course of the move the banks have surged 21.5%. You could certainly call the banks the most hated sector in the entire U.S. economy so it’s only appropriate that the banks surge over the course of the world’s most hated rally….

Also this morning, David Grandey has a great rundown of a dozen stocks and funds that are clearly making double tops including UYM, V, & ROM so it will be interesting to see if these indivdual names are signaling weakening internals to the rally or if a rising tide will, indeed lift all ships. Over in our Phil's Favorites section, Mish has an excellent run-down on Retail Sales, along the same lines as my premise yesterday that the sales are not that impressive when you consider how many stores were closed since last year as well as the 31 Retailers who went bankrupt in 2009. Heck, if another 10% of the remaining retailers go BK in 2010 – I bet whoever is left next year is going to have some great comps too!

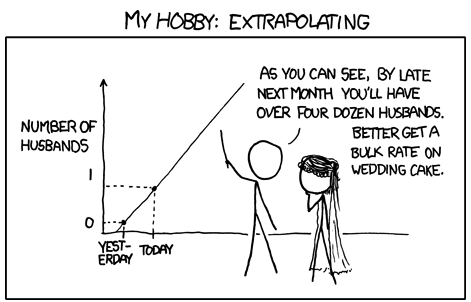

Today is upgrade insanity day for retail so look for some follow-through as analysts scramble to extrapolate comps to the worst March since the Great Depression into a record-breaking performance for all of 2010.

Today is upgrade insanity day for retail so look for some follow-through as analysts scramble to extrapolate comps to the worst March since the Great Depression into a record-breaking performance for all of 2010.

I joked about this on Monday as everyone was one-upping their targets for AAPL and now the madness has spread all the way to JCP, WSM, BJ & DISH on the upgrade list this morning so everything from bulk discount toilet paper to $500 frying pans is a BUYBUYBUY for the American consumer – even though they have 4M fewer jobs than last year and even though they are getting paid 2% less than last year and even though credit is down 15% from last year. Boy – I'm feeling better already!

Tuesday we get the real Retail Sales report for March and we won't be seeing a 10% rise in spending despite the 10% gains in same-store sales. How far off that figure is will tell us a lot about the market, as will the market's reaction to what is likely to be a disappointing number. It's no coincidence that Tuesday is the end of our "vacation" at PSW and we'll be coming off the sidelines on one side or another in what is going to be a very heavy data week accompanied by earnings that are going to have to live up to some pretty high expectations.

According to Louis Navellier, this quarterly reporting season will lead to blowout year-over-year comparisons for many firms,says, but it's just the "calm before the storm. In two weeks' time, after the first wave of earnings roll out, the bull market is going to run into a wall," Navellier says. Howard Davidowitz says it's a "sucker's rally" in retail stocks and any rebound in consumer spending will be short lived. The economy is "in a bad place, heading for a worse place."

According to Louis Navellier, this quarterly reporting season will lead to blowout year-over-year comparisons for many firms,says, but it's just the "calm before the storm. In two weeks' time, after the first wave of earnings roll out, the bull market is going to run into a wall," Navellier says. Howard Davidowitz says it's a "sucker's rally" in retail stocks and any rebound in consumer spending will be short lived. The economy is "in a bad place, heading for a worse place."

The WSJ says: "Concern over a potential liquidity shortage at Greece's private-sector banks fueled a sharp selloff in Greek debt and equity markets Thursday, suggesting that the European Union's efforts to defuse the crisis with a vague promise for an International Monetary Fund-backed rescue have all but failed. Markets signaled fresh worries that Greek banks are having trouble meeting immediate funding needs, after the country's top four banks on Wednesday asked Athens for access to an emergency government liquidity facility. Greece's banks have been widely viewed as one of the few bright spots in the country's financial infrastructure."

Hey, come on you guys – fuhgeddaboudit! Nobody wants to hear all this negative talkin' – it's bad for business if you get my drift… Even Europe is shifting gears and accentuating the positive this morning, gapping back up to Tuesday's gap open but still about half a point from Tuesday's highs, much the same as we are gapping up in the futures (9am) to within half a point of Monday's excitement. Will this be enough to get us over 11,000? Fuhgeddaboudit!

The Hang Seng was so excited about our Retail Sales reports that they jumped up 1.5%, back to 22,208 but then again, the Hang Seng has had no worries lately as they are up 1,500 points since March 25th, making our little 80-point "rally" over the same period seem sort of LAME.

Also lame is the accounting trick that is being used by big banks, including (according to the WSJ) Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup "have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, understating the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods. "

Well who cares as long as it makes things look good, right? That's the lesson we are all meant to take out of the already forgotten about financial crisis of 2008 – it's only a crime if you get caught AND you are found guilty AND there is a penalty that exceeds a day's worth of earnings. Other than that – Fuhgeddaboudit!

Have a nice weekend,

– Phil