Where do I even begin to go over this week?

Where do I even begin to go over this week?

I think, to set the proper tone, let's look at my Thursday morning Alert to Members where I said: "Get out, Get Out, GET OUT of the short-term short-side plays if we get back over the 200 dmas. Take the money and RUN. CASH OUT THE SHORT SIDE. Is that clear? We may not hold these lines but that’s why we have October Disaster Hedges, the shorter-term downside plays are huge winners and should be cashed here – we’ll find something else to short if we fall off this support level. 200 dmas need to be held and those are: Dow 10,250 (8,650 is next major support), S&P 1,100 (900), Nasdaq 2,225 (not there yet! 1,800), NYSE 7,100 (5,500) and Russell 630 (still above! 500)."

We never did hold those levels but, as I mentioned in Friday morning's post, I thought the end of day sell-off on Thursday was a bit forced, and, in my first Alert of Friday morning I said: "TAKE THOSE SHORT PROFITS OFF THE TABLE!" Now, I am not prone to making statements in all caps in Member Chat – almost never is about how often so this was a pretty important statement. Before that Alert, right at 9:42, I had already called for the SPY $105 calls at $2.45 as our first trade of the day. Those calls finished at $4.11, up 67% for the day so a good start to our expiration day!

A good start and our other day trades did very nicely as well:

- FXI June $39 calls at .98, now $1.28 – up 30%

- DIA May $102 calls at .13, out at .45 – up 246%

- DIA May $101 calls at .95, out at .80 – down 16%

- DIA May $101 calls at .10, out at .80 – up 700%

Of course we followed our strategies and took 1/2 the DIA's off the table at a double so the other half was a free ride (we like to gamble but we're not crazy!) but the FXI was the only "keeper" for the day, we'll see if that was a good idea on Monday. We also took (as I said we would in the morning post) a number of well-hedged, bullish plays on BA (from the post), TNA, TBT (have I mentioned how much I like them lately?), INTC, AAPL, VLO, FCX (I guess we're done relentlessly shorting them!), XOM and MO. Certainly not our normal selection but, if they are going to throw a sale on the blue chips – why shop anywhere else?

So that was how our week ended, with a Yee-haw! But, how did we get so damned bullish? Well, it all started on the weekend, when I posed the question in our Weekend Reading – Now What? There I mentioned how it was still a good time to jump on our Disaster Hedges because we REALLY didn't like the way the market was looking and we REALLY didn't buy that "fat finger" BS and we found the bounce unimpressive. Since we had done a little shopping on that bounce, we also picked up a bunch of short-term downside hedges to keep them safe since our October hedges are very slow payers and, as we noted on the 6th, it's no fun having the market go down 1,000 points in one day and not making a killing on your short bets. So we tightened up the time-frames and came up with this list that did MUCH better in the morning when we took them off I'll just report the current figures and I'm sure you can see why we recommended them last weekend:

- EDZ June $38/44 bull call spread at $2.80, now $4.50 – up 60%

- EDZ June $35 puts sold for at $1.25, now .40 – up 68% (pair trade)

- FAZ July $12/16 bull call spread at $1.10, now $1.50 – up 36%

- FAZ July $10 puts sold for .70, now .35 – up 50%

- IYR May $52 puts at $1.30 (fell to .79), now $4.10 – up 215% (a quad since Monday!)

- OIH May $131 calls sold for $3.45, expired worthless – up 100%

- OIH May $131 calls sold for $3.90, expired worthless – up 100%

- QID May $16 calls at .32 (fell to .27), expired at $2.74 – up 756% (another triple since Monday!)

- QID May $15 puts sold for .32 (rose to .37), expired worthless – up 100% (pair trade)

- QID June $14/16 bull call spread at $1.15, now $1.90 – up 65%

- TBT Sept $43 puts sold for $1.50, now $6 – down 300%

- TBT Sept $43/48 bull call spread at $2.60, now $1 – down 62%

- TZA June $6 puts sold for .70 (rose to .94), now .34 – up 51%

- UGL Oct $49/54 bull call spread at $2, still $2 – even

- GLD March $90 puts sold for $1.20, now $1.80 – down 50% (pair trade)

- VNO May $80 calls sold at $2.30 (rose to $3.90), expired worthless – up 100% (5x since Monday!)

