Ties Surface in Pension Chief’s Exit

Courtesy of Leo Kolivakis

Michael Syre of the Boston Globe reports, Pension chief says he’ll quit over pay:

Michael Travaglini, who as head of the state’s pension fund is among the highest-paid government employees in Massachusetts, plans to quit next month, citing as a reason efforts by legislators to limit what he and his staff can earn.In his six-year tenure as executive director, Massachusetts Pension Reserves Investment Management ran one of the top-rated public pension funds in the nation — until last year, when losses from the financial crisis made it one of the worst.

Prior to that downturn, the pension fund’s high performance earned Travaglini a $64,000 bonus in 2008, on top of his $322,000 salary. But now he cites the legislative backlash to that bonus system as a factor in his decision to leave June 11 and go to work for a Chicago investment firm.

“The issue of incentive compensation here is back on the front burner,’’ said Travaglini, who will formally announce his resignation June 1. “If you need the context for my decision, it’s an entirely personal one. I have a wife and three children, and I’m going to provide for them.’’

Under the bonus system, which Travaglini helped to create three years ago, he can make as much as 40 percent more if the pension fund exceeds certain investment benchmarks on a three-year basis. Bonuses for other pension fund employees range from 30 percent to 40 percent.

Travaglini said two legislative proposals would limit such bonuses, and thus make it harder to attract and retain talent to run the state’s $44 billion pension fund. One would limit the ability of state workers to earn more than the governor, whose annual salary is $143,000. Another would block bonuses for the years in which the fund lost money, regardless of how it performed against its benchmarks.

“Someone else can hang around for that, but it’s not going to be Mike Travaglini,’’ said Travaglini.

“Most people will say, ‘Good riddance. If you want to make more money, go do it in the private sector,’ and that’s what I’m going to do. But there’s a real threat to not being able to recruit and retain competent people here.’’

He added: “People can vote with their feet, and that’s what I’m doing.’’

Travaglini also bristled at the campaign ads aimed at Timothy Cahill, the state treasurer and gubernatorial candidate who also serves as chairman of the Pension Reserves Investment Management board. The ads, financed by the Republican Governors Association, say the state paid out performance bonuses when the pension fund lost billions in 2008.

The ads, he said, are “false’’ and “irresponsible.’’

The bonuses were paid in September 2008 and were based on the fund’s performance for the three-year period that ended June 30, 2008. The Massachusetts fund ranked among the top 5 percent of comparable funds for that three-year period, according to Wilshire Associates, which rates pension fund returns.

But the one-year return for fiscal 2008 was not so great. Massachusetts lost 1.81 percent that year, but still placed among the top 20 percent for comparable funds for the one-year period.

Cahill did not respond to requests for comment.

The Massachusetts pension fund has performed relatively well under Travaglini’s leadership, which started in 2004. He earned double-digit investment returns in each of his first three years.

But the fund lost 23.9 percent in the fiscal year that ended in June 2009, its worst performance ever. The fund had more invested in equities than other pension funds during a period when global stock markets plummeted because of the credit crisis and banking failures.

For that one-year performance alone, the Massachusetts fund ranked in the 99th percentile of Wilshire’s ratings.

Travaglini — a veteran state operative whose brother Robert is a former state Senate president — will join Grosvenor Capital Management as a managing director for business development, pitching Grosvenor’s hedge fund investments to public pension funds.

Travaglini’s bonus plan for pension fund employees has been controversial from the start, when he initially advocated for an even richer arrangement. But it has had relatively little impact so far, with none being paid last year and none expected this year, Travaglini said.

The plan rewards his employees if the fund’s performance exceeds the returns of investment indexes that reflect the mix of the state’s pension assets. Employees could earn bonuses if the pension fund loses money in a given year, so long as its decline is less than the indexes. On the other hand, if the fund makes money, but not enough to match the indexes, employees do not get bonuses.

Travaglini said a bonus system based on relative performance, not on whether the fund earns an investment profit, is important to reward employees who add value rather than pursue excessively conservative strategies.

“If there’s no added value, there’s no bonuses,’’ Travaglini said. “My naive view is that relative performance was always going to be looked at. Now, in this environment, it’s not about relative performance.’’

