Wheeee! That was fun – let’s do it again!

Wheeee! That was fun – let’s do it again!

There is nothing more fun than a nice, big dip in the roller coaster that you are prepared for and nothing more terrifying than a sudden, unexpected drop you were not prepared for (think air pockets on planes). I know my incessant harping on fundamentals gets annoying and makes me somewhat of a party pooper at market tops but think of my commentary as that "clack, clack, clack" sound you hear when a roller coaster is climbing to the top of the tracks – the sound lets you know there’s a big drop coming and the more clacks you hear – the bigger the dip is likely to be.

In fact, much like a roller-coaster, most of our well-prepared members were disappointed that we didn’t get a BIGGER dip on Friday but we’ve learned not to be greedy on the bear side and to quickly take those profits on our short-term plays while we let our long-term disaster hedges run wild, waiting patiently for the big score. By the way, it’s not that we’re perma-bears – far from it, when Cramer, Adami, Finerman, John AND Peter Najarian were telling you to crawl into a bunker and hide your head in the sand a year ago – I was the one yelling BUYBUYBUY while our hugely successful Buy List, which is the bulk of our virtual portfolios, has been all bullish since Feb 8th. Just because we think a rally is BS, doesn’t mean we don’t participate in it!

As a fundamentalist, I believe there is a market "truth" a real value that can be placed on stocks and indexes based on reality, not hype and, when the MSM hype stampedes the herd and takes the market (or an individual stock) too far one way or the other – we simply step in and take advantage of it. It’s not complicated but it takes a little bit more work than the average "Lightning Round" participant is used to so PSW is not for everybody – this is our JOB, not our hobby, but boy is it fun when we get it right!

Despite the sell-off this week, we still finished up over 11,000 on the Dow but poor 1,200 on the S&P couldn’t hold and Nas 2,500 was merely a brief flirtation. The NYSE fell all the way to 7,550, down 200 from Thursday’s high and the Russell touched 710 (where we started Wednesday) and decided to split the difference at 715 by the day’s end, still our strongest index.

My biggest problem with market timing is being too early. We started buying in February of last year and had to painfully average into positions on some scary dips but our Buy/Write Strategy led us through the wilderness and all the way through our Thanksgiving feast, where I was again a bit premature with a cash-out call. Of course we day traded the market and made short-term opportunity bets while we waited but it wasn’t until Feb 8th that I felt confident enough that we had bottomed to put up a new Buy List and we cashed most of that out on March 18th, also, it seems, a bit too early. On the whole though, it is better to be too early than too late because too late is broke and too early just means you could have made a little bit more!

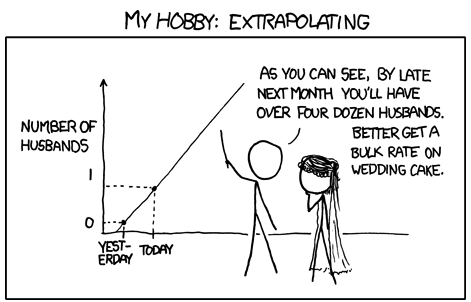

And what have we missed since March 18th? Not too much until April 5th, when we had that crazy Monday spike (when the US was the only market open and we flew up on no volume) and everyone had IPad fever. I warned against the dangers of extrapolating on limited data while that day was a banner day for BS as Geithner "fixed" the China problem by delaying his report to Congress that would brand them a currency manipulator by 3 months and Alan Greenspan said U.S. is “on the edge of a significant build-up” in inventories “and that is a self- reinforcing cycle.” While that great news was celebrated the market ignored the record bankruptcy filings, an EU investigation in Chinese subsidies that portends a spreading trade war and, best of all, we not only ignored a US office vacancy rate of 17.2% in Q1 (2% worse than last year) along with a continuing decline in net rents, but IYR actually went UP over the next week – so high, in fact, that we finally had to short it again!

As usual, most of the big gains come during overnight trading sessions, leaving retail investors little opportunity to participate in the rally. As the Dow got near 11,000 on March 18th, we decided not to press our luck and went to mainly cash but the 20 open positions we couldn’t bear (oops, don’t say bear!) to part with on our remaining Buy List ALL made money. ALL of your positions are not supposed to make money – the markets aren’t supposed to be that easy so, rather than be greedy, it occurs to us that something is wrong and we get more cautious, not less.

