I’m sorry, I am trying so hard to get bullish but it’s not working…

I’m sorry, I am trying so hard to get bullish but it’s not working…

My only solution is to, as we often joke, switch off my brain and stop reading the news (listening to it is great as everything is coming up roses in TV-land) and ignore the now-exposed shenanigans on Wall Street (why should I worry about my investments just because the people running the game are up on fraud charges?) and for goodness sakes don’t even look at something as depressing as "The Economic Elite vs. the People of the United States of America," neither Parts 1-3 or Parts 4-6 because that can lead to thinking and thinking makes it REALLY hard to go to sleep at night with your money riding on the top of an 80% market while gold is trading at $1,150 an ounce because of overwhelming global instability and a total lack of faith in the global financial markets.

Yep, if we don’t think about all that stuff and focus on the good stuff, like the fact that Unemployment is only 3% for those of us who earn $150,000 a year (for the poor it’s 31%), and 93% of our virtually fully-employed analysts predict the S&P will finish the year even higher (although not too much higher) with only Andrew Garhwaite of Credit Suisse in need of an "attitude adjustment" with his puny target of 1,175, which is 32 points lower than Friday’s close. Fortunately, enlightened analysts like Deutsche Bank’s Binky Chad think we can still squeeze another 100 points out of this rally (about 10%) although Goldman Sachs is wimping out at 1,250, their partner in "whatever you want to call it", JP Morgan is up at 1,300. So it’s BUYBUYBUY from the gang of 12 and we’ll be whipping Andrew into shape by the next report or he may find himself the fall guy for the next scandal…

Oops, sorry, I wasn’t supposed to mention the scandals as that’s not really a buying premise unless of course you look at the sheer volume of things the IBanks were getting away with and then look at the virtual nothing that is being done about it and then we can conclude there is no reason they can’t pump this market back up to Dow 14,000 because we already know it was such total BS last time, when we dropped 50% like a rock in 2008 – so what’s another 3,000 points of BS in 2010?

Oops, sorry, I wasn’t supposed to mention the scandals as that’s not really a buying premise unless of course you look at the sheer volume of things the IBanks were getting away with and then look at the virtual nothing that is being done about it and then we can conclude there is no reason they can’t pump this market back up to Dow 14,000 because we already know it was such total BS last time, when we dropped 50% like a rock in 2008 – so what’s another 3,000 points of BS in 2010?

Pieur du Plessis put up the old "Investor Psychology" chart this weekend and makes the case that we are ONLY moving out of the caution phase and into the enthusiasm just now (it’s that damn Andrew Garhwaite again!) while I have been thinking we are moving past "Greed and Conviction" (maybe because bankers are finally starting to be convicted) and into the "Indifference/Dismissal/Denial" zone as MOUNTAINS of negative news are being shaken off by new rounds of cheerleading accompanied by pathetically low-volume market rallies that have, frankly, only moved the Dow up 200 points in the past two weeks despite "fantastic" earnings reports that "blew the doors" off estimates.

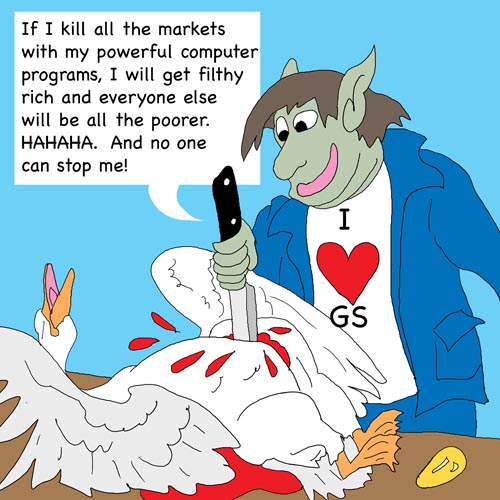

Can an entire market rally really be engineered by a few computer programs using low-interest government loans from the Fed to make Billions of dollars for the same investment banks and their media lackeys who rate the market a BUYBUYBUY no matter how awful life is getting for the bottom 90%? Of course it can! Ellen Brown, from Web of Debt has an excellent article on the subject so I won’t get into it here.

