Courtesy of Allan

In the midst of a mindless rally, a new Short has garnered my attention; TEVA. Why has a hot stock in a hot sector (Generic Pharmaceuticals) flipped to a Sell in its Daily Trend Model? We don’t know, nor do we care. Respect.

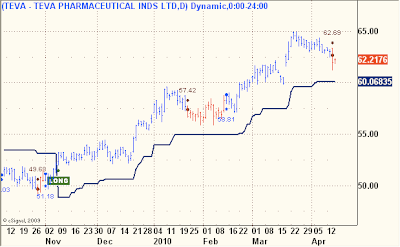

Below are two TEVA charts. The first one uses the standard Trend Model 2.0 and the second one uses my new beta version Trend Model 4.0 with wider settings that result in fewer trades at the expense of efficiency in both entry and exits. This will be a good test and example of how these two models differ in their approach to trend following.

Under current parameters, TEVA triggered Short at the close Wednesday. Under the wider settings in the beta version of the Trend Model, a TEVA is still Long but will trigger Short on Daily close under 60.07. If the beta version it does trigger Short, it will represent a powerful confirmation of the first Short signal. Stop loss is at 63.94 according to the standard settings.

(Bar colors & price entries are from Model 2.0)

*******

Allan’s newly launched newsletter, “Trend Following Trading Model,” goes with the trend-following trading system he’s been working on for years. Most trades last for weeks to months. Allan’s offering PSW readers a special 25% discount. Click here. For a more detailed introduction, read this introductory article.