Yesterday, we got involved in an Overnight Trade that was a dud. Breifing,com’s Earnings Calendar told me that Suncor was reporting today, and I checked that with another source which said so too. Unfortunately, there was some mixup there, and they did not report. We should be about neutral when the market opens and should just sell it off. As for our Play of the Week in Align Technology Inc. (ALGN). We are seeing the fruits of that pick develop today. The stock is trading in the 19.30s in pre-market this morning. We got involved at 18.50, and we are looking at a solid 5% gain for this one on the week. Hope lots of you are ready to sell ALGN!

Buy Pick of the Day and Short Sale of the Day: Seacoast Banking Corp. of Florida (SBCF)

Analysis: We all know that playing earnings reports is one of the most lucrative ways to get involved with directonal volatility. I use earnings to help propel a lot of my plays because it is the easiest to manage – beat or no beat. What occurs afterwards is no always exactly what I think it will be, but for the most part, I can guess what will happen if a company has reported a certain earnings based on estimates and history.

Analysis: We all know that playing earnings reports is one of the most lucrative ways to get involved with directonal volatility. I use earnings to help propel a lot of my plays because it is the easiest to manage – beat or no beat. What occurs afterwards is no always exactly what I think it will be, but for the most part, I can guess what will happen if a company has reported a certain earnings based on estimates and history.

So, I am trying something a little new today by combining my buy pick and short sale into one play. I am looking at a small regional bank called Seacoast Banking Corp. of Florida (SBCF). The company is a very standard savings, loans, checking, IRA, etc. bank. It operates primarily in Florida (hence the name) and trades on average just under 700,000 shares per day. The company reported earnings this morning with an earnings beat that was pretty large. The company reported an EPS of -0.04 while expectations were for -0.14. The company’s beat has fueled the stock in pre-market trading for a solid 19% gain.

That is a huge gain. The problem is I think the company still has a bit more room to get some more gains out of the beat right at the beginning of the day. These gains will be short lived, however, because the market is retracting today it appears, and it will get market pressure as well as 19% gains pressure for a lot of selling. We want to be involved in that quick pop by market ordering right at 9:30 AM and quickly being ready to sell and move to a Short Sale.

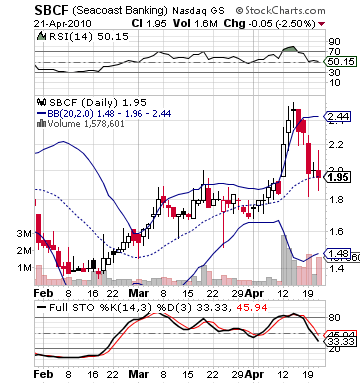

The upper bollinger band on this stock is right at 2.40, and I think around that 2.35 the stock will feel pressure. We want to harness that risk and set our range a bit higher to ensure that we don’t get burned. The company cannot maintain 19% gains as way too many sellers are about to enter the picture. We have done a lot of great short sales on these large gains, but one of the things is we are never taking advantage of the fact that we expect a small pop. Today’s article, hopefully, will allow us to do a bit of both.

Get in quick and get ready to Short Sale!

Entry: We will want to enter SBCF right as the market opens and hold for a 2-3% gain and sell. Then, I am looking to Short Sale if SBCF gets in the range of 2.40 – 2.50.

Exit: We are looking to exit for a 2-3% gain on both the Buy and Short.

Stop Loss: 3% both ways.

Good Investing,

David Ristau