Corporate Bonds Smacked, Yields Rise, Deals Pulled; Treasuries Rally; Yield Curve Flattens; Global Slowdown Coming

Courtesy of Mish

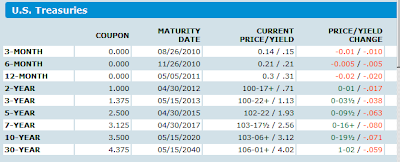

The 30-year long bond is sitting just 3 basis points away from hitting a 3-handle and the yield on 5-year treasuries is 1.94 after hitting 2.60 in April. That is quite a reversal.

Yield on the 10-year note is at 3.13% a price last seen a year ago.

Meanwhile, Libor Shows Strain, Sales Dwindle, Spreads Soar

Corporate bond sales are poised for their worst month in a decade, while relative yields are rising the most since Lehman Brothers Holdings Inc.’s collapse, as the response by lawmakers to Europe’s sovereign debt crisis fails to inspire investor confidence.

Companies have issued $47 billion of debt in May, down from $183 billion in April and the least since December 1999, data compiled by Bloomberg show. The extra yield investors demand to hold company debt rather than benchmark government securities is headed for the biggest monthly increase since October 2008, Bank of America Merrill Lynch’s Global Broad Market index shows.

Junk bonds issued in the U.S. have been especially hard hit, with spreads expanding 141 basis points this month to 702, contributing to a loss of 3.78 percent. Leveraged loans, or those rated speculative grade, have also tumbled. The S&P/LSTA U.S. Leveraged Loan 100 Index ended last week at 89.23 cents on the dollar, from 92.90 cents on April 26.

Question of Solvency

“This is a quintessential liquidity crisis,” said William Cunningham, head of credit strategies and fixed-income research at Boston-based State Street Corp.’s investment unit, which oversees almost $2 trillion.

I disagree. This is a return, and rightfully so, to questions of solvency. Many corporations were given a new lease on life in May of 2009 by once again securing funding at cheap levels.

Now, huge cracks are appearing in the corporate bond market. At least seven junk bond deals have been pulled. This environment is not good for equities.

JNK – Lehman High Yield Bond ETF

click on chart for sharper image

Is this another scare like we saw in January and February or is this the real deal? I think the latter, but I thought so in February as well.

Notice how the top in junk bonds coincided with the top in equities. I cautioned many times as long as junk bonds fetch a bid, equity selloffs would be contained.

If this is a return to a solvency issue, junk bonds have a huge way to go to the downside, as do equities.

Comments from Rosenberg

Rosenberg commented this morning "Speaking of credit, just a month after what can only be labeled as a frenetic pace of new-issue activity, risk premia in the high-yield space has done a complete about-face as spreads in the junk bond space in a matter of a month have moved out 150 bps in the most pronounced reversal since late-2007 meltdown. This is now forcing deals to be pulled back in rapid fashion — at last count, a total of seven have been either withdrawn or postponed since April 29."

US Treasuries Rally Across the Board

The chart from Bloomberg shows nice gains across the yield curve any place gains could be had. The following chart shows a huge flattening of the curve in just a month.

Yield Curve March 2008 Through May 2010

click on chart for sharper image

Please note that vertical red oval. This cannot possibly be blamed on North Korea although the economic cheerleaders sure will try.

See Tensions Mount in Asia; North Korea Prepares for Combat; South Korea Won Sinks to 8-Month Low; Futures Sink, Nikkei Hammered Again for details on rising tensions in Asia.

This action in treasuries is not in any way, shape or form synonymous with a recovery but rather a global slowdown. Equities are not remotely priced for this event.