Typically, I do the Daily Musing in my own story, but it appears my comment was too large for the comment box because it erased the entire story I have written (luckily I saved). I am going to be doing a three part series over the next three days about the failure of the oil and fossil fuel market and my choice for alternative energy that I think is the most viable solution to the problem. Today, we investigate the failure of oil, coal, and natural gas.

“The world consumes two barrels of oil for every new barrel discovered,” – Chevron’s 2006 Will You Join Us campaign.

“The world consumes two barrels of oil for every new barrel discovered,” – Chevron’s 2006 Will You Join Us campaign.

The world has been, currently, and will continue to face an energy crisis of major proportions. Our society depends much too greatly on non-renewable fossil fuels for nearly every aspect of our lives. The crisis is an extremely large and complex issue that deals with both economic and environmental issues and highlights a number of market failures that plague the future and viability of fossil fuels. Currently, our world is seeing an increasing demand for oil, coal, and natural gas. At the same time, though, production, discovery, and extraction of these fossil fuels is unable to match rising demand. The fact of the matter is that these resources are endless, and as our societies continue to use them up, the problems associated with these resources will become more greatly magnified.

Problems with fossil fuels begin with supply. Experts agree that determining the amount of fossil fuels that are left in the world is an extremely difficult task to gage and on which we can obtain exact data. Demand and supply are constantly changing, which causes a cloudy picture of how much more sustainability humans have from oil, coal, and natural gas. With this aside, one aspect remains true in that fossil fuels are not limitless.  While reserves may loom large, they continue to dwindle in number even with the advancement of technologies for discover and extraction and as supplies continue to decrease, relative prices will continue to increase. For the time being, humans will continue to innovate and produce new technology to continue to find more resources. For example, as MSNBC article How Long Will the World’s Oil Last? points out:

While reserves may loom large, they continue to dwindle in number even with the advancement of technologies for discover and extraction and as supplies continue to decrease, relative prices will continue to increase. For the time being, humans will continue to innovate and produce new technology to continue to find more resources. For example, as MSNBC article How Long Will the World’s Oil Last? points out:

Technology is expanding the industry’s ability to find and extract oil – in some case finding new fields once thought to be fully exploited.Horizontal drilling has provided access to pockets of petroleum otherwise unaffordable or unreachable…3D visualization…allows geologists to “see” underground formations with a degree of clarity and detail unimaginable a decade ago. Advances in remotely operated vehicles (ROVs) are extending the reach of deep-water exploration and production further and further offshore. ‘There’s no such thing as limitless, but the limits keep being expanded all the time,’ said Adelman. ‘There are many offshore places that in the fullness of time will get explored. But I don’t know (how much oil) there is there, and in fact nobody does. That’s the kind of frontier you have. It’s disorderly.

The issue is that even as we continue to dedicate endless dollars to finding more and more of these fossil fuels, no one truly knows how much oil, coal, and natural gas exists, which highlights the market’s most critical failure.

The most severe issue that supplies of fossil fuels highlights is a lack of information, which is a critical issue for sustaining a market, especially one as crucial as fossil fuels. It is impossible to know how much oil is actually left in the world at any point in time. The amount of unknown reserves that are usable is unable to be completely determined. The amount of reserves on hand, at any moment, is unknown. Since knowing supply levels is nearly impossible, it creates both price problems and issues with understanding sustainability. Due to this lack of knowing quantities used and available, market supply levels are a guess, which causes equilibrium prices to be extremely hard to determine. Supply curves and demand curves are fuzzy, when known, and can only be known in the past. This is a serious market failure.

Another market failure for fossil fuels comes from the fact that the supplies of oil is a market with imperfect competition. Oil, natural gas, and coal, due to their nature as natural resources, are not available in every nation, but at the same time, nearly every nation uses these sources of energy. This dilemma causes serious problems. The  lack of perfect competition causes further issues for these markets as it means that nations are dependent on others for energy sources, and groups of nations control the resource.

lack of perfect competition causes further issues for these markets as it means that nations are dependent on others for energy sources, and groups of nations control the resource.

