Courtesy of Market Tamer

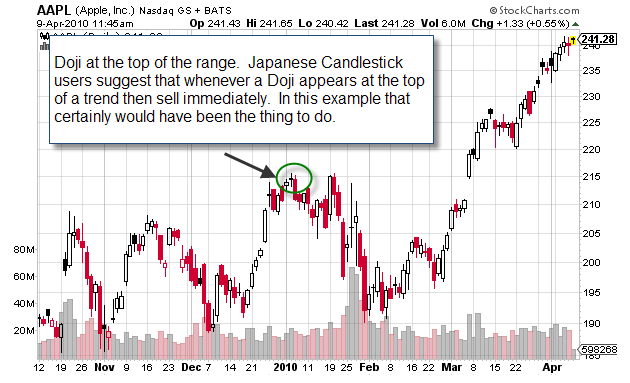

- The Doji occurs when the stock opens and closes at the same level.

- It is an indication of major indecision in investment sentiment.

- It is important that we interpret the Doji in the context of the market.

- The Doji is a single candlestick pattern and is extremely powerful in foretelling a reversal.

- There are many variations of the Doji- The Doji Star, The Long Legged or High Wave Doji, The Gravestone Doji and The Dragonfly Doji. Each has a slightly different story to tell.

- The primary message that the Doji sends is that there is a "Tug Of War" going on between the bulls and the bears.

- When found at the top of a trend, it may be prudent to sell if you are long the market.

- Dojis at the bottom of the trend although very significant require more confirmation for a reversal.

- Dojis found in a sideways channel are not very significant

- The market will not always reverse immediately after a Doji, but many times the reversal will occur very shortly thereafter.

- Dojis specifically and Candlesticks in general are extremely powerful when used in conjunction with other technical indicators that confirm resistance and support.

Where is the Market Headed?

Dow

S&P 500

Nasdaq