In the week of April 5th my clacking got a little louder as you can tell by the article titles:

In the week of April 5th my clacking got a little louder as you can tell by the article titles:

- Toppy Tuesday – LA "Out of Money" on June 30th?

- Which Way Wednesday – Fed Up Edition

- Thursday Thump – Suddenly Things Matter?

- Forget About It Friday

We had a fun dip on that Wednesday, which I led off saying "I don’t know what Fed minutes the market red yesterday but the ones I read scared me!" Thursday’s shot of market sobriety was brought to us by Fed Governor Tom Hoenig, who said: "Holding rates down at artificially low levels over extended periods encourages bubbles, because it encourages debt over equity and consumption over savings" which, by that afternoon was interpreted once again as "PARTYPARTYPARTY."

Monday – Now 11,000?

That brings us right up to speed for this crazy week when Friday’s "fuhgeddaboudit" attitude carried through the weekend as Greece was, once again, "solved" and a much larger than expected BUILD in inventories was taken as a good sign that sales were anticipated, rather than the "remote" possibility that sales expectations had gotten ahead of themselves. If inventories are built up then the manufacturers get to book strong sales, regardless of whether or not anyone ultimatley consumes them. This is leading to very high expectations for earnings as analysts are forecasting 27% gains in S&P earnings over last year, when the S&P was priced 80% lower:

That brings us right up to speed for this crazy week when Friday’s "fuhgeddaboudit" attitude carried through the weekend as Greece was, once again, "solved" and a much larger than expected BUILD in inventories was taken as a good sign that sales were anticipated, rather than the "remote" possibility that sales expectations had gotten ahead of themselves. If inventories are built up then the manufacturers get to book strong sales, regardless of whether or not anyone ultimatley consumes them. This is leading to very high expectations for earnings as analysts are forecasting 27% gains in S&P earnings over last year, when the S&P was priced 80% lower:

"Earnings expectations are high enough to make it just too hard for a lot of companies to live up to them," worries Justin Walters of Bespoke. "We believe the market is more likely to struggle early on in earnings season than make a big move higher," Mr. Walters wrote to clients last week.

We’ve already seen this week that earnings beats by TLB, ADTN, CSX, INTC, LLC, JPM, PGR, YUM, PPG, AMD, GOOG, ISRG, BAC, FHN, GCI, GE, GPC and MAT were not enough to keep the rally going and even raised guidance from TLB, INTC, LSTR, ATR and FCS were not enough to keep all but Intel from falling on Friday and many of those who didn’t actively raise guidance actually finished the week lower despite their beats. How many of the 38 companies reporting this week actually did increase their revenues by 27% over last year? 5 (see list). How many reported LOWER revenues than last year? 8. How many had less than 10% improvements in revenue? 16. How many companies are up less than 50% since last year’s Q1? Not many (if you feel like counting, go ahead but I’m comfortable with that guess!).

Let’s take just a couple of well-known companies for example:

- AA lost .59 per $9 share last year. Now they are making .10 per $14 share (up 55%, 2-year average earnings -.30)

- BAC made .44 per $8 share last year. Now they are making .29 per $18 share (up 125%, average earnings .36)

- CSX made .62 per $30 share last year. Now they are making .78 per $55 share (up 83%, average earnings .70)

- FCS lost .32 per $5 share last year. Now they are making .25 per $12 share (up 140%, average earnings -.04)

- GE made .26 per $12 share last year. Now they are making .21 per $19 share (up 58%, average earnings .24)

- INFY made .55 per $27.50 share last year. Now they are making .61 per $62 share (up 130%, average earnings .58)

- INTC made .11 per $15 share last year. Now they are making .43 per $24 share (up 60%, average earnings .27)

- JPM made .40 per $30 share last year. Now they are making .74 per $45 share (up 50%, average earnings .52)

Well you get the idea… We are priced, not just for the increased earnings over last year, but based on the assumption that this trend will continue into next year. Either that or we are paying p/e’s in the mid 20s for most of our stocks and that, one would have to think, is a little excessive – even in the most robust markets. Then – if you want to REALLY put on the old thinking cap – you might want to consider that last year’s Q1 was a TERRIBLE Q1 when we thought the world was ending and the companies were generally way overstaffed for the very weak demand so if we were NOT up AT LEAST 10-15% off of the worst quarter since the Great Depression, then we should be REALLY concerned!

