The S&P downgraded Spain yesterday.

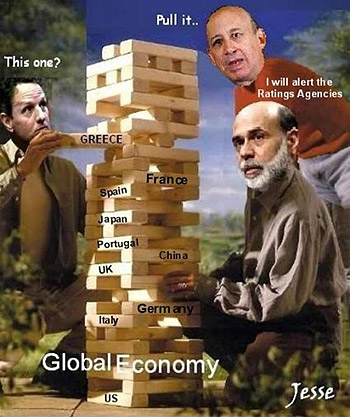

That sent our markets tumbling to the day's lows and rightly so. After all, how much better does our economy look than Spain's (8th largest in the world)? It's certainly worse on a debt to GDP basis by a wide margin and so is Austria, Belgium, France, Germany, Greece, Hungary, Italy, Ireland, Japan, Netherlands, Portugal and, of course, the UK – who are particularly worrying because they also have one of the largest bank assets to GDP ratios (570%), which means the country would be hard-pressed to stop a major slide in the financials, which is what, ultimately, undid Iceland.

Wouldn't it be lovely if we didn't have to worry about these things? We've grown accustomed to facing Greek debt and no one is even asking why can't the English pick a government but just you wait, because it will take more than a little bit of luck before this market is off to the races and we can once again dance all night instead of worrying about what's going to happen in the morning. Until, then, we're going to be staying mainly in cash, although some would say that ain't nothin' but trash – so we hedge it with TBT, of course!

Yesterday morning's news prompted me call for an EDZ hedge in Member chat, which is an ultra-short on the emerging markets and Spain's very close ties to South America make it a very prominent domino if things begin to fall apart. Things are already falling apart in China, where the Hang Seng dropped another 170 points this morning and 200 of them came after lunch, right into the close. That drops the Hang Seng all the way to 20,778, down 1,000 points (just under 5%) since Monday and now 7.5% below the April 12th high at 22,400. India also got whacked for 1.7% and the Shanghai continued to tumble while Japan was mercifully closed today:

If this set of charts made you spit coffee on your keyboard, you are not alone – that's what happened to me when I pulled up the 2-month set this morning! Yes, this is the planet Earth – although obviously not a part of the planet covered by the US media, nor part of the planet where the FOMC (not you Hoenig – you are my hero!) says:

- Economic activity has continued to strengthen

- Business spending on equipment and software has risen significantly

- Financial market conditions remain supportive of economic growth

- Inflation is likely to be subdued for some time

- The Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability

Here's what a joke the Fed has become. There is no mention of the Fed's 2:15 statement yesterday on the front page of the WSJ (other than one of their bullet items) or in their on-line version or the NY Times or even Bloomberg as the Fed has pretty much lost all credibility to the point where they barely even move the markets any more. Already the Federal Reserve Bank of the United States of America has sunk to the same level as the Bank of Japan – who have been little more than the excuse to run a printing press for the past 20 years as Japan has racked up a World-record debt to GDP ratio of 200% – making Greece's 105% ratio look responsible by comparison.

Of course Japan isn't the only problem this year. National governments, according to Forbes, have issued over $1Tn worth of debt in Q1 of 2010 and are on track to issue $4.5Tn in new debt this year – so 10% of the global economy is now deficit spending, this is triple the rate of the past 5 years and it's accelerating rapidly as major debtor nations like Germany and the US bail out the little ones like Greece and Ireland as they start to fail so we are "solving" the debt of small countries by increasing the debt of big countries – what can possibly go wrong with this plan? Oh, by the way, Europe is flying higher this morning along with the US futures because Greece is "fixed" again!

Of course Japan isn't the only problem this year. National governments, according to Forbes, have issued over $1Tn worth of debt in Q1 of 2010 and are on track to issue $4.5Tn in new debt this year – so 10% of the global economy is now deficit spending, this is triple the rate of the past 5 years and it's accelerating rapidly as major debtor nations like Germany and the US bail out the little ones like Greece and Ireland as they start to fail so we are "solving" the debt of small countries by increasing the debt of big countries – what can possibly go wrong with this plan? Oh, by the way, Europe is flying higher this morning along with the US futures because Greece is "fixed" again!

We'll be watching the CAC to see if they can get back over that 50 dma at 3,900 and the FTSE needs to retake 5,600 and hold that while the Dax is bouncing nicely off of their 50 dma at 6,000. As I mentioned yesterday, when we looked at the US index charts, I'm comfortable within that range between the blue and red lines but the US indexes are WAY over lines and need to consolidate at least through earnings but not today, as the fabulous Fed came out and saw the shadow of a pullback and declared 6 more weeks (until the next meeting, at least) of MORE FREE MONEY.

