Goldman’s Claim Tourre Acted Alone is Horse$&*t

Courtesy of Larry Doyle at Sense on Cents

Courtesy of Larry Doyle at Sense on Cents

(If you missed my enlightening interview with Larry, click on "The FINRA Fiasco.")

Goldman Sachs is playing this SEC charge of fraud by the book. How so? Wall off senior management, pin the blame on one low level junior employee, and sell that individual down the river. This approach by Goldman is not a surprise but, in my opinion, it is total horse$&*t. How so? Let’s navigate the world of structured finance transactions on Wall Street.

Bloomberg reports the Goldman defense in writing, Goldman Sachs Says SEC Case Hinges on Actions of One Employee:

Goldman Sachs Group Inc. said the U.S. fraud case against the firm hinges on the actions of the employee it placed on paid leave this week.

Fabrice Tourre, the 31-year-old Goldman Sachs executive director who was accused of misleading investors about a mortgage-linked investment in 2007, will also be de-registered from the Financial Services Authority, a spokeswoman at the firm in London said yesterday.

“It’s all going to be a factual dispute about what he remembers and what the other folks remember on the other side,” Greg Palm, Goldman Sachs’s co-general counsel, said in a call with reporters yesterday, without naming Tourre. “If we had evidence that someone here was trying to mislead someone, that’s not something we’d condone at all and we’d be the first one to take action.”

By characterizing the case as a dispute involving a single employee, Goldman Sachs may be taking its first steps to publically distance itself from Tourre in the case, some lawyers said. That could reduce bad publicity and ultimately make it easier for the company to settle the case.

Goldman Sachs may also want to separate itself from Tourre if it’s concerned he will cooperate with the SEC or implicate more senior employees, said Onnig Dombalagian, a professor at Tulane University Law School in New Orleans and former attorney fellow at the SEC.

Goldman’s defense is no surprise, but it is pathetic and ridiculous. In pinning all the blame on Tourre, Goldman would like America to believe that a 27-year old junior level employee structuring a synthetic CDO has the ability to sign off on the capital commitment and other legal liabilities associated with this type of transaction. Wow!! Goldman Sachs must truly believe America is incredibly naive.

Within Wall Street firms, these transactions would typically have deal teams in which a structurer played one role. The balance of the team would consist of the deal head (typically, a more senior level employee within the CDO group), and a marketer who would work with salespeople. Above these individuals, other senior level people who would typically need to sign off on the transaction would be the head of the CDO group and the head of the firm’s mortgage business.

I am not sure of Tourre’s reporting lines, but they would have at least been ultimately into the head of the CDO group and very possibly into the head of the mortgage business. These individuals have the responsibility to properly manage each and every individual employee reporting to them. The failure to properly manage is known as ‘failure to supervise.’ That charge is extremely serious and has cost many mangers on Wall Street their careers. All the senior level managers at Goldman may want to be careful because potential perjury charges are also quite serious.

In the midst of all the noise around this specific transaction, America should not be distracted from the fact that there were likely many more transactions of a similar nature at other firms. Does the lack of disclosure provided by Wall Street on these transactions rise to the level of a criminal charge? I would like to see how a jury would rule on that.

In regard to the charge of whether America can trust senior level management on Wall Street, America is screaming guilty loud and clear via its unwillingness to play the markets.

LD

Please subscribe to all my work via e-mail, an RSS feed, on Twitter or Facebook. Thanks.

Plagiarizing Larry’s last sentence for my own benefit, to follow my work on Twitter, click on Twitter. For Seeking Alpha, click here – Ilene

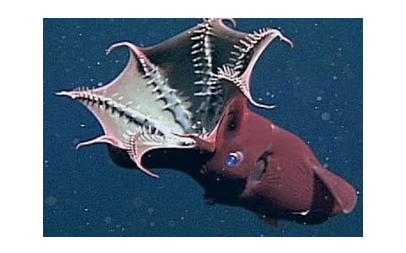

Pic credit to Jr. Deputy Accountant.