Happy Tuesday to all! Market is taking a fall today, and it looks like it is making a solid opportunity for an overnight trade of the day for us, which we should get involved with this morning and take advantage of a day long advance as I think the market will cool down. It is basically a Buy Pick of the Day and Overnight Trade of the Day in one. Yesterday, we got involved with a Week Long Play with JC Penney Co. (JCP). I was afraid this cool down would occur, but I went ahead and got involved at 29.15. We are down about ten cents right now, so not too much of a concern.

Also, later in the day for all of my PREMIUM and OXEN ALERT MEMBERS, I am going to be publishing an interesting look at the oil market that will help you to better understand how to play oil ETFs and make some money.

Overnight Trade of the Day: Electronic Arts Inc. (ERTS)

Analysis: The gaming market is one of the continual growing industries that has continued to make more and more money, as a whole, every year. That, however, has not translated in any established growth stocks as the companies all stay rather cyclical with hot quarters when sales are good of a new game and cold quarters when the buzz dies. This quarter, I believe may be a semi-hot quarter for Electronic Arts Inc. (ERTS), and it will be much hotter than for what analysts will give the company credit.

Electronic Arts is projected to report an EPS of 0.05 today in after hours. The stock has been hit as most stocks have with recent declines in value. ERTS lost, in the last two weeks, over 8% in value. The stock looks poised to run up today as I think the market will continue recover and surprise people tonight with good earnings. In the first quarter of 2010, which corresponds with ERTS’ earnings (even though it their Q4 already), ERTS had two of the most major selling games – Mass Effect 2 and Battlefield: Bad Company 2. The company sold 890,000 units of Mass Effect 2 on XBOX 360 and 1.28 million copies of Battlefield on XBOX and PS3 combined. These are huge sales.

Electronic Arts is projected to report an EPS of 0.05 today in after hours. The stock has been hit as most stocks have with recent declines in value. ERTS lost, in the last two weeks, over 8% in value. The stock looks poised to run up today as I think the market will continue recover and surprise people tonight with good earnings. In the first quarter of 2010, which corresponds with ERTS’ earnings (even though it their Q4 already), ERTS had two of the most major selling games – Mass Effect 2 and Battlefield: Bad Company 2. The company sold 890,000 units of Mass Effect 2 on XBOX 360 and 1.28 million copies of Battlefield on XBOX and PS3 combined. These are huge sales.

Signal Hill analyst Seth Greenwald commented that these sales are far above any expectations the company would have ever had. Further, the company should have gotten a boost in its FIFA line of games due to the World Cup buzz. FIFA is the only major soccer game for console games in the country. With all that, the company is only projected to have an EPS of 0.05. Last quarter, the company projected this quarter’s EPS would be 0.02 – 0.06 before knowing how well they were doing with these two titles and that 2011 earnings would be below estimates, resulting in the stock’s quick sell off. Yet, with the success of Mass Effect and Bad Company and the continued recovery of the American markets, one would think that the company might be less cautious in this report than last quarters.

Many analysts, therefore, are looking at this earnings season as a chance for ERTS to also raise guidance going forward for 2011. MKM Partners analyst Eric Handlers commented, "people are already expecting a healthy beat relative to guidance and consensus." Yet, the stock only rose yesterday and slightly today, which does not show me much indication that the market is pricing in a beat. We have analysts commenting that the EPS will be beat, and the market has not. That seems like a discrepancy I would want to take advantage of if I was a buyer.

Another fact that I like ERTS is that they are projected to make a profit. One year ago the company was losing money. It is always a psychological boost to investors when they see that title "ERTS turns to profit" or "ERTS moves into the green." It is exciting and helps push the buy button, driving up demand. The company also lost money in the prior quarter, so a move to profitability will be huge for this stock.

Further, a lot of other gaming companies have been doing surprisingly well. ERTS’ competitors THQ Inc., Activision, and Take Two have all reported beats in the last month of pretty high margins, highlighting the fact that the buzz from the end of 2009 buying season may have transferred to 2010 more than analysts were expecting. This tends to make me believe that ERTS and analysts are being a bit too cautious with their estimates.

Further, a lot of other gaming companies have been doing surprisingly well. ERTS’ competitors THQ Inc., Activision, and Take Two have all reported beats in the last month of pretty high margins, highlighting the fact that the buzz from the end of 2009 buying season may have transferred to 2010 more than analysts were expecting. This tends to make me believe that ERTS and analysts are being a bit too cautious with their estimates.

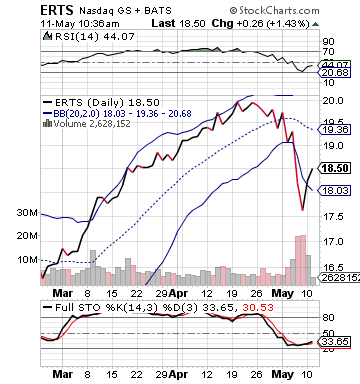

Finally, the technicals on ERTS help to allow for a large pop tomorrow. The stock was below its lower bollinger band even with a great day yesterday. The stock has been mightily oversold and undervalued on the RSI. It should continue to gain throughout the day, especially in the last two hours. Then, if the beat does come and 2011 projections are better, it shoud be able to make a huge pop as buyers funnel into the stock.

Good luck to you all!

Entry: We are looking to get involved in the 18.50 – 18.60 range.

Exit: We are looking to hold through the day and exit on tomorrow morning’s announcement, unless we can gain 3-5% from entry, in which we should sell today.

Good Investing,

David Ristau