Well you get the idea… We are priced, not just for the increased earnings over last year, but based on the assumption that this trend will continue into next year. Either that or we are paying p/e’s in the mid 20s for most of our stocks and that, one would have to think, is a little excessive – even in the most robust markets. Then – if you want to REALLY put on the old thinking cap – you might want to consider that last year’s Q1 was a TERRIBLE Q1 when we thought the world was ending and the companies were generally way overstaffed for the very weak demand so if we were NOT up AT LEAST 10-15% off of the worst quarter since the Great Depression, then we should be REALLY concerned!

- DIA $110 puts at .67, out at .65 – down 3%

- FCX May $85 calls sold for $4.20, now $2.35 – up 44%

- C complex 2012 spread – on target

- SDS June $29/34 bull call spread at $1.27, now $1.30 – up 2%

- SDS Sept $26 puts sold for $1.05, still $1.05 – even (pair trade – Disaster Hedge)

- BGZ Oct $12/17 bull call spread at $1.10, now $1.20 – up 9%

- BGZ Oct $11 puts sold for $1, still $1 – even (pair trade – Disaster Hedge)

- BGU Oct $28.72 puts sold for $1, still $1 – even (alternate pair trade)

Since I went into detail in chat (and in an Alert that was sent to Members on Tuesday morning) on the last two disaster hedges and since it may be very relevant next week, I’ll reprint the logic of those two trades here:

I like the SDS disaster hedge. The June $29/34 spread is $1.27 and you can drop it to .27 by selling the Sept $26 puts ($360 margin) and that has a $5 upside and is already .54 in the money with a max win of 1,750% if SDS gets back to where it was in early March. For SDS to get to $26 (down 12%) the S&P would have to go up 6% to 1,272 so there’s your risk (rollable puts, of course) and let’s say you want to go for 20 and set aside $7,200 in margin and $540 in cash to make up to $10,000 on a market slide – that’s pretty good protection.

Before we even consider going bullish, I want to see that 1,200 on the S&P and, of course, 11,000 on the Dow needs to hold for more than a day along with NYSE 7,500, Russell 700 and Nas 2,500.

BGU is looking amazingly overbought so I like selling the BGZ Oct $11 puts for $1, which, according to TOS has a net (after collecting $100) margin requirement of $1,125. On the upside, the Oct $12/17 bull call spread is $1.10 so this combination play will cost $10 of cash with a $500 upside (4,900%) and you must set aside about $225 in margin per contract to cover the possibility of being assigned BGZ at net $11.10 (now $12.97).

If you are more bullish, here’s an interesting thought. Rather than use the BGZ Oct $11 puts to pay for the spread, you can sell the BGU (3x bullish large caps) Oct $28.72 (I know, strange) puts for $1. BGU is currently at $64.04 so the ETF would have to fall 60% by October for that put to go in the money (and then it’s rollable) and don’t forget that in order for that put to be in the money you would absolutely have $5 on the BGZ bull call spread. In general, it would take a 20% drop in the S&P, back below 1,000 to trigger the BGU $28.72 puts.

So if you finance the BGZ with the BGU puts, if the BGZ call spread doesn’t pay off, it will only cost you .10, which means you can cover $24,500 worth of downside risk for $500. The margin is much higher on the BGU puts (around net $3,200) so keep that in mind as well but, if you are bullish on the market and just want a little bit of protection – please humor me and consider this one!

Prospectus for the United States – Would You Invest?

Prospectus for the United States – Would You Invest?

This was a fun article looking at the work put in by Jim Grant, of the Interest Rate Observer, who presented the financials for the USA in the form of a Prospectus offering to sell $16Bn in Treasury Notes. A very good read if you are used to looking at these things!