So more or less doubles from where they were Sunday, even if you didn't take an optimized exit like we did this morning. This is not bad for free advice is it? Sadly I won't be going into much detail on the 50+ bullish positions our Members took this weekend as we are still working into them. We're very happy to discuss the plays we've filled or are done with but we are quite protective of the trades we're still working on. Still, as you can see, even our breadcrumbs are worth picking up on occasion…

So more or less doubles from where they were Sunday, even if you didn't take an optimized exit like we did this morning. This is not bad for free advice is it? Sadly I won't be going into much detail on the 50+ bullish positions our Members took this weekend as we are still working into them. We're very happy to discuss the plays we've filled or are done with but we are quite protective of the trades we're still working on. Still, as you can see, even our breadcrumbs are worth picking up on occasion…

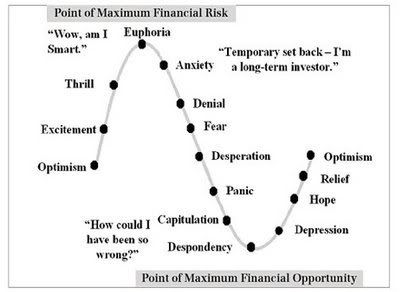

We had the charts and the levels we were expecting in our weekend post so hopefully you don't need me to shout at you to take massive profits off the table when we get a big spike down. We are generally bullish, long-term investors but that doesn't mean we put blinders on and run into whatever mo-mo stock Cramer and his Fund Buddies are pitching that day. When the market is overbought, we go short, but we go short looking to use that cash to go long as soon as we find some bargains we feel good about. If the market doesn't go down, we are pleasantly surprised and go long and then our downside plays become our insurance hedges and so it goes – round and round and up and down, as markets tend to do.

Now that we have a little more consolidation near our 1,100 mark on the S&P (see Friday's chart) we'll be a lot happier to see some upside action next week – as long as it doesn't get too ridiculous. Last weekend I closed with: "There has been surprisingly little news this weekend and that’s not good for the market as we needed some reason to move over our technical levels." Let's see how that panned out in a week that started the previous Wednesday:

Which Way Wednesday – Testing Those Tops Again

Which Way Wednesday – Testing Those Tops Again

We had this great Fallond chart from our PSW Chart School section and our Members know I am quite the critic of TA so I can assure you that the guys in our Chart School are THE BEST! My attitude is, if you are going to consult with witch doctors, get the best ones – and the TA on this chart is BRILLIANT and helped illustrate my opening statement on that Wednesday, on why we already flipped back to bearish after bottom fishing the day before:

Bouncy, bouncy markets!

We had a heck of a time yesterday – going bullish on 2 DIA plays in the morning for very nice gains (35% and 14%) and then flipping bearish in the afternoon for another 20% gain on the day. You have to be quick on your feet and NOT GREEDY to make money in this crazy market. We set up some long-term bullish plays but very well hedged because we still don’t trust the market but all cash is no fun at all so we are beginning to pick up a couple of key stocks that we REALLY want to accumulate over the long haul.

You will see the word "REALLY" a lot this week because I cannot emphasize enough how important it is to be ABSOLUTELY certain you WANT to OWN a position for 10 years before you buy a single share or, more importantly to our traders, short a single put. We are clearly in an environment where any day you may wake up and find the market has fallen 10% and the next day we may be down 20% and you will be STUCK with whatever is in your virtual portfolio for quite a long time at those prices. We are not buying any stock that does not give us AT LEAST a 20% discount on our entry but even that has us nervous enough to cover – THAT's what I mean when I say we're "bullish."

Sure we're very bullish – 20% down from here! If the market does head up, we'll make our 20% and that's that. Our biggest "problem" last year was we took a lot of long-term positions that "only" made 20% even as some of the stocks we picked up at the bottom doubled. We knew we were getting bargains but, just in case the World actually did end, we still wanted some downside protection but that caution cost us some upside. That's OK as these long-term holds are for the sensible majority of our virtual portfolios, not the small portion of short-term plays and day trades that garner most of the attention (See "Smart Virtual Portfolio Management" Series).

Forgive the length of this review but I think it's important to follow the psychological themes that govern this market and hopefully, let you get inside my head so next time I'm rambling on about "THEM" and the Media and TradeBots – it will sound a little less like a conspiracy theory and more like an actionable observation. This is a good time to explain to new readers that I am not actually a tin-foil hat wearning conspiracy theorist.