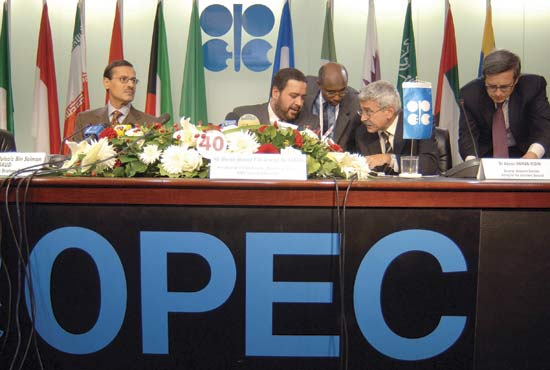

The Organization of Petroleum Exporting Countries (OPEC) for some time attempted to control the market for oil and keep prices at an artificially high level since they controlled a majority of the supplies of the world. OPEC was affective in the 1980s and 1990s at controlling these prices, yet as new markets for oil entered and created more competition, prices came closer to marginal revenue. Recently, this failure was also seen by Russia’s ability to create a stranglehold around Germany and Poland when the country refused to send oil to the nation over a dispute on tariffs with Belarus. Germany and Poland were, literally, left stranded without incoming oil for weeks until the issue was resolved. This type of issue shows the monopolistic nature oil producers are able to flex that causes a serious market failure that requires government intervention and trade issues.

At the same time that supply issues are prevalent. Demand for fossil fuels also creates critical issues for this market. The International Energy Agency believes that world demand for energy will increase by 40% from its current level by 2030. Energy development and extraction of fossil fuels cannot continue to keep up with increases in populations and the development of new markets, which will further overemphasize the scarcity issues of these fuels. The IEA believes that the increase in demand by 2030, also, will be 77% supplied by fossil fuels. This continued rise in demand and stagnation or even decrease in demand will continue to function as a threat to increase prices of these fuels, which can hinder developing nations that need lower energy prices to develop as well as developed nations, who rely on these fuels to power much of their economic base.

in populations and the development of new markets, which will further overemphasize the scarcity issues of these fuels. The IEA believes that the increase in demand by 2030, also, will be 77% supplied by fossil fuels. This continued rise in demand and stagnation or even decrease in demand will continue to function as a threat to increase prices of these fuels, which can hinder developing nations that need lower energy prices to develop as well as developed nations, who rely on these fuels to power much of their economic base.

The continued exploitation and overuse of fossil fuels further is detrimental because these energy sources are pollutants that emit emissions that have had and will continue to have extremely adverse affects on our environments. The IEA commented, in its latest energy report, that “the continuation of current trends (of usage of fossil fuels) would have dire consequences for climate change…exacerbating ambient air quality concerns…causing serious public health and environmental effects, particularly in developing countries.” The costs of these energy sources is not in the discovery, extraction, refining, and usage alone.

Major costs are also accrued on these sources due to the damage they cause to our environment and to our health, mostly seen through the rise in global temperatures. Fossil fuel combustion, the burning of these fuels, has been linked as the leading contributor to the global warming phenomena. While costs of global warming cannot be blamed on these fuels and their usage directly, the excessive use of them and continued excessive use is detrimental to our society and a contributor to the problem. For example, as the organization Environment America writes, “a 2007 study by…Stanford University found that global production of three of the six largest global crops experienced significant losses due to global warming between 1981 and 2002…global wheat growers…lost $2.6 billion and global corn growers lost $1.2 billion in 2002.”

Further global warming is expected to cause more issues for food sources as well as increase natural disasters, less rainfall, increase heat-related illnesses, and increase smog levels. The organization comments further that “World Bank Chief Economist Sir Nicholas Stern indicates…global warming has the potential to reduce global per-capita consumption by as much as 20 percent” due to the various reasons mentioned. Further pollution to water and the air, increases to global warming, and other environmental issues are also a major part of this energy crisis.

These problems highlight another of the market failures of the fossil fuel industry as they threaten public goods, such as environmental quality, air quality, water quality, and other parts of the environment that are shared by global citizens. These different industries are motivated by their own interest and threaten various public goods and create negative externalities that threaten public goods. Negative externalities, such as pollution, health risks, and global warming contributions generate costs to third parties.The costs that were mentioned above in loss of crops and  possible damage done by natural disasters are just the tip of the iceberg. The failure lies in that the costs of these externalities are not included in the price of fossil fuels. There is really no motivation or reason that firms would want to include these negative externalities in the cost of their good, therefore, the cost is passed onto society. This problem creates a major market failure and shows the severe public good detriments and negative externalities created by this industry.

possible damage done by natural disasters are just the tip of the iceberg. The failure lies in that the costs of these externalities are not included in the price of fossil fuels. There is really no motivation or reason that firms would want to include these negative externalities in the cost of their good, therefore, the cost is passed onto society. This problem creates a major market failure and shows the severe public good detriments and negative externalities created by this industry.

The failures of the fossil fuel market creates an eminent issue that must be addressed. In the past twenty to thirty years, this issue has started to be resolved by the introduction of more renewables into our energy grid, but the industry still has far to come. The beauty of renewables is that it reduces many of the negatives of fossil fuels and can provide many other benefits. One such industry, however, seems to be the leader in the renewables and can provide a very beneficial and valuable alternative to fossil fuels moving forward.

Good Investing,

David Ristau