Top of the World Tuesday – The 566% Play

We finally had our bullish signal (holding 11K all day) and we had already laid our our last two disaster hedges so it was finally time to consider pulling a little cash off the sidelines to join in the upside fun – switching off our brains and running with the bulls, as I like to say.

Whenever we want to switch off our brains it’s always good to resort to pictures so I put up a couple of TA charts on the S&P – the first by David Fry who I said was "the only person more fed up than I am with this nonsense" but Cap corrected me and he is right, he is also more fed up than I am! As David said that morning: "There’s no need to make this stuff up anymore since end-of-day stick saves are right there and in your face." My morning commentary was:

None of that matters though, as David says, it’s right in your face and the people manipulating the market can’t even be bothered to pretend not to be doing it anymore. I’ve already sent out an Alert to Members this morning with our last major disaster hedge of this cycle in preparation of HAVING to go bullish if we make S&P 1,200. I say having to to go bullish because I’m still convinced it’s a different kind of bull that’s driving us higher and we’ll be making few long-term commitments for the first few weeks but if we have another 10% more to gain on our indexes – there’s no point on sitting it out, is there?

I added a 566% upside play for the DIA right in the morning post for what was, effectively, upside disaster protection for our still-bearish short-term virtual portfolio. And, as I said in my outlook:

I added a 566% upside play for the DIA right in the morning post for what was, effectively, upside disaster protection for our still-bearish short-term virtual portfolio. And, as I said in my outlook:

I’m not going to talk about fundamentals this morning because fundamentals don’t matter. If we make our levels, then we can go higher and if we don’t make our levels – we’re probably doomed (but we’re already playing for that!). Oil failed $85 yesterday and hopefully will save our OIH shorts as it continues to slide into next week’s contract rollover. Gold is still insane at $1,156 and copper is unaffordable at $3.59 but that doesn’t matter because no one is actually building anything or driving anywhere (see yesterday’s chart) so they can charge whatever they want for things no one is buying.

By Friday I was looking pretty damn clever wasn’t I?

- DIA May $108/110 bull call spread at $1.35, now $1.40 – up 4%

- DIA May $107 puts sold for $1.05, now $1 – up 5% (pair trade, Disaster Hedge)

- HSIC May $60 calls sold for $2.15 average, still $2.15, even

- DENT short at $20.90, now $20.88 – even

- GOOG Jan $440 puts sold for $11, now $13.80 – down 25% (used as another way to fund disaster hedges)

- Oil futures bullish play at $82.50, out at $84 – up $10 per penny per contract!

- MEE May $45 puts sold for $4.10 average, now $4.40, down 7%

- DIA $110 calls sold for .62, finished at .18 – up 70%

- DIA $111/110 bear put spread at .62, finished at .72, up 16%

- TZA $6 calls at .40, out at .35 – down 13%

- IYR May $52 puts at $1.20, now $2.65 – up 120%

- GOOG complex spread, off target – see Member Chat for adjustments

- TBT May $48 puts sold for $1.35, now $1.25 – up 8%

- SDS June $27/32 bull call spread at $2.05, still $2.05 – even

- SDS June $29 puts sold at $1.30, still $1.30 – even (pair trade, Disaster Hedge)

In our lunchtime Members Chat session, I put up this great chart from Barry, making my point that there is LITERALLY not enough money in the entire world (green) to pay off the debt (yellow and red) – why is this such a complicated idea for people to get their heads around and have I mentioned I like TBT lately?

Wednesday Rally – 80% Gain for the S&P!

