Courtesy of Market Tamer

Improve Your Market Timing: The Piercing Line Candlestick Pattern

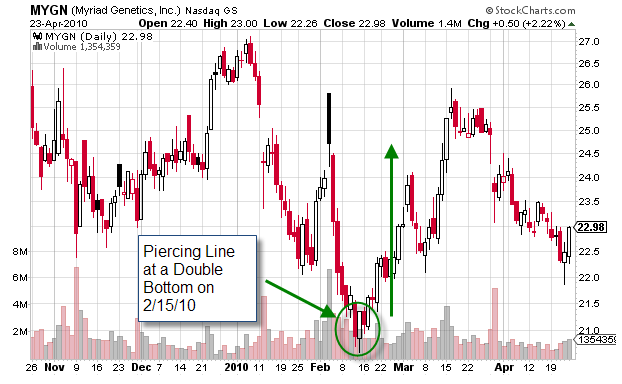

- The Piercing Line pattern is a two session pattern found in a bearish market.

- The pattern is most effective when found at a level of pre-defined support such as a double bottom or a major moving average.

- The candle will gap down and then proceed to trade up and close past the half way point of the previous bearish candle.

- The pattern is even more convincing as a reversal when the stock recovers from a significant gap to the downside and trades up with increased volume.

- The pattern is very similar to a Bullish Engulfing pattern but is not quite a bullish.

Dow

S&P 500

Nasdaq