Jeremey Grantham calls the market move "nothing but Fed-sponsored monetary pornography" (Zero Hedge) and perhaps that’s what’s really bothering me – if I think of my investors like children than I guess I see all these little market concerns like one of those one of those predator maps that has way too many red tags around where my kids are playing!

Jeremey Grantham calls the market move "nothing but Fed-sponsored monetary pornography" (Zero Hedge) and perhaps that’s what’s really bothering me – if I think of my investors like children than I guess I see all these little market concerns like one of those one of those predator maps that has way too many red tags around where my kids are playing!

Now don’t get me wrong, I don’t want to compare our fabulous IBanks to child molesters (although they certainly do enjoy taking candy from babies) – it’s only your money they are after and, as we see in the news every day – that’s hardly illegal at all! So the market is forever blowing bubbles and the children are dancing without a care in the world. P/E multiples are flying, risk premiums are at zero and, as Grantham points out, alternate investment returns are so low that all of the sheep are being herded into the blind alley of equity and commodity investments – like lambs to the slaughter, as the saying goes. Yeah, just a little creepy…

We are not, of course, above riding the market movement higher but I cautioned Members to lighten up this weekend on our 566% plays while they are only halfway to goal. The 566% plays were established 2 weeks ago because we were "worried" the market would head higher and damage our bearish position. We ended up getting the best of both worlds as the market swung wildly up and down, giving us a chance to cash in on both sides and we don’t turn opportunities like that down. Now that we have broken our upside watch levels of Dow 11,000, S&P 1,200, Nas 2,500, NYSE 7,700 and Russell 720 and SEEM to be holding them, we can begin establishing some bullish plays, using the 3 of 5 rule as a sign to get the heck out if we fall back below. As a new disaster hedge, I like the following play on TZA (ultra-short on the Russel):

- Buy Oct $6 calls for $1

- Sell Oct $10 calls for .50 (net .50)

- Sell Oct $4 puts for .30 (net .20)

This hedge pays $4 (up 1,900%) on a market crash that sends the Russell down about 20%. TZA was over $10 in early February, when the Russel was just below 600 (now 741). With TZA now at $5.41, your risk of assignment comes on a $1.41 drop in TZA (26%) which would require roughly an 8% gain in the Russell to 800. You can commit $1,000 to this hedge with 50 contracts and margin on the trade should be roughly $5,000 and you have a commitment to buy 5,000 shares of TZA at $4 ($20,000). You can roll or adjust that play as time goes on of course but since even the most bullish of the Gang of 12 only expect a 10% move up from here for the whole year, we’re not anticipating getting blown out of the position by October options expiration.

This hedge pays $4 (up 1,900%) on a market crash that sends the Russell down about 20%. TZA was over $10 in early February, when the Russel was just below 600 (now 741). With TZA now at $5.41, your risk of assignment comes on a $1.41 drop in TZA (26%) which would require roughly an 8% gain in the Russell to 800. You can commit $1,000 to this hedge with 50 contracts and margin on the trade should be roughly $5,000 and you have a commitment to buy 5,000 shares of TZA at $4 ($20,000). You can roll or adjust that play as time goes on of course but since even the most bullish of the Gang of 12 only expect a 10% move up from here for the whole year, we’re not anticipating getting blown out of the position by October options expiration.

What we do buy with protection like this is peace of mind because we structure most of our Buy List plays to have a 20% margin of error (see "How to Buy Stocks for a 15-20% Discount") and, generally, all we need is a flatline to make a 20% profit on our positions. That means, if we have a $100,000 virtual portfolio, we can commit just $1,000 of cash and $5,000 of margin to the TZA spread and we are protecting $100,000 worth of bullish positions from a 20% loss – THAT’S GOOD HEDGING! Should the Russell rise 20% and force us to buy TZA at $4, we are pretty damn sure we will have made a lot more than $20,000 on the way up, especially if we throw in a couple of new 566% plays along the way (we will!).

