Why the "Nascent Recovery" Won’t Last

Courtesy of Charles Hugh Smith, Of Two Minds

The "nascent recovery" continues to be nascent a year later. Why? Because it’s constructed on sand and hyped by smoke and mirrors.

The "nascent recovery" will soon be revealed as "failed" rather than "nascent." How long can "nascent" be deployed as cover for a "recovery" constructed of propaganda, manipulated statistics and "confidence-building" spin?

As my esteemed blogging colleague Mish pointed out not long ago, "nascent" continues to be the word of choice in the MSM, as if no one dares declare the "recovery" real for fear that such a claim will be easily revealed as utterly false. So to keep the spin machine intact, the "recovery" will remain "nascent" as cover for the less rosy reality.

Let’s run through the fundamental reasons the recovery is bogus, not nascent.

1. Propaganda and "confidence-building" are constantly substituted for reality. The problem, we are repeatedly told, is a "lack of confidence." Consumers’ and corporations’ accounts are bulging with idle trillions awaiting "renewed confidence" to gush back into the economy, creating millions of new jobs and trillions in new wealth.

Here is a typical example:

Forecasters optimistic about economy, job creation

How many MSM stories have you read which refer to the "162,000 jobs created last month" as evidence that the "economy is turning around? Dozens, if not hundreds. How many note that the 162,000 number is entirely bogus, boosted by temporary Census Bureau hiring and tens of thousands of fictitious "birth/death model" phantom jobs?

The spin, hype and forced good cheer is essentially unlimited. As I write, stocks are up on news that Caterpillar reported an 11% decline in revenue to $8.24 billion, a huge "miss" since analysts polled by Thomson Reuters had forecast $8.84 billion in revenue.

The "surge in profits" didn’t come from sales; it came from squeezing costs, a strategy which has some upper limit of effectiveness on goosing the bottom line.

Machinery sales surged 40% in the Asia-Pacific region, but of course no one explores the source of that "surge:" out of control spending on empty cities and luxury highrises in China. If that unprecedented real estate bubble in China ever pops– and can any bubble continue forever?–then Cat sales will go into freefall.

That’s not "confidence building" so it goes unsaid, despite being glaringly obvious.

2. Tax/borrow and spend is alive and well. States and local governments gorged on the housing/stock bubbles in the last decade, adding billions to their annual tax revenues and spending in just a few years. California went from collecting $76 billion in 2001 to $96 billion in 2008–a 26% increase of $20 billion.

Other than some modest increases in student test scores and another prison, the state has nothing to show for this gargantuan increase in spending. The high-cost status quo vacuumed up all that money and is now crying for taxpayers to pony it up, no matter what the consequences.

Meanwhile, back at the MSM Propaganda Ranch, everything’s rosy, of course:

Here is the standard-issue "confidence-builder" on California’s "nascent recovery", with a few editor’s comments added:

Year-to-date revenue is ahead of estimates by $2.3 billion, or 4.1%. Revenue collections are running 2% above last year for the same period.

CHS: Wow, $2.3 billion! That means everything’s "fixed," right?

The state’s current general-fund budget is $86 billion, and the nonpartisan California Legislative Analyst office has projected that the state faces annual $20 billion shortfalls through the 2014-15 fiscal year, which ends June 30, 2015. The current budget gap, through June 2011, is $19 billion.

$19B minus $3B leaves a $16B deficit. Oops, I guess not.

In fiscal year 2001, the state took in $75.7 billion in major tax revenue. It plummeted to $62.7 billion the following year because of the national downturn and the dot-com bust. It took four years until revenue recovered to $80.1 billion, in fiscal year 2005.

So the state collected a staggering $20 billion more in taxes in 2008 than it did in 2001, and now it’s crying poor. The state spent $20B more–fully 26% more than its 2001 budget–but to what effect? What got fixed? Nothing.

"When it gets to 2011, we’re expecting rapid growth in California, and because it comes on the heels of several years of deep cutting in expenditures, it should be a year when we don’t have another fiscal crisis, though government will be smaller in California," said economist Jerry Nickelsburg of the UCLA Anderson Forecast.

Mr. Nickelsburg, your name offers a clue as to the value of your forecast.

So everything’s fine in tax/borrow-and-spendland because the politicos only have to paper over a $16 billion deficit rather than $19 billion. Wow, who knew it would be this easy to "grow our way" back to fiscal health?

The sordid truth is that accounting gimmicks, higher taxes on the wealthy, the flurry of speeding tickets and all the rest of the tricks being enacted have zero chance of closing a $16 billion deficit. Despite the painful visibility of this reality, the main output of the state capital continues to be denial and silence, as if all the politicos need to do is keep quiet until 2011 when "rapid growth" will magically levitate the state’s structural budget and pension deficits into outer space.

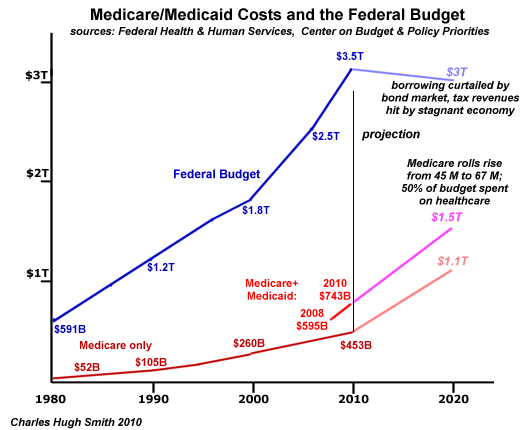

3. The demographic time bomb is still ticking. The aging of the 78 million-strong Baby Boom means that the number of citizens sucking up Medicare expenses (roughly $400-$500,000 each under many projections based on current costs) will rise by 50% to 67 million in a few years.

