SpendingPulse Reports Retail Sales Drop 2 Percent; UCLA Ceridian Commerce Index Drops .3 Percent; Recovery Has Stalled

Courtesy of Mish

Inquiring minds are reading the April SpendingPulse™ Retail Sales Report provided by MasterCard Advisors.

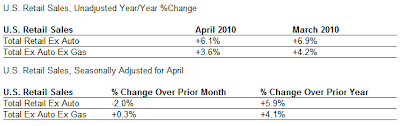

Kamalesh Rao, Director of Economic Research for MasterCard Advisors SpendingPulse, reported that following three months of steady, month-to-month growth averaging about 2%, total U.S. retail sales ex-auto stopped to catch its breath in April, falling by 2% since March on a seasonally adjusted basis. Taking out gasoline, the month-to-month number performed better, rising 0.3%, also on a seasonally adjusted basis, but not as strong as the 1.5% average of the previous quarter.

“Although there were pockets of strength, for example double digit growth in luxury sales and eCommerce, retail sales overall seemed to have lost some momentum in April. However, this is not untypical of a recovery, which will happen in fits and starts, rather than by taking a direct path,” noted Rao.

Year-over-year growth for total retail sales ex-auto also dipped slightly, cooling to 6.1% compared to the 6.9% growth of March. Added Rao, “This slight drop still puts retail growth at relatively healthy levels, especially when you compare it to the losses of last year.” Excluding gasoline the same trend holds: April saw retail sales ex-gasoline grow at a 3.6% year-over-year clip, down slightly from the 4.2% growth of March.

Retail Sales Statistics

Those stats reflect all retail sales, including cash, not just MasterCard transactions.

Ceridian-UCLA Pulse of Commerce Index™ Drops 0.3 Percent in April

Please consider Ceridian-UCLA Pulse of Commerce Index™ Drops 0.3 Percent in April

With the release of April’s figures, the Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management is showing flat, overall performance during the first four months of 2010. The PCI in April fell 0.3 percent, suggesting the economic recovery may have stalled, although an uptick in consumer spending could continue to drive a slow but steady recovery.

Year-over-year growth of 6.5 percent in the PCI marks the fifth straight month of steady increase at “better than normal” levels. However, year-over-year growth of 10 to 15 percent in the PCI is required to drive down the unemployment rate.

While the economy continues to climb year-over-year, the PCI indicates that expectations in the market for a robust recovery may be too optimistic. The PCI closely tracks the Federal Reserve’s monthly Industrial Production index, and with each PCI release comes a lowering of expectations for Industrial Production growth. The PCI now indicates Industrial Production to grow by 0.4 percent in April when the Federal Reserve releases its report on May 14. Last month, the PCI suggested an April growth rate of 0.6 percent, and in March, PCI anticipated an April increase of 0.85 percent.

“The latest PCI numbers are disappointing and cast considerable doubt on the strength of the recovery and the strength of GDP numbers for 2010,” said Ed Leamer, the PCI’s chief economist. “The next two months will tell if the first quarter’s healthy consumer spending will help lift the PCI and propel stronger GDP growth for the year.”

The PCI is based on an analysis of real-time diesel fuel consumption data from over the road trucking tracked by Ceridian, a global provider of electronic and stored value card payment services and human resources solutions. The complete April report and additional commentary is available at www.ceridianindex.com.

Here are a couple of charts from the above link.

Ceridian Index vs. Industrial Production

Ceridian Index vs. GDP

Please click here for a 2 minute animated video on the Ceridian Index.

Comments on Retail and Gasoline Sales

It is important to remember that the reportedly "strong" increases in retail sales earlier this year are only in comparison to extremely weak, easy to beat numbers at very depressed levels. As the year wears on, comparisons will be more difficult, but should still be considered relatively easy, at least for a while.

The falloff in real-time diesel fuel consumption is suggestive of an inventory replenishment cycle that has run out of steam. Moreover, with the expiration of $8,000 home tax credits, home prices have again started to drop.

Moreover, barring another Federal bailout to the states, mass-layoffs at the state and local level are coming. Those effects have not yet been felt, but they will.

Finally, as noted in Recovery? Show me the Money, tax receipts do not support the widespread belief the economy is improving.

There is every reason to believe this artificial recovery is on its last legs.