Well, it has been an up and down week for us. Some of our positions looked to be doing fantastic, and then, they all disappeared. The market is playing some tough games with us right now, and I am having some trouble knowing the trends because when we get really great American fundamentals the market sells off, but if we have none, it rises. Anyways, we lost on our Short Sale from Monday of the Direxion Daily Bear Euro ETF (EUO) after being up close to 2%. We took a 3% loss yesterday. The same goes for Chico’s FAS Inc. We were up to almost 2%, and then, CHS started to drop hard, and we ended up at a 3% loss. That is okay with me, though, because the stock dropped over 11% today. Finally, we were up over 4% on our Play of the Week in Aeropostale Inc. (ARO), and we did not sell because I just did not see the market tanking at that point, and it lost all of its gains. It is now down just under 1%, and we continue to hold.

Let’s get into today’s plays…

Short Sale of the Day #1: Citi Trends Inc. (CTRN)

Short Sale of the Day #1: Citi Trends Inc. (CTRN)

Analysis: The market is completely bugging me out over the last few days, and I cannot seem to get a really great read on its direction. It appears to be opening down, but futures have moved up after a worse than expected consumer price index report. Huh? I am trying to stay away from the normal selections today that I like to get involved with on fundamentals and go for a strictly…this stock should not be this high…even if the market is doing well or bad. That stock is Citi Trends Inc. (CTRN). This small company produces "urban clothing" and reported some solid earnings this morning with an EPS of 0.86 vs. the expected 0.67. The company saw a 27% rise in revenue year-over-year, and the crucial metric was a rise in their outlook for the FY to 1.75 – 1.80 EPS vs. the expected 1.68.

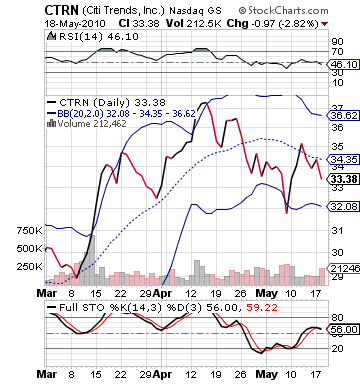

The stock, therefore, has gained rapidly over 6.5% this morning in pre-market. This is a red flag for me for a possible short sale if the stock is getting into territory where it is above its upper bollinger band and will be overbought because that means profit taking should occur. The company’s upper band is right at the 36 level, and the stock is trading in the mid 35s, meaning it does not have too much more room to the upside before it will probably meet some solid resistance and be driven back down.

We can look to play CTRN through a short sale or through some $35 puts. The stock I would expect to continue a small rise this morning before making a movement back down. Futures were down significantly with renewed fears over Europe arising, and they have come up somewhat. Yet, yesterday, the market looked to have some very solid fundamentals and sold off the entire day. My guess is that we should continue to see more pressure on the market again today, which will also help to bring down CTRN.

Look for CTRN to have a small rise to start the day and then get in and ride it down.

Entry: We are looking to enter at 35.85 – 35.95.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Short Sale of the Day #2: The Crude Inventories Trade – Direxion Daily Energy Bull/Bear ETF (ERX/ERY)

Analysis: If you have been following me for any significant amount of time, you will know that another one of my favorite trades when I am just not sure what is going on in this crazy marketplace is the crude inventories trade. The way this trade works is that on Wednesdays at 10:30 AM, the Energy Dept. releases crude inventory movement in the past week. It helps to show how much inventories have grown or shrunk over the past week to show the rise or fall of oil demands. A rise in inventories means that demand was not as great as assumed, whereas a fall means demand was greater than assumed. A rise means that the price should typically drop, while a drop means the price should fall.

Last week inventories rose 1.9 million barrels, sparking an extended drop in the price of oil that has been helped along by a bear market and other poor fundamentals around the world. The oil inverse ETFs have had a great rise and are getting close to pretty toppy, but the bull ETFs are scraping the bottom of their bollinger bands. That is why today’s report is really important. If inventories rise more than 1.5 million again, then we want to short sale ERX. While it is already undervalued, another rise could kill the price of oil back to $65 per barrel. If there is a drop in inventories at all below 0, then we want to pick up a short sale in ERY, which will fall fast and hard.

The trade should be set up prior to 10:30 AM. Watch closely for the report to be released and make our move right at 10:30 AM when the report is released. I do not know how much more upside ERY has or how much further down ERX can go, but if the inventories are above 1.5 million again that is a large number, and it will drive this market even more crazy. If they fall, then it will be very big news, as well. If they are between 0 – 1.5 million in rising, I do not think we really have a trade.

Good luck and watch closely. Set up the trade on two screens or two tabs before 10:30, so you can pull the trigger right then.

Entry: We are looking to short sale ERX/ERY on the crude inventories news released at 10:30 AM.

Exit: We will look for a 2-3% gain before covering.

Stop Buy: 3% on top.

Good Investing,

David Ristau