The stock market is just not looking too great this morning with a lot of very poor indicators out there for our enjoyment. We were unfortunate not to get involved in any new positions yesterday. Our Double Short Sale of the Days were not actionable because of ranges that I had set for safety. Our first Short Sale on Citi Trends Inc. (CTRN) was good for a 12% decline throughout the day, but we missed the entry by fifteen cents. Our second short sale was on ERX/ERY if crude inventories were significantly up or down, but they were neither. So, we made no play. Hopefully, today, we can have some better success with getting into some winning positions.

Let’s get to it with another round of short sales…since I don’t think I can recommend buys on a day when futures are down 165 points…

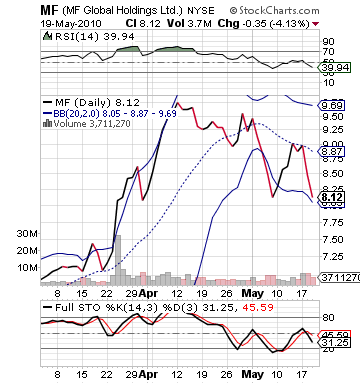

Short Sale of the Day #1: MF Global Inc. (MF)

Short Sale of the Day #1: MF Global Inc. (MF)

Analysis: The Euro is in free fall once again. Europe does not know what the heck they can do to stop it. The foreign markets are in the red again today, and we are staring at one of the biggest gaps in the last couple months between predicted jobless claims and actual claims. Is the sky falling on anyone? The US Department of Labor reported that jobless claims were at 471,000 for the past week, more than the 440,000 predicted. It also was a rise from last week’s 446,000. Not good…

Overall, the markets are not looking at all tempting, and we are looking at trying to find a couple of groovy short sales to help us make some money in this upside down market. The first place I want to start today is MF Global Inc. (MF). MF is an investment brokerage who specializes as a derivatives clearinghouse. This company reported absolutely awful earnings this morning. The company missed their estimates by -1900% with an EPS of -0.18 vs. the expected profit of 0.01 EPS. The company, in addition to the bad profit, cut their FY estimates, and for the cherry on top, MF announced that they will be cutting 10% – 15% of their total workforce. Uh…yikes!

The stock is down over 4.5% in pre-market trading. Yet, with no good buys out there. This type of news, and the fact that everything is going to drop hard out of the gates. I think this might be a nice place to throw our money at the start of the day. MF was already doing rather poorly yesterday. Investors were already worried about the company yesterday and dropped it over 5%. The drop should continue. Even if the market was even neutral, there is no reason to buy this company. Short interest is going to be significant for it, and you do not want to miss the opportunity.

Get in while you can!

Entry: We are looking for an entry of 7.55 – 7.70.

Exit: We want to cover on 2-4% gains.

Stop Buy: 3% on top.

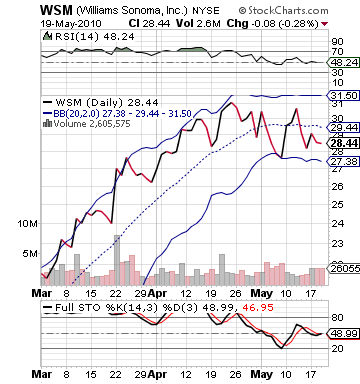

Short Sale of the Day #2: Williams-Sonoma Inc. (WSM)

Analysis: For the same basis reason, we are looking at Williams-Sonoma Inc. Yet, the company is at a different starting point. The company, who like a lot of luxury retailers and specialty retailers, somehow is managing to do rather well so far in 2010. WSM reported some very good earnings this morning. They nearly doubled the estimates that were set for them, reporting an EPS of 0.23 vs. the expected 0.12. The company also raised the yearly estimates, and it was all in all a very good reporting from the home goods store.

The problem, though, does not lie with WSM. The problems lies in that the market is being shorted. Anything with some gains is going to have profit taking right away, and there is going to be very little buyer demand. WSM is one of the few stocks in the green in pre-market. In fact, it is up over 1% right now. It was up over 3%. It is dropping in pre-market. That pre-market drop is showing me what will happen to it during today.

The stock also is one of the few companies not right at its lower band or oversold. With the rise this morning, the company is actually slightly overvalued and overbought. So, it is even more reason to believe it has a lot of room for selling off, and there will be some definite profit takers on the day.

As long as the market does not skyrocket out of the gate, WSM will be another good place to look to short sale. Good luck!

Entry: We are looking for an entry of 28.80 – 28.90.

Exit: We want to cover on 2-3% drop.

Stop Buy: 3% on top.

Good Investing,

David Ristau