Of course, getting TZA put to us at $20,000 (assuming we don’t roll) does not mean we are taking a $20,000 loss. If TZA drops about 50%, all the way to $3, our loss taking it at $4 would be $1 times 5,000 shares or $5,000 against projected gains of well over 20% on $100,000 – not a bad price to pay for the ability to sleep at night and owning 5,000 shares of TZA at $4 might be pretty darned clever as we hit the next set of major resistance ponts. Let’s keep that one thing in mind as we switch the rest of our brains off and try to get more bullish in this creepy rally – we will ALWAYS have our hedges and we will ALWAYS have our stopping out levels to the downside because danger lurks around every corner and we want to keep our precious assets safe!

It has been a very interesting week as we recovered off of Friday’s option expiration day catastrophe with Goldman’s SEC news and, of course, the on again – off again – on again news coming out of Greece. We finished this week more than 50 points over that Thursday’s close so yay bulls and all that. Our week’s picks were surprisingly pretty good considering what BS I thought the whole thing was:

It has been a very interesting week as we recovered off of Friday’s option expiration day catastrophe with Goldman’s SEC news and, of course, the on again – off again – on again news coming out of Greece. We finished this week more than 50 points over that Thursday’s close so yay bulls and all that. Our week’s picks were surprisingly pretty good considering what BS I thought the whole thing was:

Monday Market Mayhem – Is Goldman’s Goose Cooked?

Wow, I am so bored with Goldman at this point I can’t even bear to read my own post on the subject so let’s move on. We had the volcano in Europe bad news in CRE as demand for properties slid and rents fell with vacancies on office space in Los Angeles climbing to 17.6% in the first quarter even as average rents fell 10% year over year. Needless to say, IYR took this as great news and jumped 7.5% for the week. My outlook for the week was fairly chipper:

We’ll be very proud of the markets if they do manage to shake off this adversity and move higher but, on the whole, we’re happy to be mainly in cash and simply deciding when (and if) to cash in our short positions. The Weekend Wrap-Up reviewed our newest disaster hedges and they are still in play as are our two 566% upside plays from last week as we’re right back to where we first looked at them (breaking over Dow 11,000). As I said at the time, these are VERY easy lines to watch so we can afford to get agressive on the bull or bear side of Dow 11,000 and S&P 1,200 as long as we keep a good strong stop discipline. Meanwhile, it’s earnings season so let’s go out and have some fun!

- GS 2012 $100/145 bull call spread at $30, now $29.30 – down 2%

- GS 2012 $70 puts at $2, now 1.91 – down 4.5% (pair trade)

- DIA 566% play (see "Should We Take Profits at 300%?") at .20, now $1.10 – up 450%

- SSO 566% play at net .30, now $1.10 – up 266%

- C 2012 complex spread – on target

- GOOG Jan complex spread – on target

- GS July $125 puts at $2.25, now $2.31 – up 3%

- GS May $165 calls at $5.70, out at at $7 – up 22% (pair trade)

- UNG Oct $7/9 bull call spread at .58, now .78 – up 34%

- UNG Oct $6 puts sold for .43, now .32 – up 25% (pair trade)

- XLF June $15/17 bull call spread at $1.25, now $1.41 – up 11%

- IBM ratio backspread (earnings play) at net $110, now $320 – up 200%

We love our little earnings plays as they make for nice, fast payoffs and, if they don’t – then we end up with stocks we like anyway for a longer haul. Notice we were 100% bullish on the day and this was, of course, our second round of our 566% plays, as we did the first two back on the 13th and 14th. We saw Friday’s dip as a great opportunity to re-up since, other than the GS fiasco, they were doing amazingly well in their first week. That’s why that play was once again sent to all Members in the morning Alert as it’s a nice, liquid play that anyone can make and we love to make money for our Members!

Turnaround Tuesday – Flip Flop and Fly!

Turnaround Tuesday – Flip Flop and Fly!

We were in a giddy and bullish mood on Tuesday morning as the pre-markets were running up and clearly our decision to go long on Friday’s dip below 11,000 had already been a good one. Of course some were saying I was being a "flip-flopper" for going long when I’m overall bearish on the market fundamentals but, as the cartoon suggests, it’s not always profitable to stick with your original premise.