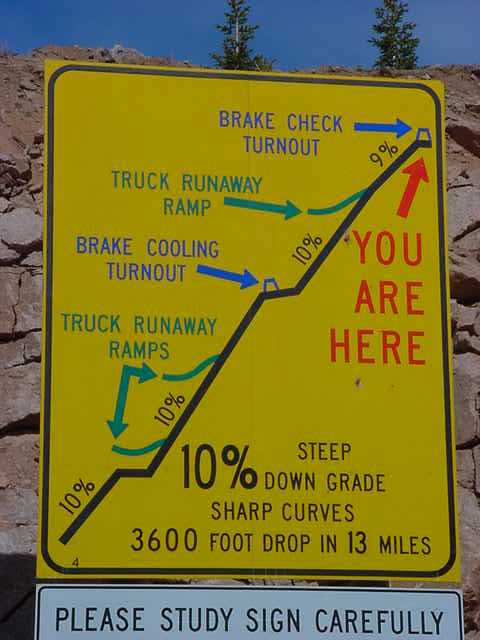

After all, like the crazy guy on TV says, if the government is giving free money away – shouldn’t we be getting ours too. Only I’m not telling you you need to buy a book or do anything special – just join my Membership site AFTER you make your 566% – that’s a pretty good deal! Of course, keep in mind these are the bull plays and we are generally hedging for a possible correction so obey the sign on the left and play wisely! Consider that you can make 5% a month by risking just 1% of your virtual portfolio on successful plays like this one – that’s 60% a year if all 12 months are positive, and the last 12 months have been so why not 12 more?

I laid out my technical take on the index numbers, pointing out that the Dow was not at all acting like it was joining the rally as they needed to make 11,592 to catch up to the gains we were seeing in the other indexes. This is why we played the Dow up (in case they do catch up) in the previous day’s post but it was also our primary point of concern as 11,000 was nothing more than a psychological block – there was no technical reason for the Dow to be having trouble there and that SHOULD make investors nervous.

Also, I concluded in the analysis: "It’s worth noting that the Russell was the first index to top out in 2007 – LONG before the others so we’ll be watching out for that action going forward. Finally, the NYSE is our canary in the coal mine as they just barely got over 80% (7,525) and they haven’t made it to 30% from the top yet (7,990) so we’ll be watching this zone with a great deal of interest." The NYSE fell all the way back to 7,550 on Friday before bouncing back 34 points…. Also in Wednesday’s morning’s post, I noted several things that were seriously bothering me and I warned: "Remember, if the S&P does NOT make 1,200 – especially on these positive reports from CSX, INTC and JPM – then it is a FAILURE and we should not be making these (or any) upside bets."

- SSO May $42/44 bull call spread at $1.25, still $1.25 – even

- SSO May $42 puts sold for .95, now $1.10 – down 11% (pair trade)

- Oil futures short at $85, out at $84.50 – up $10 per penny per contract

- FXP May $7 calls at .60, now .90 – up 50%

- DIA April $110 puts at .26 – out at .21 – down 19%

- BMRN complex Jan/July spread – on target

- UNG Oct $8/10 bull call spread at .50, now .40 – down 20%

- UNG Oct $8 puts sold for $1.23, now 1.42 – down 15% (pair trade)

- Oil futures short at $86, out at $85.80 – up $10 per penny per contract

- USO April $42 puts at .48, finished at $1.40 – up 191%

- MON Jan $65/75 bull call spread at $3.60, still $3.60 – even

- MON Jan $65 puts sold for $6.10, now $6.55 – down 7% (pair trade)

We had a ridiculous run-up into the close and in Member Chat we analyzed the Fed’s Beige Book, which was actually better than any book we’ve seen in a long time, leading me to conclude:

If we do reverse now, then I will be certain that this market is the biggest scam since Ponzi invented the thing 100 years ago. We are past anything that can be fundamentally justified and maybe this is the blow-off top or maybe it is just like 1999 when the Nas went from 2K to 5K and the big push came in October when we were just over 2,500 and then it was 3,000, 3,500, 4,000 in December, 4,500 in Jan and 5,000 in March and every step of the way past 3,000 we all knew it was ridiculous but that didn’t stop the market from going 60% higher than any logical stretch of the imagination could take it. When we first went over 3,000, we all waited for the world to explode every day but by 3,500, we were in for the next 500 and then when 4,000 popped (after Y2K didn’t happen) we were in for the next 1,000. I think right now we’re at that 3,000 stage, it’s now getting silly but if people want to keep buying, then who are we to argue? Just be first in line to buy the sock puppet and early in line to sell the sock puppet….

The banks that were too big to fail are now bigger, the unemployment is greater, the debt is much greater, the budget is more out of balance, commodities are higher than in any year except the year the global economy collapsed and Cramer says there has never beeen a better time to invest so BUYBUYBUY until they start arresting people I guess…

And, wouldn’t you know it – that’s exactly what happened on Friday!