Mr. Travaglini is wasting his time with US public pension funds. If he wants the big bonuses based on bogus benchmarks, he should try to land a job with a Canadian public pension fund. There’s a reason why CPPIB’s managers were smiling last year.

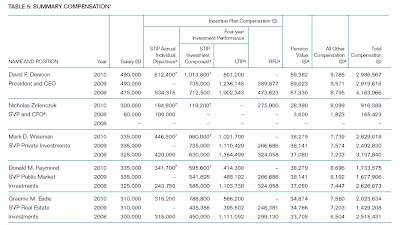

And this year is no different. I perused through the CPPIB’s 2010 Annual Report, and right on page 73, we see total compensation doled out to CPPIB’s Senior Management:

(click on image to enlarge)

As you can see, we pay our public pension fund managers big bucks in Canada. I can assure you David Denison, Mark Wiseman, Grame Eadie and Don Raymond make a lot more than the Prime Minister of Canada or any other public service or Crown Corporation employee (except, of course, for their cousins in Montreal, PSP Investments which are anxious to make as much).

Even better, their bonuses are based on four-year rolling returns, not three year rolling returns, ensuring a handsome payday even when the Fund gets whacked hard as it did in FY2009.

It gets even better. Neither CPPIB nor PSPIB clearly present their benchmarks for private markets. When pressed for an explanation as to why this is, PSP’s president , Gordon Fyfe gave a convoluted answer to NDP finance critic, Thomas Mulcair.

Back to Travaglini. While we grossly overpay our public pension fund managers here in Canada, in the US, they grossly underpay them, leaving public funds exposed to fraud and abuse. Travaglini’s bonus system was reasonable (except for bonuses when the Fund loses money), but in the US, politics trumps reason. So they end up getting what they pay for – mediocre public pension fund managers delivering mediocre results.

But there is something else that concerns me in this whole Travaglini affair. Michael Norton of the Boston Herald reports, Ties surface in pension chief’s exit:

The Chicago-based hedge fund hiring Michael Travaglini away from the state pension management team survived the pension fund’s downsizing of its hedge-fund portfolio last fall and landed a major asset management contract under his watch, the State House News Service has learned.Grosvenor Capital Management was one of five firms slated to manage the Pension Reserve Investment Trust board’s $3.2 billion in hedge-fund assets last fall.

The board, chaired by state Treasurer Tim Cahill, last October axed four hedge fund managers – The Blackstone Group, E.I.M, Strategic Investment Group and Crestline Investors Inc. – as it reduced its investments in hedge funds to 8 percent of all assets, down from 11 percent. It placed the remaining $3.2 billion with Grosvenor and four other firms: Arden Asset Management, K2 Funds, Pacific Alternative Asset Management Company and The Rock Creek Group.

Grosvenor emerged from the asset allocation shake-up with $616 million in PRIT funds under management, according to state pension fund documents.

In an April 6, 2010 letter to the treasurer and State Ethics Commission, Travaglini stated he would be discussing employment with Grosvenor and recused himself from further dealings with the firm. Travaglini, the fund’s director since 2004, earns $322,000 a year and is leaving June 11. The board will meet June 1 to discuss a succession plan, Cahill said in a statement yesterday.

This sort of stuff should never be allowed. There should be clauses barring senior pension fund managers from joining any fund they allocated money to for a minimum three year period. This is all part of pension governance 101, and it makes me sick to my stomach seeing this sort of nonsense going on time and time again.

Unfortunately, it also takes place here in Canada. In fact, I’d like to see the Auditor General of Canada stop fussing over over the expenses of members of Parliament, and start fussing over expenses at Canadian public pension funds, and closely examine ties between senior public pension fund managers and the private funds they allocate to.

The truth is that way too many shenanigans are routinely taking place and taxpayers deserve to know what the hell is going on at these large funds. As I’ve said repeatedly, financial audits are simply not enough. These public funds should be subjected to comprehensive performance, fraud and operational audits every year and the results of these independent audits should be publicly available. Amazingly, MPs’ expense reports are a more pressing concern!!!