I do believe the markets are overly controlled by a relatively small group of wealthy people but whether they do this by having secret meetings over at the Pine Valley or it's just a confluence of various global socio-economic events leading to similar actions based on rational self-interest on the part of the larger participants – it's my choice to shorthand it to "THEY" as I do like personifying things. That's why we call the sucker we sell a call to a "caller" and the sucker we sell a put to a "putter," even though there's no specific person who owns your contracts, it very much helps me to focus by thinking of it as a sort of chess match against an opponent with moves and counter-moves on each side. So, Wednesday the 12th, my morning commentary was this:

My morning post was aptly titled "It’s Deja Vu All Over Again" as that’s EXACTLY what happened yesterday and we even doubled down on the spike over 1,166 because we were fairly confident the move was nonsense and also confident that 1,170 would not break for the day. TODAY, on the other hand, we should get a proper test. We’ve gone 2 full days without the World ending and that should be enough to get the bulls back on TV telling us how great things are again and that will bring all the itchy investors back off the sidelines as their money is burning a hole in their pocket AND EVERYTHING LOOKS SO CHEAP!

But is it cheap? Certainly not compared to Thursday. In fact, I think 5% higher than Thursday’s sale prices is outrageous – especially considering it was only a 15-minute sale and, when we all rushed into the store, the shelves were pretty bare so we hardly got a chance to buy anything (although we did get a few good deals on Friday). Now that they’ve suckered the people into the store, the salespeople will surround them and try to not let them leave without buying SOMETHING. There will never be another opportunity like this, they will tell you. The time to act is now, they will tell you. You don’t want to miss out, they will warn you.

"But gee," you may say "didn’t you guys just have your second massive drop of the year and wasn’t May to June last year a bad time to buy stocks and May to June of 2008 about the stupidest time ever to buy stocks and May to June of 2007 also a bad idea as that July and August we fell 1,500 points?" Oh hey, they answer – that was "fat fingered Fred" – we fired that guy. Now, give us your money…

I said last Thursday that "We Won’t Get Fooled Again?" and I put the question mark at the end of the title because I know investors WILL be fooled again – it’s kind of the whole point of the market. If you think that Goldman Sachs and JP Morgan can both pull perfect quarters without having fooled someone, then you do need to get on your knees and pray – because Lloyd is doing God’s work and you’d better repent! I was doing Nostradamus’ work on Thursday as I closed that post with a picture of David Cameron under "Meet the New Boss" and it’s already official that Brown is down in the UK (I told you I was very influential in Europe!) – can anarchy be far behind? As Bill Murray said in Ghostbusters: "Conservatives and Liberal Democrats sharing power in the UK – mass hysteria!"

Doesn't sound too crazy in retrospect does it? That was before the rioting in Bangkok and before new riots in Greece. As a fundamentalist, I tend to get frustrated when the fundamentals are being ignored and I went on to list my concerns for the week, closing with "For goodness sakes – be careful out there!" In the morning Alert to Members, we went for the DIA $107 puts at $1.23 right out of the gate but the day was bullish and we were forced to double down and were lucky to get out even. Trades we are done with include:

- WFMI May $41/38 bear put spread at $1.55, expired at $1.76 – up 13%

- TZA $5 2012 buy/write at net $1.03/3.02, TZA now $7.34 – on target

At 12:19, in Member Chat, I observed: "What a huge shove in the indexs so the hourly charts would show bullish. When I see those things happening I really want to go contrarian to the move!" and at 1:05 I said: "LOL – Now they are pushing AMZN. Quite the agenda to get the Nasdaq moving today. Meanwhile, IBM is good for 32 of the Dow’s 107 points but there’s no proper strength to these moves – just back to low volume BS that can pop in seconds… " and, my closing comment to Members said it all:

IWM/JRW – I agree, I think this is totally irrational. Unemployment tomorrow morning along with Import/Export Prices but all trumped by Retail sales on Fri with +0.6% expected. We also get Industrial Production and Cap Utilization and Michiigan Sentiment AND Business Inventories Friday so they can talk all they want on CNBC but if we get bad data, Friday will suck.

Meanwhile, the stick is back! What a job today closing us at the highs.

That was one seriously BS day! I don’t believe a single thing that happened today

What Me Worry Thursday?

The pre-markets were rallying that morning and I was well beyond Fed up, our remaining DIA puts were getting crushed and our new TZA play, designed to give us a 400% gain to protect our bullish bets was already looking like a mistake and I said:

Our short-term bearish plays (mostly DIA and TZA) have been crushing us so far, which is good in a rally but yesterday was a bit much for us and we got a little more bearish but it looks like the G7 has adopted the "Better Red Than Dead" mantra as the World racks up astounding deficits to put off admitting that this little debt problem is not isolated to the PIIGS nations.