Freaky Thursday – Foreclosures and China GDP Hit Records

Freaky Thursday – Foreclosures and China GDP Hit Records

Nothing pisses me off more than families losing their homes – it’s a real failure of society that we allow this to happen and you can lay blame wherever you want – from the math teacher that failed to explain to the homebuyer-to-be how interest works to the realtor who pushed the family into the home or the appraiser who should know better than to just sign-off on ever increasing valuations, or the mortgage broker who enabled the bank to write an ill-advised loan or the Fed for yo-yoing rates up and down to create and pop bubbles to Greenspan who said adjustable mortgages made sense for the average homebuyer or the government for overseeing an entire decade where no net jobs were created while our national debt tripled and 30M jobs were shipped overseas by companies who effectively get tax breaks for doing so. Plenty of blame to go around but explain that to a 6 year-old boy who loses his home…

3% of the homes in America will be taken away from their owners THIS year and, with 20% of the homes in America currently underwater, we may have several years to go at this foreclosure rate or higher until we at least get all 10% of those unemployed people out of the homes they can no longer afford – homes that were, up until they went underwater, their only real asset most of these people had. Small wonder consumer confidence is once again plummeting!

We discussed the evils of the property cycle and I pointed out that Asia was looking very shakey (and we had just bought FXP so fine with us!) with China nursing their own property bubble while Europe seemed to be off again on the Greece issue but we did get a good Empire Manufacturing Index number (which made no sense) and I said: "So ho-ho-ho we’re going to party like it’s 1999 for another day at least, the Nasdaq will punch through 2,500 today and the NYSE is over 7,700 and we’ll get our Russell 720 too. All that’s left now is SOX 400 and it’s the perfect top – oops, I mean mid-point… silly brain, must have had too much coffee this morning… "

In the morning Alert to Members I clarified that statement, saying:

The last domino to fall (or rise) is SOX 400 and then we are in technical heaven where we will brook no blaspheme against our rally. Meanwhile, I’m still skeptical and here’s why:

Obviously (to me, anyway) "THEY" have pulled out all the stops, ignored every warning sign, done whatever it took to jam us up to these technical levels. Why? To pull money off the sidelines. What if we get to these technicals and the money doesn’t come off the sidelines? That means "THEY" have made a critical error and overestimated their ability to influence investors who, in poll after poll, are (for some reason) starting to think the market is a gigantic scam and are not too gung-ho to give Goldman-Madoff their money again.

- MBI Aug buy/write at $5.75/6.38 – on target

- TZA May $6 calls at .42, now .49 – up 16%

- MRK 2012 buy/write at $23.12/29.06 – on target

- GOOG – series of complex spreads on earnings, see Member post for adjustments

- ISRG Jan $38/410 bull call spread at $13.50, now $11.50 – down 15%

- ISRG Apr $400s call sold for $7.50, expired worthless – up 100% (pair trade)

- TZA Oct $5/9 bull call spread at .85, now .95 – up 12%

- TZA Oct $5 puts sold at .70, now .66 – up 6% (pair trade – Disaster Hedge)

- NLY Jan buy/write at $15.20/15.10 – on target

Financial Regulations Explained For Your Children

Financial Regulations Explained For Your Children

And, as it turns out, explained for the SEC – who finally sprang into action on Friday!

High Frequency Friday – The WSJ Finally Catches On!

Interestingly, in a week where I had already been calling GS "Goldman-Madoff" and I had predicted on Wednesday that the rally would last "until they start arresting people" and we featured the above video on Thursday afternoon to illustrate what a crooked scam the financial marketplace had become that it finally hit the fan on Friday morning when even the WSJ could no longer ignore the evidence that myself and a few others have been ranting and raving about for months AND the SEC finally wakes up and does SOMETHING – not much but it’s a start. Going after GS is a statement that too big to fail does not mean too big to prosecute (or at least charge).