As I said last week, remaining mainly in cash gives us the flexibility to make these quick adjustments and cash out on plays that work (ones that pay 20% or better) as soon as they change direction, knowing that there will always be another opportunity to play for another 20% tomorrow. As I said (correctly it turns out) about our IBM earnings play in the Morning Alert to Members:

Nice $350 payout (up 200%+) on the IBM trade. It’s fine to ride out and just keep a tight stop on 1/2 the callers (now $1.55) and then stop out the longs if it turns back down but really, we’re playing for $500 at the end of May so taking $350 today and using it for another dozen trades between now and then is likely to be a better use of funds.

- IBM Jan $120/130 bull call spread at $5.70, now $5.90 – up 3%

- IBM Jan $110 puts sold for $3.30, now $3.10 – up 6%

- AAPL June $270s at $3.30, now $12.10 – up 266%

- AAPL May $260s sold at $3.60, now $14.20 – down 294% (pair trade)

- XOM 2012 complex spread – on target

- STX earnings play at net .50 credit, now .85 credit – up 70%

- GSK 2012 $40/45 bull call spread at $1.60, now $1.30 – down 19%

AAPL really blew us out of the water on earnings and our Alert play the next morning was to cash out the June $270s and pick up the July $300s (then $1.90) for an eventual roll of the May $260s to 2x the June $280s (now $7.85) at which point we have a bearish spread remaining on AAPL. That’s the trick to these earnings plays – even when they don’t work out, there’s plenty of good ways to adjust them as long as you stick with the basic concept of selling premium ahead of earnings.

Whipsaw Wednesday – Is Los Angeles Burning?

Whipsaw Wednesday – Is Los Angeles Burning?

It will all be over in about 60 days as states, cities and counties across the nation have to finalize their budgets. We’ve been worried for quite some time that many local governments will have to make serious cut-backs, like Los Angeles announced on Wednesday morning but in this "Alice in Wonderland" market – maybe bad will continue to be good and the markets will just keep on plowing through it. My logic (HAH – Logic!) on the situation is:

As we get closer and closer to budget time (fiscal years begin July 1st) for local governments, we’ll get a clearer picture on what this recovery really looks like. Cities and Counties are collecting less income tax revenues not more, their expenses (inflation) are going up, not down and their taxable land bases and sales tax collections are down, not up. It’s easy to fudge national numbers as you only have to control a couple of dozen reports written by a hundred Federal employees operating under a strict hierachy – try doing that on a national scale with 50 states, 3,141 counties and 18,000 cities and towns and things tend to fall apart and, from that rubble, you may actually get to the truth!

Meanwhile our markets are driven by Greed and Fear. as I said in the morning post: "Investors are currently being driven into the stock and commodities market by FEAR. FEAR of inflation, FEAR of leaving money in the banks, FEAR of treasuries, FEAR of bonds (thanks PIMPCO), FEAR of missing out… There simply is nowhere else to put money and earn reasonable returns but that is no reason to be complacent about leaving money in the market. This is why we maintain our disaster hedges – even when things seem to be going great."

I predicted we’d complete a 60-70 point move up from Tuesday’s low by 10 and we’d drop 60-70 points again during the day – we ended up falling 75 points before turning it around on the 2:30 stick but that was close enough for some great short plays, of course. My comment strategy at the end of the morning post was "We’re not just selling yesterday’s calls at 10 today but we’ll be going short on this idiotic run-up, happy to get out if we really break our levels but even happier if we get another pullback first" so keep in mind that the numbers we report at the end of the week are a simplification, making the assumption we just set and forget our short-term trades and don’t take any advantage of these even shorter-term opportunities.