Nonetheless, the global markets are rallying in unison – even while the Pound ($1.47) and the Euro ($1.26) collapse and even the Yen jumped back up last night, falling off the very BS 93.63 to the dollar it hit at 3am to psych up the Nikkei exporters back down to 92.75 this morning. I noted weeks ago how the Yen knocked down for Japan’s open and then drifts lower into the US open virtually every night – it’s what currency traders call the "Goldman Trade" because you can bet it every single day and have a perfect quarter. Sure it’s blatant manipulation designed to fool an entire nation of investors but, what else is new – Fuggedaboutit…

My 9:50 Alert to Members followed up on the theme:

Good morning!

I’m in a better mood now, I needed to get that stuff off my chest.

We’re still watching the good old 5% lines at Dow 10,900, S&P 1,166, Nasdaq 2,380, NYSE 7,250 and RUT 685. This is an all or nothing game – failure is not an option. Well, it is an option but its one with a lousy outcome…

1,166-1,1170 on the S&P is our bull/bear switch, of course.

Congrats to those who stayed bearish into yesterday’s stick but let’s watch out if NYSE holds up and, of course, we will be surprised if S&P 1,155 fails again (that’s what signaled last Thursday’s massive drop).

Oil is a catastrophe at $74 this morning and copper is back below $3.20, right at $3.19. The Euro is $1.25 and the Pound is $1.46 so a total mess over in Europe and the Yen is rising too so a full-blown panic our of the EU – Again!

If we have another big breakdown today I don’t think we’ll be getting a fast comeback so hold on tight and keep an eye on copper $3.20 and oil $75 as our turn-around indicators but they are already jamming the indexes up despite the huge commodity drop and dollar rise.

Asia was up because we were up and Europe was up because Asia was up but they are coming off their highs quickly as the currency collapses (what’s the point of your stock holding up if the money you exchange it for drops 10%?).

As usual, ALWAYS sell into the initial excitement as we expect to be very bouncy off our S&P zones so try to sell your short plays as we test 1,166 and buy them back if we fail 1,170 and vice versa on the call side. If we break below 1,166 – then that’s the play down to 1,155 but below 1,155 is DOOM!!!

Have a great day

Trades from that Thursday that we are finished with include (open plays will be added to this week's Buy List for Members, by the way):

- DIA May $108 puts at .74, finished at $6.16 – up 732%

- NFLX Sept $135/May $120 ratio backspread at net $20, now $1,320 – up 6,600%

- QID June $16 calls at .95, now $2.94 – up 209%

- BIDU Sept $90/June $80 ratio backspread at net credit $800, now credit $290 – up 36%

- FXP June $40/46 bull call spread at $2, now $3 – up 50%

- FXP June $37 puts sold for $1, now .50 – up 50% (pair trade)

We were shorting into the market rally and I was beyond incredulous, saying to Members at 11:32: "Pound down from $1.49 at 3am (same time the Yen was being cranked up) to $1.4677 now – that’s a pretty shocking daily drop for a currency while the FTSE is open but they are still up for the day (.75%) even though the country just lost 2% on it’s cash in a day. The whole global market has it’s fingers in its ears and is chanting "La la la la la – I can’t hear bad news…" followed, in that same comment, by: "Oops, looks like the BIDU fantasy value hour has ended." That proved to be the first true sign of the coming market apocalypse. We were all waiting for the next shoe to drop and at 11:55 I reminded Members: "Hey remember that time when the S&P started the day at 1,170 and then it fell below 1,166 and then below 1,155 and then, like an hour later, we were down at 1,070? Ah, good times…" That led to my 12:37 warning:

Wow, they have the bears scared to sell (or short) and the dip buyers jumping into every buy signal on the 1 minute chart. I think that’s what last Thursday was all about – "THEY" want the retail holders to be slow to sell and quick to buy on dips so "THEY" can unload their crap because right now, any volume selling still collapses the market. The trick is to train the retailers to "not want to miss" the next big dip so now a 200-point drop will set off a buying frenzy and "THEY" can get several good volume days of selling out of a 5% move (500 points) down because every day Cramer will tell you what a great chance it is to get in and every day people will believe him…

We had targeted a fall to at least test 10,700 again and the wild gyrations that day were testing our patience but, as the S&P was once again testing our upside target of 1,166 at 2:07, I commented to Members "Is anyone else noticing this?" and put up the futures charts for the S&P, Nasdaq and Dow, which gave us a good indication of the general direction, despite the wild gyrations:

