Good morning to everyone. The market this morning may be well on its way to having a healthy pullback after the unemployment claims came out at 8:30 AM meeting estimates for number of job losses at 440,000 for last week. While it was not above estimates, the market has moved at great distances in a short time on relatively good news. This is the first big hit, and I think it may be a catalyst for a small pullback. Our JC Penney position is still open. We entered this Play of the Week on Monday at 29.15. The stock closed yesterday at 29.63. Kohl’s, this morning, reported earnings that beat expectations (0.64 vs expected 0.62). The market, however, is not reacting well on disappointing outlook. We will just have to wait and see how JCP reacts to the news and its pre-earnings buzz. We are looking for an exit of 30.30 at the lowest.

Let’s get into today’s picks…

Buy Pick of the Day: Direxion Daily Energy Bear ETF (ERY)

Analysis: The oil market is looking to dip lower today back into the 75s, and it may continue on down past this with the market’s inability to rally for a fourth straight day. Oil is being pushed lower as the dollar is rising in value compared to the Euro and other currencies as well as the fact that crude inventories were reportedly higher than expected yesterday, making it consecutive weeks in which the inventories have rose. This is not boding well for the fundamentals of raising oil prices, and the market is falling.

.png) With that said, I am thinking that the inverse oil ETFs are a good buy today, especially after they have been bludgeoned over the past few days as the market rallied. For the more volatile investor, like myself, we are looking at Direxion’s Daily Energy Bear ETF (ERY). This ETF inverses a number of oil companies and tends to follow oil prices in reverse. As they fall, it rises. The ETF dropped around 10% over the past three days of trading. It has quickly become oversold on fast stochastics, and its RSI has moved to neutral from being heavily overvalued. It once again represents a good trade because it is not overvalued and has lots of room to the upside.

With that said, I am thinking that the inverse oil ETFs are a good buy today, especially after they have been bludgeoned over the past few days as the market rallied. For the more volatile investor, like myself, we are looking at Direxion’s Daily Energy Bear ETF (ERY). This ETF inverses a number of oil companies and tends to follow oil prices in reverse. As they fall, it rises. The ETF dropped around 10% over the past three days of trading. It has quickly become oversold on fast stochastics, and its RSI has moved to neutral from being heavily overvalued. It once again represents a good trade because it is not overvalued and has lots of room to the upside.

Entry: We are looking for an entry of 9.80 – 9.90.

Exit: We are looking to exit for 2-4% gains.

Stop Loss: 3% on bottom.

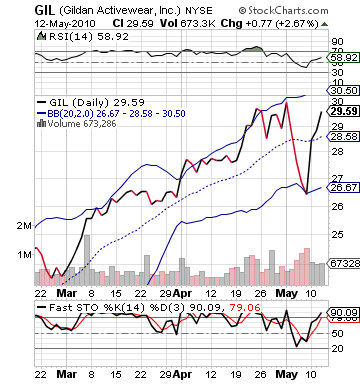

Short Sale of the Day: Gildan Activewear Inc. (GIL)

Analysis: One company that had some pretty nice earnings this morning was Gildan Activewear (GIL). The company is the producer of basic apparel like undershirts, sweatshirts, and t-shirts that are plain and 100% cotton. They operate through a number of US distributors. The company offered up their Q1 FY2010 earnings this morning with an EPS of 0.41 vs. the expected 0.36. Further, the company also raised its FY2010 guidance to $1.5 billion in revenue over the $1.25 billion that was consensus. The company saw a year-over-year revenue growth of over 35%. It was a very nice quarter, and the market reacted with over 5% pre-market gains.

The stock since has declined as the rest of the market has over the past hour, but I still think it represents a good short sale. The company will most likely pop to start the day up a bit, but it will most likely not be able to sustain much more in gains. The stock has risen just over 10% in the past three days coming into earnings, and sellers are ready to turn in their profits. The company has had a nice run, but fast and slow stochastics are showing overbought signals. The RSI is getting way too high on valuation, and it is right at its upper bollinger band. All good signs that a selloff is in order.

It is strange the catalyst is good earnings, but in reality, those earnings have been priced in. Now that the earnings have been met, it is time to selloff. The stock is bouncing around a bit here in pre-market, but I think our entry/exit ranges give us a nice cushion for a pop to start the trading day and then a slow decline as the market is in the red.

Good luck!

Entry: We are looking to enter at 30.25 – 30.35 for our short sale.

Exit: We want to cover on 2-3% gains from entry.

Stop Loss: 3% on top.

Good Investing,

David Ristau