Yesterday was a one out of two day for us as our Buy Pick of the Day worked out very well for us while our Short Sale of the Day struggled. We got involved with PulteGroup Inc. (PHM) as our Buy of the Day because of the release of existing home sales. The numbers were going to be very large, and it would short-term be bullish for residential construction companies. As a result, we got involved at 10.70, and we exited at 11.04 for a 3% gain. On the flip side, our Short Sale of the Day in Ultrashort Proshares Financials (SKF) was a dud. We got involved right off the bat as I thought the market would increase quickly, but we were too quick buying in at 20.15. We got stopped out for a 3% loss in the afternoon.

Yesterday was a one out of two day for us as our Buy Pick of the Day worked out very well for us while our Short Sale of the Day struggled. We got involved with PulteGroup Inc. (PHM) as our Buy of the Day because of the release of existing home sales. The numbers were going to be very large, and it would short-term be bullish for residential construction companies. As a result, we got involved at 10.70, and we exited at 11.04 for a 3% gain. On the flip side, our Short Sale of the Day in Ultrashort Proshares Financials (SKF) was a dud. We got involved right off the bat as I thought the market would increase quickly, but we were too quick buying in at 20.15. We got stopped out for a 3% loss in the afternoon.

We are hoping for a 2/2 day today.

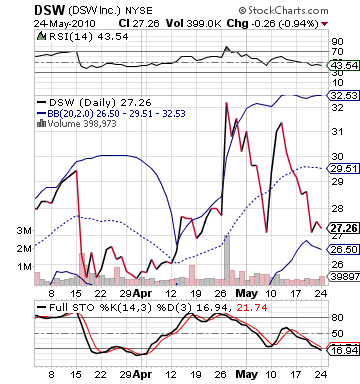

Buy Pick of the Day: DSW Inc. (DSW)

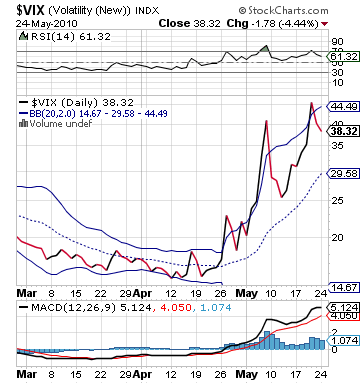

Analysis: The market is facing another tough day, and I keep digging around to find some slippers in the mix. I am hoping that once again today we will have the same success. The market is facing fears again out of Europe, but it is also gearing up for the situation brewing in Korea between North Korea and South Korea. Overall, the world situation is definitely not at its best right now. With a lack of our news to help ease the pain, the futures in the market have dropped to 188 points down on the Dow as of 8:40 AM. The last time, however, that the market went down this greatly in the morning, we saw a nice big jump to start the day before moving back down and stabilizing. The VIX, on the left, shows exactly what I am speaking about, and there is a direct correlation between its rise and the fall in the market. Geopolitical factors are truly having a major role in the market’s effectiveness currently.

The same would be helpful, but I think even with a market that is moving down DSW Inc. (DSW), the shoe closeout retail store, will be able to churn up 2-3% in gains. The company reported some outstanding earnings this morning that are truly amazing. The company reported an EPS of 0.67 vs. the expected 0.49. Those profits were quadruple of what they made one year ago. The company also saw a 16% rise in sales, beating expectations as well. The company reaffirmed its 2010 outlook, and things are looking very bright for the Columbus, OH-based retailer.

The stock does not trade in pre-market trading at all, so it is hard to tell exactly where it will start the day. I have placed our range in such a way that we expect a small bounce. Yet, we did not put it too high because if it opens too high then it actually starts to become a nice short sale option. I am hoping we can catch it right at the right place before it moves upward. The market will most likely not be a huge help, but I think this company’s news alone should be enough to give a few percentages to the upside before it will feel any pressure.

Technicals help DSW as well. The company, like most others, has been sold heavily over the past few weeks. In the last four weeks, the stock has dropped nearly 15% in price, and it sold off into earnings. The surprise earnings should help to fuel buyers into this oversold and undervalued stock that has about 18% to the upside to its upper bollinger band. This one could move out of the pits very quickly if the market could get going.

Stick to the range, and if it opens lower than the range feel free to buy into it.

Entry: We are looking for an entry of 27.35 – 27.50.

Exit: We are looking to gain 2-3% from entry.

Stop Loss: 3% on bottom.

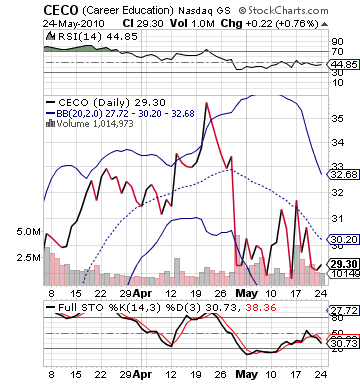

Short Sale of the Day: Career Education Corp. (CECO)

Analysis: Education has been one of those industries that was able to do well in the recession era as more and more laid off workers went back to get Associate’s Degrees and other certificates. Yet, as the education buzz has worn off, these for-profit educational companies have seen their share prices dip or lose major growth. Today, however, Career Education Corp. got a solid upgrade from Argus from hold to buy. CECO, however, will most likely not be able to sustain much in the way of gains because of a larger fish in the education pond making headlines. That would be Corinthian Colleges (COCO). The company got a downgrade from Argus, and it is down nearly 2% in pre-market.

Analysis: Education has been one of those industries that was able to do well in the recession era as more and more laid off workers went back to get Associate’s Degrees and other certificates. Yet, as the education buzz has worn off, these for-profit educational companies have seen their share prices dip or lose major growth. Today, however, Career Education Corp. got a solid upgrade from Argus from hold to buy. CECO, however, will most likely not be able to sustain much in the way of gains because of a larger fish in the education pond making headlines. That would be Corinthian Colleges (COCO). The company got a downgrade from Argus, and it is down nearly 2% in pre-market.

CECO, further, is not exactly getting an upgrade from Goldman or Morningstar. Argus is a smaller fish, as well. The upgrade has set up CECO where it will open not down, but it will most likely face a quick selling as the "real market" hits it. Futures continue to dwindle downwards, which shows that the selling should continue out of the gate, which is not good for CECO.

Additionally and amazingly, CECO is actually not heavily oversold. The stock has actually stayed very neutral over the past few weeks without much gained or lost. It is right in the middle of its bollinger bands, and it could see a quick rise in short interest as the larger market and competitors influence selling off CECO.

We definitely need to watch our entry, so check back with me for an update on the range in my Morning Levels alert as well as updates from me on when to pull the trigger. If the market starts to move up in the morning off the bat, then we do not want to buy right away. If it starts to drop fast, then we want to pull the trigger. I will be giving updates.

Entry: We are looking to enter for a short sale between 29.50 – 29.65.

Exit: We are looking to exit on 2-3% to the bottom.

Stop Buy: 3% on top.

Good Investing,

David Ristau