The End of Cheap Credit

Courtesy of John Lounsbury

Americans have enjoyed nearly three decades of declining credit costs. From days of Treasury bills paying interest rates in the upper teens in early 1980s as then Fed Chairman Paul Volcker led a campaign to squeeze high inflation out of the economy to the ZIRP (zero interest rate policy) of today Americans have gotten used to being able to count on future borrowing costs going lower.

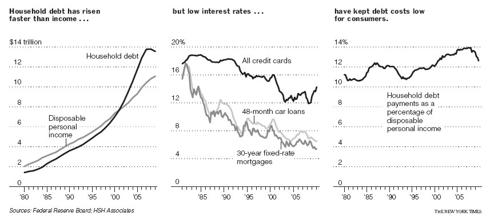

This has resulted in consumers taking on more and more debt over the years without experiencing any change in relative expense, as shown in the following graphic from the New York Times:

For larger image, click here.

No more! One of the consequences of the credit bubble and the increased government debt that continues to pile up in an attempt to cushion the impact of private sector deleveraging is that interest rates must rise. It is obvious that interest rates can’t continue to go down. Yet that is the psychological conditioning developed over a generation.

The situation can be compared to that of the illicit drug trade. The lenders (banks and credit card companies for individuals and Japan and China for our government) have been giving away cheap samples. Now that we are psychologically dependent on the low cost credit, the price will go up. We are addicted and a chronic dependency can be milked with ever increasing prices to obtain the narcotic until we are broke, go to rehab, or both.

From an article by Nelson D. Schwartz in the Sunday New York Times:

"Americans have assumed the roller coaster goes one way,” saidBill Gross, whose investment firm, Pimco, has taken part in a broad sell-off of government debt, which has pushed up interest rates. “It’s been a great thrill as rates descended, but now we face an extended climb.”

The rise in interest rates may be gradual at first. It well could be like the proverbial process of how to boil a frog without his awareness: heat the water slowly and he doesn’t feel the change until it’s too late to escape. After all, we still are facing deflationary pressure in areas such as housing, employment and personal incomes. The recent rise in Treasury rates may be reversed during 2010, and even in 2011.

But, absent a new Great Depression (which is not likely), interest rates must eventually go up. The law of supply and demand dictates that if a credit bubble collapses, after the deleveraging is substantially complete and the high levels of government liquidity recede, supply of credit will remain constrained and, if there is demand, the cost will go up.

Even if the consumer finds a new lower credit dependency religion, the government will have no choice, short of debt default. The NYT articlediscusses how rising interest rates will affect the consumer. But government is the ultimate addict and will pay the new higher price. Even if Washington went to rehab and shook the demons of continuing deficits, the cost of rolling over the existing debt may become a devastating burden.

According to the U.S. Treasury, the total cost of financing the Federal debt for fiscal year 2010 will, be $202 billion. If we were to return to the days of Volcker inflation containment policies, this figure could grow five-fold. Annual finance charges of $1 trillion? Yes, that is what it could be, even without any further deficits to add to the current national debt. And if those high rates were to come after a further doubling of the national debt, which some are projecting, the result would be astounding:

Our annual national debt service cost would total $2 trillion!

The total federal budget for fiscal year 2010 is $2.165 trillion. A decade from now that could be the size of just the interest payments on the national debt. All it takes to get there is continued large deficits and an significant surge in inflation that requires a return to Volcker era interest rates.

Is it any wonder that some are saying that the only way to solve this is to balance the budget and grow (or inflate) our way out of the problem? From my perspective, growth can only go part way; inflation will have to carry most of the burden.

That is why all investors should have commodity positions in their investment plan. One way to do this is through commodity related ETFs such as XLB(Select Sector SPDR – Materials), USO (United States Oil Fund), XLE (Select Sector SPDR – Energy), GLD (SPDR Gold Shares), DBC (PowerShares DB Commodity Index Tracking Fund) and DBA (PowerShares DB Agriculture Fund).

If you have read my two recent articles here and here, which are quite pessimistic about the prospects for house prices in the next year or two, home prices will rise with inflation. However, home costs will probably not do better than keep up with inflation, and they might lag somewhat. Even so, owning a home will be a much better choice than cash or bonds when you look out ten years or more.

A good argument in opposition to mine by Andrew Gavin Marshall can be read at Raging Debate.com. Marshall believes that a new bubble can not be inflated and the attempt will create a horrendous collapse. If my argument is prescient, a semblance of life as we have known it will survive. If Marshall is right, I’ll see you in another life, brother.

Disclosure: Positions are traded in many commodity related ETFs. No positions as of the time of writing. I own my own home.