We didn’t know about GS until later in the day but my pre-market commentary, based on the WSJ actually giving credibility to our complaints about HFT was: "Has the World Gone Sane?" I capped off a week of amazingly prophetic statements by commenting: "The article is buried but the fact that the Journal is reporting on it means they don’t want to be caught with their pants down when it all hits the fan so now they can point to this article and say: "See, we warned you about this way back on April 15th, before the market crashed – if only you had read the Journal!" I had really, after just 3 days of trying to disconnect my brain and be good little bull, already reached my boiling point of fundamental frustration, closing with:

The fundamentals don’t mean anything and (if they did) they do not indicate, at this point, anything that can sustain these pumped up fake rally valuations. I’m particularly pissed this morning because the futures were a massive joke. Check out the movement in this chart.

How can you say valuations aren’t a joke when they can shift that violently from hour to hour? Note how low the volume is yet 50 Dow points represent $150Bn of market value up and down – your virtual portfolios fate decided by just a handful of small transactions performed by shadow traders while the market is closed. And they wonder why investors are shunning the markets? You can run a shell game for a while and rake in some suckers but every good con man knows when it’s time to move on and head to another town once they’ve played all the suckers and word gets out about their scam. The problem Wall Street has is they scammed the entire planet – which is why there is probably renewed interest in a mission to Mars – Goldman needs some fresh suckers!

I said to Members yesterday we have to consider the possibility that this ridiculous, pointless, baseless rally was nothing more than a desperate attempt by the Gang of 12 to bang out the technicals and finally draw some fresh money off the sidelines so they could get out of their positions now that the Fed is turning off the spigots and the carrying costs (rates) are starting to creeep up. As we can see from the WSJ FACTS above, so far, it hasn’t been working and if that sideline money doesn’t start coming in soon – what will our next catalyst be?

We did try to stay bullish but by 9:59 I sent out an Alert to Members saying: "Consumer sentiment was a train wreck at 69! Sorry bulls but I’m cashing out again!" We had already taken DIA $111 puts for .19 as our first play of the day and I felt so strongly about my call and was so worried about people getting burned (still not knowing about GS yet) that I also sent out a Stock Talk Alert on Seeking Alpha and Twitter saying: "That Consumer Sentiment (69.5) was the last straw – back to cash over weekend. Still some bear plays but bullish exposure off the table!" I feel very good about doing my best to stop my people from getting burned!

We did try to stay bullish but by 9:59 I sent out an Alert to Members saying: "Consumer sentiment was a train wreck at 69! Sorry bulls but I’m cashing out again!" We had already taken DIA $111 puts for .19 as our first play of the day and I felt so strongly about my call and was so worried about people getting burned (still not knowing about GS yet) that I also sent out a Stock Talk Alert on Seeking Alpha and Twitter saying: "That Consumer Sentiment (69.5) was the last straw – back to cash over weekend. Still some bear plays but bullish exposure off the table!" I feel very good about doing my best to stop my people from getting burned!

If your broker of financial guru didn’t contact you directly to warn you the market was going to crash while the Dow was still well over 11,100 please consider subscribing to our PSW member site, where you get these Member Alerts as well as the above trade ideas live, every day, while the market is in session. May will be the last month to lock in current pricing and Premium Membership will close soon when we fill up – so don’t say I didn’t tell you so well in advance…

- DIA $111 puts at .19, out at $1, up 426%

- GOOG $570 puts sold for $4.70, out at $5 – down 6%

That’s it! Cashing out our short-term, unhedged longs was a job in the morning and riding out the DIA $111 puts kept us busy until the afternoon so there wasn’t much else to do. The drop was really too fast to chase down and we had, of course, been making our directional bearish bets for 2 days and we took non-greedy exits on those too as we have no idea what next week will bring and, after a great week like this with 46 trade ideas and only 12 misses – not too shabby in a choppy market so we deserve a day to just sit back, relax and watch the carnage unfold.

My 4pm closing Alert to Members said it quite nicely: Today’s market summary: ![]()

We’ll have to see what next week brings but our cash remains sidelined until we see better evidence than was presented last week that we should be making more bullish plays. Meanwhile, we can continue to amuse ourselves with our hit and run plays – especially during earnings season where every single day is another opportunity to play the volatility!