- DIA Apr $109 puts at .85, out at $1 – up 13%

- USO Apr $40 puts at .97, out at $1.17 – up 20%

- TBT Apr $47 puts sold for $1.25, now .79 – up 37%

- OIH $131 calls sold for $3.45 – out at $3.80 – down 10%

- SPWRA June $17.50/20 bull call spread at .85, now $1 – up 17%

- SPWRA June $16 puts sold for .75, now .65 – up 13% (pair trade)

- TBT June $47 puts sold for $1.60, now $1.40 – up 12%

- TBT Sept $43 calls for $5.25, now $5.65 – up 7% (1st two legs of complex spread)

- MS $31 puts at .66, now .70 – up 6%

- EBAY July $27/May $26 calendar spread (earnings) at .02 credit, out at .20 credit – up 1,800%

- LEG May $22.50 puts at .50, out at .20 – down 60%

- LEG Dec $17.50 puts sold for .50, now .40 – up 20% (pair trade)

- NFLX Sept $105 calls at $4, out at $9.50 – up 137%

- NFLX May $95 calls sold at $2.60, now $7 – down 169% (backspread)

- SBUX $24 puts for .38, out at .10 – down 73%

- TZA $7 puts solf for $1.30, out at $1.30 – even

- TZA June $6 puts solf for .70, now .94 – down 34%

- TZA June buy/write at $4.59/5.30 – on target

- EDZ Jan complex spread – on target

Notice how we get a little nervous about the market and we start adding shorts after a bullish start to the week. The short plays not only protect our profits but they let us leave our bullish plays to ride through what was, as predicted, a very choppy day. We got the big stick in the afternoon but that was such absolute nonsense that we completely reversed the next morning but THEN we began our 200-point move up as President Obama came to Wall Street and, apparently, fixed everything.

Notice how we get a little nervous about the market and we start adding shorts after a bullish start to the week. The short plays not only protect our profits but they let us leave our bullish plays to ride through what was, as predicted, a very choppy day. We got the big stick in the afternoon but that was such absolute nonsense that we completely reversed the next morning but THEN we began our 200-point move up as President Obama came to Wall Street and, apparently, fixed everything.

Thursday’s Thrills – Greek Tragedies and Wall Street Worries

You don’t have to like Obama to like what he does for the markets when he speaks – that man is MONEY!!! Just as GWB was the greatest sell signal we ever had, Barack Obama almost never fails to give us at least 50 Dow points when he makes a speech. Thursday was no exception and the relief in the financial sector was palpable as he made calm and measured comments about regulations and did not show up with a mob carrying pitchforks and torches as many investors seemed to think he would.

We were thrilled, this is why we went long on the XLF spread on Monday (but notice we weren’t so confident that we sold puts on that one). Greece was "unsolved" again in the morning but everyone is getting bored with them already so once those silly Europeans stopped trading at 11:30 and at 11:33 I said to Members: "That’s 11:30 – Europe closed near the day’s lows, down about a point and Obama is about to badmouth Wall Street so probably another test of the lows coming up." We were looking for support from Dow 11,000 and Russell 714 and that’s just what we got…

- Oil futures long at $82, out at $84 – up $10 per penny per contract

- NFLX June $115 calls at $1.45, now $1.25 – down 14% (new cover for backspread)

- TBT June $47 puts sold for $1.85, now $1.40 – up 24%

- TBT Sept $43 calls at $5, now $5.65 – up 13% (1st two legs of complex spread)

- UNG Oct $7 calls at $1.05, now $1.28 – up 22%

- UNG Oct $7 puts sold for .85, now .67 – up 21%

- BWLD $50 puts at $1.70, now $2.25 – up 32%

- BWLD Dec $40 puts sold for $2, now 2.20 – down 10% (pair trade)

- NFLX May $100 calls sold at $5, now $4 – up 20%

- FAS $109 puts sold for $9.80, out at $7.80 – up 20%

- NFLX May $100 calls sold at $5.70, now $4 – up 30%

- VNO May $80 calls at $2.30, now $3.90 – down 70%

- IYR May $52 puts at $1.30, now .79 – down 39%

- TNA May $69 calls sold for $3.10, now 5.10 – down 64%

- AMZN earnings ratio backspread at $980 credit, cashed $1,840 (net credit $2,880), short 5 May $150 calls, now $2.47 ($1,235) – up $1,645

- Selling 5 May $150 calls at $7 ($3,500), buying 4 July $160 calls at $6.30 ($2,520).