We made an assortment of momentum plays into the close, scalping dimes on DIA and QID and my 2:55 outlook for members was: "Some (or maybe a lot) of this selling may be fear of the retail report tomorrow. The lower we get the more likely we get a relief rally on the actual numbers. I was kind of hoping we’d finish on the high side so we could take some speculative shorts into the close. If retail numbers are bad tomorrow, the reaction could fill that gap back to around 10,500 so it’s a very random overnight session ahead, which means don’t go too crazy leaving short-term bets on the table. Now we can use 1,167 as a quitting line for day-trading shorts. Then if 10,850 fails we can use that and 2,400 on the Nas and then 7,250 on the NYSE….." It's a very good discipline to keep moving your stops to lower and lower inflection points on key indexes as we tend to focus too much on the gyrations of just the index we're betting on.

Freak Out Friday – Global Edition

We woke up to Europe being down 2% at 7:30 and we fell hard in the morning but held it together with a very BS stick-save at the close. Since our bets were already in place, I spent the morning post talking politics and we decided to join Gemany's Pirate Party. We don't know what they stand for but, hey – PIRATE PARTY – worth it for the T-shirts alone!

The undercurrent to the post was that the Euro was in trouble. We had bet EUO in early May so this was no news to us but it seemed to shock many others, giving us a chance to sit back and enjoy the fun as the MSM caught up to our fundamental observations. I had sent out a rare Early Morning Alert to Members where we caught the oil futures at $72.50 for a huge run up but I warned on the market saying: "It will take a lot to get our cash off the sidelines as we expected 10,700 to be tested again and a quick bounce off this level won’t satisfy us – we need some consolidation down here to get more comfortable with the upside. That’s going to be a tough trick to pull off into option expirations next Friday!" and my 9:43 Alert to Members was some really good advice:

Good morning!

I know we wish we were more bearish but we’re too close to expiraitons to risk it and holding short-term positions over the weekend is madness so any quick trade we make today has to be in cash by EOD, which means there is no room for error and so, we should be cautious.

Before buying anything bullish I want you to say "I am not a lab rat, I do not have to buy on dips" at least 5 times, maybe 20. Then, if it still seems like a great idea to you – SCALE IN VERY CAREFULLY!

Until we break over the red lines I charted this morning (more or less the same old levels) there’s no rebound whatsoever. The next set of levels that should hold but already aren’t are: Dow 10,700, S&P 1,050, Nas 2,350, NYSE 7,200 and Russell 685. Let’s be VERY concerned if we lose the RUT and the Nas!

We do have that gap to fill all the way to 10,200 so that’s another 5% down from here, hopefully the worst case but there’s not much volume to this selling so far and maybe it’s EU players scrambling for cash as selling US equities to get dollars against a weak Euro is not a bad play today. EU closes at 11:30 so if we’re going to get a move up, that would be the most likely time.

Meanwhile, sit back, grab a drink and enjoy the ride

Keeping the above in mind we made a few upside bets (you have to do something to hedge shortside profits) including hedging our US Dollar cash with our favorite TBTs, which have not been very good to us lately:

- TBT June $39 puts at .75, now $1.95 – down 160% (roll from May $42 puts)

- SSO May $37/38 bull call spread at .75, closed worthless – down 100%

- SSO June $31 puts sold at .68, now $1.20 – down 76% (roll from May $37 puts)

- TNA May $48/51 bull call spread at $2.50, stopped out at $1.50 – down 40%

- TNA June $36 puts sold for $3.20, now $3.50 – down 9% (net roll from $47 puts)

- USO May $33 puts sold for .88, expired at .73 – up 17%

Notice we sell offsetting puts to pay for our long gambles as we try to get closer to neutral ahead of a possible bull move up over the weekend. The reason we sell the puts is we can roll them and, of course, every time we have to roll a bullish put, it means our long Disaster Hedges are heading towards that big pay-off. If at any point the market ticks up instead of down, we are released from our obligation to buy the stock and we are free to reset with a new set of protection if needed (often that would be the point where we stop out the shorts, making new protection unnecessary).

I reminded Members at 1:51: "I’m hoping for a double bottom here and a stick into the close and I think all Europe has to do is not burst into flames over the weekend and we’ll get a little relief move but cash is still king other than some speculating so far. Volume at 1:50 now 138M on the Dow so just 18M in the past hour – dead slow and VERY stickable." We did get our stick but not enough to thrill us and that takes us right back to the Weekend Reading post where I reiterated the bearish positions we were protecting with our new bullish bets.