Social Security rolls will rise by the same number as Boomers rush to cash in their dwindling retirement chips. The Social Security surplus has already rolled over into deficit as unemployed and downsized Boomers are taking their Social Security at 62 rather than waiting to get their full draw at 67.

So if half the budget is being captured by Medicare/Medicaid alone, where will the money come from for running the Empire, Social Security, interest on the national debt, etc.?

We’d rather not discuss that because it isn’t "confidence building."

These gargantuan deficits aren’t 20 years away–they’re just a few years away. yet all the rosy projections never mention them, as they are inconvenient flyspecks of reality on the rosy forecast of "nascent recovery."

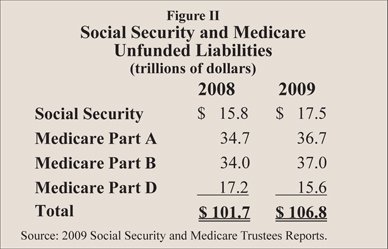

Here is a chart of the unfunded liabilities of the Savior State’s entitlements:

Even if you expropriate the entire wealth of the nation–$54 trillion–you come up $50 trillion short.

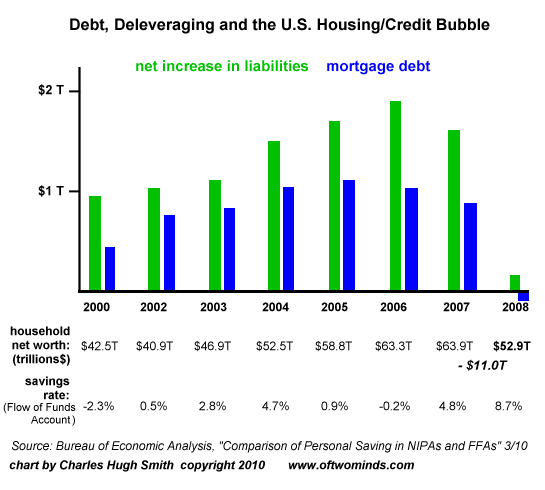

4. U.S. GDP and personal income has been propped up by unprecedented Federal borrowing. The private-sector GDP plummeted by $1.5 trillion, so the Federal government borrows $1.5 trillion to backfill the decline. And for good measure, it also socialized the entire U.S. mortgage market, buying or guaranteeding 99% of all the mortgages issued in the past year.

Here we see that without government transfers–unemployment, tax credits, and various forms of welfare–personal spending would have plummeted along with real income. Thanks to government transfers, income and spending were successfully propped up:

Of course the money that was transferred was borrowed. It accrues interest and must be rolled over as it comes due in future years. Since all debt is a draw against future income, we as a nation are simply transferring future income into the present, just to keep the "nascent recovery" afloat.

5. The fundamentals of housing are dismal for decades to come. The family house, long viewed as the foundation of middle-class wealth, is now a moneypit, a black hole which sucks up wealth.

The Census Bureau just announced that there are 19 million vacant dwellings in the U.S., up from 18.9 million. How do you say "oversupply"? Housing Headwinds and Baby Boom Demographics (April 13, 2010)

In the best-case scenario, it will take nine years to unload current inventory: 104 weeks to clear housing inventory, shadow inventory. So what happens if the foreclosure pipeline stays full longer than expected? What if current inventory keeps growing? The time needed to "clear inventory" essentially stretches out to infinity.

As I described in Housing and the Collapse of Upward Mobility (April 16, 2010), the equity remaining in 50 million mortgaged homes is a pathetic $1 trillion. Americans can no longer extract trillions in "free" cash from their homes–most have no equity left, and those who do cannot borrow against it because lenders will only loan 80% of value.

Housing’s freefall devastated the nation’s wealth and removed the middle class’s ability to leverage their assets into debt-based spending.

So let’s add this up. American’s personal income is in a freefall and spending is only flat because the Federal government is borrowing and distributing fully 10.7% of the nation’s GDP every year.

The two-thirds of households who own homes in the U.S. have seen their equity plummet from $16 trillion to $6 trillion. Those who own their homes free and clear (roughly 30% of all 75 million homeowners) retain $5 trillion in equity while the remaiing 50 million homeowners have essentially no equity left.

The house-as-ATM-machine economy is gone for good.

Corporations are reporting "better than expected earnings" even as their revenues continue dropping. The end-game of that trend is obvious: once the cutting, slashing and burning of costs reaches its inevitable endpoint, profits will "disappoint."

Much of the global economy’s "nascent recovery" is based on wild construction spending in China on empty cities and thousands of empty luxury condos being built by speculators abetted by local governments and "too big to fail" state banks.

Once that real estate bubble pops, then all the commodities and equipment sales propping up the other global economies will dry up.

When does "confidence" become a "confidence game"? Right now. We got your nascent recovery right here, pal.

In case you missed these related entries:

Incomes Decline, Debt Increases: Why the Credit Bubble Cannot Be Reflated

(April 6, 2010)

The U.S. Status Quo: Unsustainable, Doomed and Danced Out

(April 5, 2010)

Deleveraging and the Futility of "Printing Money"

(April 2, 2010)

Yin-Yang Unity: Asset Deflation and Price Increases

(March 31, 2010)