Greatly Overvalued Stocks – Time to short?

Courtesy of Allan

Ilene, at PSW, sent me this list of overvalued stocks in the news fromOckham Research and asked me to run them through my system looking for short sales. I’ve run them through my trend models and have posted results, in red italics. Below that, a few of the charts that look especially Bearish.

Caution: Greatly Overvalued Stocks in the News

At Ockham, we recently released a new stock screening tool on our site that we now use daily around the office to more efficiently wade through our coverage of over 8400 stocks. One interesting filter we used today was to see stocks that have our Greatly Overvalued rating, and also have been mentioned in the financial media within the last 30 days according to RazorWire. These stocks represent a subset of our most negative ratings that are also attracting some attention lately either because of earnings releases or some other reason to be mentioned on business television or influential financial blogs.

Ockham’s "Overvalued" Stocks: Allan’s Trend Analysis

Occidental Petroleum (OXY): New Buy as of Friday’s close;

ArcelorMittal (MT): Sell Daily, New Sell on Weekly;

Caterpillar (CAT): New Sell Pending, trigger is close under 67.88

Johnson Controls (JCI): Still in uptrend, but Sell under 33.09

PACCAR, Inc (PCAR): Still in uptrend, but Sell under 45.65

Vornado Realty (VNO): Uptrend;

Kinder Morgan Energy Partners (KMP): Daily Sell, Weekly Long;

Eaton Corporation (ETN): Daily Sell signal; Weekly still Long;

Fidelity National Info Services (FIS): Strong Uptrend;

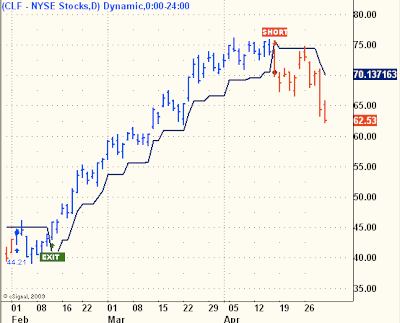

Cliffs Natural Resources (CLF): Daily Short, Weekly new Sell;

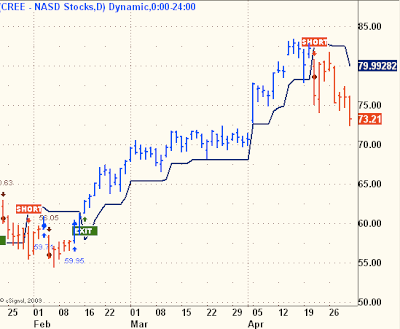

Cree, Inc. (CREE): Daily Short, Weekly Sell pending;

Eastman Chemical Company (EMN): New Sell on Daily chart;

BorgWarner, Inc. (BWA): Strong uptrend;

Autoliv, Inc. (ALV): Daily Short, Weekly Sell pending;

M.D.C. Holdings (MDC): Uptrend;

Redwood Trust (RWT): Daily Short, Weekly Long;

Imax Corp (IMAX): New Sell on Daily;

Permian Basin Royalty Trust (PBT): Strong uptrend.

Allan’s newly launched newsletter, “Trend Following Trading Model,” goes with a trend-following trading system he’s been working on for years. Most trades last for weeks to months. Allan’s offering PSW readers a special 25% discount. Click here. For a more detailed introduction, read this introductory article.