Could you imagine how totally screwed our economy would have to be in order for our Central Bank to tell us that we can look forward to "exceptionally low levels of the federal funds rate for an extended period. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability" and we still couldn't make new market highs? Listen to the MSM – companies are beating earnings at record levels AND the Fed is going to keep lending out as many Trillions as will be necessary at 0.25% OR LESS! How would you like that deal for your business? Take a few Billion, buy something. If it doesn't go up, pay the 0.25% with the next few Billion you borrow and try something else. If that fails, Borrow a few more Billion, pay the 0.25% interest and try something else. Eventually, you may find something that works, all you need is a small positive winning percentage…

Goldman Sachs finds things that work for them 93% of the time. Boy those guys must be smart! In fact, for all of 2009, there were only 19 trading days in which GS lost money with 244 days tucked into the win column. On 130 of those days, GS generated more than $100M in profits at their trading desk. Do Goldman's clients win 93% of the time? Of course not! Goldman's clients, as Lloyd Blankfein explained to Congress, are big boys and take risks on both sides of the transaction so they pretty much come out even in the "zero sum game." Why is it then, that GS comes out at 43% better than even and who are the zeros they are taking their $100M per day from?

Goldman Sachs finds things that work for them 93% of the time. Boy those guys must be smart! In fact, for all of 2009, there were only 19 trading days in which GS lost money with 244 days tucked into the win column. On 130 of those days, GS generated more than $100M in profits at their trading desk. Do Goldman's clients win 93% of the time? Of course not! Goldman's clients, as Lloyd Blankfein explained to Congress, are big boys and take risks on both sides of the transaction so they pretty much come out even in the "zero sum game." Why is it then, that GS comes out at 43% better than even and who are the zeros they are taking their $100M per day from?

The biggest zero is, of course, our beloved Uncle Ben, who hands GS as many Billions as they may need through the "discount window" at zero percent, so they can use it to game fix manipulate play the markets. Ben doesn't mind because this is a good game for him – Goldman pays him back and makes him look good as the Fed gets to say they made a "profit" of $45Bn last year. That's very nice but when you lend out $2,500,000,000,000, even at 0.25%, you are going to accidentally make a few Billion in "profits."

So, who is the biggest loser in this game? Why it's you of course! You, through the auspices of the US Treasury, borrow money every day. In fact, just yesterday you borrowed $42Bn for 5 years and paid 2.54%. That money makes it possible for Uncle Ben to hand over our borrowed cash to Goldman Sachs and other Banksters through the aptly named discount window, where they pay 80% LESS than we do to use the money. Some banksters turn around and lend our money back to us for quite a bit more than 2.5% and some banksters run a street con, like Goldman, and spin the little market wheel round and round every day where, coincidentally, their number always seems to come up.

So, who is the biggest loser in this game? Why it's you of course! You, through the auspices of the US Treasury, borrow money every day. In fact, just yesterday you borrowed $42Bn for 5 years and paid 2.54%. That money makes it possible for Uncle Ben to hand over our borrowed cash to Goldman Sachs and other Banksters through the aptly named discount window, where they pay 80% LESS than we do to use the money. Some banksters turn around and lend our money back to us for quite a bit more than 2.5% and some banksters run a street con, like Goldman, and spin the little market wheel round and round every day where, coincidentally, their number always seems to come up.

It was a funny coincidence that the markets tanked when GS was called to Congress to answer for their actions and the market rallied back as soon as Congress let Goldman go and the Fed gave them a parting gift of MORE FREE MONEY. At PSW we found it EXTREMELY funny because we are cynical bastards and , as I said to Members in Tuesday's with the Dow down 150 points:

For those of you with margin, you have to love the DIA $110/112 bull call spread for $1.03, selling the $107 puts (another 350 points down) for .84 is net .19 on the $2 spread that was in the money yesterday. Not a bad bet on a recovery but it chews up $1K of margin so if a quick profit presents itself, that’s worth taking. This is a play now on Blankfein’s powers of persuasion later.

That play was already up to .33 yesterday, up 73% in 24 hours and should be even better this morning. As I often say to Members – We don't care IF the game is fixed, as long as we understand HOW it's fixed so we can play along. In fact, I closed Tuesday morning's post saying: "Boy, I just can’t wait for the Fed to tell us just how super everything is tomorrow, can you? So lots of drama but Greece can be fixed in an instant and the post-Senate analysis could be a crushing victory for Goldman Sachs and the Fed can say nice things and we still have 900 earnings reports to chew the green shoots of this week so I guess it’s time for another 566% play this morning." I mean, come on people, with GS winning 244 out of 253 trading sessions, it's not a big stretch to figure out the playbook, is it?

As I said though, today the play is back to cash. We took our unhedged plays on both sides off the table yesterday as the Spain downgrade got me nervous and this morning it looks like we're going to have such a nice pop that we'll be back to asking ourselves, as we did (thank goodness!) on the weekned: "Should We Take Profits At 300%?" on our more complex spreads like the one above (and I'll save you some trouble – the answer is "YES"). Cash doesn't mean sitting on our hands, cash means flexible. Cash means being able to grab opportunities like the chance to sell BIDU calls to suckers this morning and the chance to short oil at $85 again.

Whatever you do, just be careful out there!