FOMC Analysis 4/28

Courtesy of Karl Denninger

Courtesy of Karl Denninger

Information received since the Federal Open Market Committee met in March suggests that economic activity has continued to strengthen and that the labor market is beginning to improve.

Borrowing and spending 10% of GDP makes it appear the economy is doing reasonably well and has improved. We continue to accumulate GDP distortions, however, and now are up to about 52%, or twice what we were going into 1931.

Growth in household spending has picked up recently but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit.

That 52% distortion comes out of private demand, of course, and that shows up directly in unemployment, lack of real income growth (it’s negative when one removes transfer payments and handouts) and house prices. No banker in their right mind will lend to someone without a job or assets, ergo, credit remains tight.

Business spending on equipment and software has risen significantly; however, investment in nonresidential structures is declining and employers remain reluctant to add to payrolls.

Business people are not as stupid as we think you are. Indeed, they’re putting pins in the Kewpie dolls with my name on them – daily.

Housing starts have edged up but remain at a depressed level.

Without a job you can’t buy a house, and nobody in their right mind would buy an overpriced house irrespective of income. We did that before and conned America – they wised up. Damn.

While bank lending continues to contract, financial market conditions remain supportive of economic growth.

Goldman Sachs’ HFT algorythm has been successful in passing shares of stock between each other and producing faux "prosperity" in the stock market. Ain’t it grand?

Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.

The stock market, on the other hand, has priced in a roaring recovery. Oh, and that claim of "price stability"? Don’t look at oil, eh? No inflation there!

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

Yes, we have record oil inventories and plenty of production, not to mention banks sitting on scads of the black stuff in tankers they leased a year ago.

Oh, you do remember that inflation in energy, food and stock prices don’t count, right?

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

I see bubbles everywhere… and I love them!

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Do you really believe this bilge? If so you’re dumber than a box of rocks.

In light of improved functioning of financial markets, the Federal Reserve has closed all but one of the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities; it closed on March 31 for loans backed by all other types of collateral.

We gave your money away to banks. Ain’t it grand?

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.

All but one of us are treasonous jackasses. We’ll find a way to get rid of Hoenig…. don’t fly in any private planes Tom….

*****

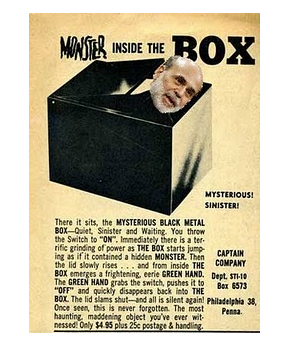

Pic credit to Jr. Deputy Accountant