Rahm Emanuel and Magnetar Capital: The Definition of Compromised

By Yves Smith at Naked Capitalism

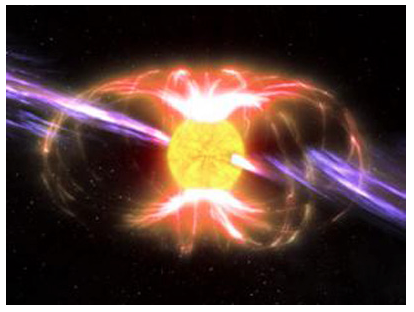

Magnetar

1) A neutron star with an intense magnetic field, capable of emitting toxic radiation across galaxies

2) A hedge fund, the single market player most responsible for the severity of the 2008 financial crisis, through the toxic instruments it createdRahm Emanuel

1) White House Chief of Staff

2) Politician selected by Magnetar’s CEO to be sole recipient of his political donations, 2006-2008Strange as it may seem, nearly three years after the onset of the global financial crisis, its greatest, most destructive, and most profitable “it ought to have been a crime” has gone almost entirely unnoticed.

Most people believe that they understand the broad outlines of the financial crisis, and that a central element was an explosion in mortgages made to people who could not afford them.

But how did such destructive behavior occur on such a large scale? The conventional view is that the subprime mortgage blowup resulted from bank executives being short-sighted, greedy, or both.

But that simple story deters inquiry into how and why this disaster came to pass. Some recognize that the appetite for subprime mortgages seemed to come from investors. In fact, it resulted in a large degree from the way traders at certain large banks used subprime mortgages in a strategy to make their profits seem much larger than they actually were. The effect of this “negative basis trade” strategy was to overpay employees of those banks and consequently eviscerate the banks’ abilities to withstand future economic uncertainty.

The appetite for subprime mortgages was also inflated by people who were betting that the housing market would fail.

Moreover, the devastation wrought by this strategy remains virtually a secret. The fact that it has been almost invisible and appears to have been entirely legal, demonstrates a set of vexing problems. First, that investigations of the crisis have not delved deeply enough, and second, that the deregulation so keenly sought by the financial services industry has made activities legal that by any common-sense standard should be criminal.

But the sponsors of this toxic trade did bother to make sure they had a powerful friend. The head of the firm in question gave substantial amounts of money by political contribution standards to Rahm Emanuel’s PACs, and only his PACs, over the period when these transactions were in play.

The moving force behind a brilliant and devastating subprime short strategy was a heretofore unknown Chicago hedge fund, Magnetar, headed by Alec Litowitz, formerly of the hedge fund behemoth Citadel. Our studies indicate that Magnetar alone accounted for between 35% and 60% of demand for subprime mortgages in the year 2006.

See Also: Don’t Want To Read That Gigantic Report About The Hedge Fund Magnetar?