- AAPL Jan complex spread (Disaster Hedge) – off target

- HD Jan $35/40 bull call spread at $2, now $2.20 – up 10%

- HD Jan $25 puts sold for .50, now .46 – up 8% (pair trade)

- QID May $16 calls at .32, now .27 – down 16%

- QID May $15 puts sold for .32, now .37 – down 16% (pair trade)

- DVN Jan $60/75 bull call spread at $7.50, now $8.20 – up 9%

- DVN Jan $60 puts solf for $4.25, now $3.80 – up 10% (pair trade)

- MSFT Oct $35/May $33 calendar spread at .03 credit, now .47 credit – up 1,467%

- AMZN earnings ratio backspread at $1,210 credit, cashed $1,840 (net credit $3,050), short 5 May $150 calls, now $2.47 ($1,235) – up $1,835 so far or a bazillion percent (since it was a credit spread to start)

- FXP 2012 complex spread – on target

Wow! I didn’t realize how many trade ideas there were Wednesday and Thursday until now… Of course a lot of them are us pursuing things as the entries got better like TBT, AMZN, UNG and NFLX and you can also see we’re laying in some put plays, not just because we’re contrarian but as a set-up for our money to come off the sidelines and into some bullish positions next week if we start heading higher. These are our target levels and above here we MUST take more bullish plays or risk missing out on another leg up in the market. Having downside protection of IYR, QID, and VNO (we really don’t like CRE) let’s us get more comfortable moving into our first round of new Buy List plays.

Forget About It Friday – Again

Forget About It Friday – Again

Once again, everything is back to "normal" and the markets are going up and up and up Greece is once again bailed out – ironically by the rest of the EU, who also need a bailout down the road but not today so party on boyz! As I said in the morning post, the Mayans predicted the World would end in 2012 and the G20 is pretty much counting on it as their exit strategy.

As I mentioned in the morning post, discussing the UK’s 50% drop in growth in Q1:

Jonathan Loynes, chief European economist at Capital Economics, said the figures underline the fragility of the economic outlook. "With a big fiscal squeeze coming under any form of government, monetary policy needs to remain extremely supportive," he said. You know what that means, don’t you? More FREE MONEY!!! The markets love free money, which is why bad news is such good news for the markets.

The banks run their little machines and buy up the market and the market rises and the banks declare gains on their investments and use the assets to leverage – MORE FREE MONEY – which they use to buy more stock and pump up the market so they can declare gains on their investments and use the assets to leverage – MORE FREE MONEY!!! You get the idea – this party never has to stop as long as they keep getting FREE MONEY and no one notices the average p/e on a stock is now pushing 23 with pretty much zero risk factored in and not a penny of rate discounting priced in because rates are zero so there’s nothing to discount. It’s BRILLIANT – what can possibly go wrong?

- NFLX $100 calls sold for $4.50, now $4, up 11%

- GOOG Sept $750 calls for $1.10, now $1 – down 10%

- GOOG May $590 call sold for $1,85, still $1.85 – even (pair trade, 5:1)

- C 2012 complex spread – on target

- INTC 2012 complex spread – on target

- DIA Jan complex spread – on target

Notice how we started getting bullish again as we broke our final levels. We have our downside protection plays losing money already so it’s up to us to make sure their sacrificies will not be in vain. C, INTC and DIA are all aggressively bullish upside plays – a preview of what we want on our new Buy List, which I will barely have time to get started on this weekend after such a long wrap-up. That’s OK, though as we have a Fed decision on Wednesday after Tuesday’s Case-Shiller numbers and Consumer Confidence so we sure weren’t going to be rushing into things anyway. Thursday is advanced Q1 GDP (3.2% expected – no way I say as I think we’re more like the UK and will be 1/2 of last Qs 5.6%).

Of course we also have an earningspalooza next week with close to 1,000 companies reporting so strap in for another wild ride – that we can promise you!