David Kotok: $12.5 Billion Is Just The Start Of The Oil Cleanup Costs, And A Double-Dip Is Now Way More Likely

Courtesy of Joe Weisenthal at Clusterstock

Courtesy of Joe Weisenthal at Clusterstock

David Kotok of Cumberland Advisors is out with some very gloomy comments about the economic ramifications of the Deepwater Horizon oil spill, and what it will cost. First he notes the ugliest case scenario:

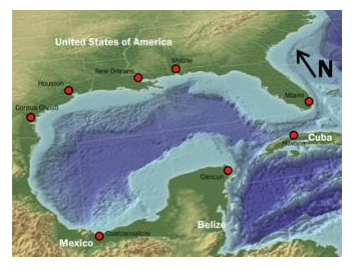

This spew stoppage takes longer to reach a full closure; the subsequent cleanup may take a decade. The Gulf becomes a damaged sea for a generation. The oil slick leaks beyond the western Florida coast, enters the Gulfstream and reaches the eastern coast of the United States and beyond. Use your imagination for the rest of the damage. Monetary cost is now measured in the many hundreds of billions of dollars.

As for numbers:

Usually, the first estimates in any crises are too low. That is true here. 1000 barrels a day is now 5000, and some estimates of spillage are trending higher. No one knows exactly. The containment and boom mechanism is subject to weather cooperation as we can see this weekend. Soon we are entering the hurricane season. The thoughts of a storm stirring up the Gulf, hampering any cleanup or remediation drilling effort and creating a huge 10,000 square mile black stew is frightening to every professional in the business.

This will be a financial calamity for many firms, not just BP and its partners and service providers. Their liabilities are immense and must not be underestimated. The first estimate of $12.5 billion is only a starter.

As for the economy beyond BP…

Thousands of small and independent businesses as well as larger public companies in tourism are hurt here. This is not just about the source of half the nation’s shrimp. That is already a casualty. It’s also about the bank loans for the $200,000 shrimp boat and the house the boat owner and/or his employees live in and the fact that this shock piles on a fragile financial system that is trying to recover from a three-year financial crisis. Case study, my fishing guide in the Everglades splits his time between Florida and Louisiana. His May bookings in LA have cancelled. His colleagues lost theirs and their lodge will be empty. They are busy trying to find work in the clean up. For him, his wife and eleven year old daughter, his $600 a day guide fees just went “poof”. When I asked him if he thought he had a legal claim on BP, he said he hadn’t thought about it yet but it gave him pause. As we suggested above, the $12.5 billion loss estimate is only a starter.

And the taxpayer…

Federal deficit spending will certainly rise by tens, and maybe hundreds, of billions as emergency appropriations are directed at larger and larger efforts to clean up this mess. At the same time, federal and state revenues tied to Gulf-region businesses will fall. My colleague John Mousseau will be discussing the impact on state and local government debt in a separate research commentary.

We expect that the Federal Reserve will extend the timeframe that we have come to know as the “extended period” in the making of its monetary policy. We do not expect the Fed to raise interest rates at all for the rest of this year, and maybe well into next year. We expect to see the deterioration of the economic statistics for the US to reveal the onset of this oil-slick crisis in May, and the negative impact will intensify during the summer months. A “double-dip” recession probably has been made more likely by this tragedy.