BERNANKE’S GREAT MONETARIST GAFFE

Courtesy of The Pragmatic Capitalist

I had to chuckle at the headline on Yahoo Finance throughout much of Monday’s trading session:

It’s an accurate headline. Mortgage rates have declined in recent weeks as U.S. government bonds have surged. But the actual article was filled with very dramatic certainties (most of which were inaccurate and/or misleading). For instance, the excellent Mark Zandi of Moody’s was quoted saying that we are seeing a once in a generation buying opportunity in real estate:

“It’s the best time in our generation to buy. It may be the best time in any generation. Mortgage rates are so low and with homes prices down and lots of inventory, you couldn’t pick a better time to buy or re-finance.”

Wow, sounds like we should all go out and buy houses, right? It gets rosier though. The article details why we should all run out and buy houses immediately:

But the decline in rates probably won’t last long, analysts say. So homeowners need to move fast.

“I think they won’t last much longer than a month or two at the best,” says Lawrence Yun, chief economist at the National Association of Realtors. “I can see them going up to 5.5 percent by the end of June if not sooner.”

Move fast, huh? Prices are low. Rates are going back up. That sounds pretty convincing. If interest rates (and home prices) are only going to be low for a brief period then we should capitalize on that opportunity. Right? But then the article takes a dramatic turn for the worst when they try to explain the actual fundamentals behind the rising interest rate argument:

“The US is fortunate now that there’s no pressure on interest rates,” Yun goes on to say. “But going forward, higher rates will be needed for financing the debt.”

(Screeching sound). Uh oh. Here we go again with the hyperinflation, the USA is dying, the dollar is finished, higher interest rates will be needed to “finance our debt”, argument. The dots are easy to connect in this article. In essence, the article implies that interest rates are at record lows because investors have sought the safety of government bonds and mortgage rates have subsequently declined. What they fail to expand on is why interest rates have been declining in recent weeks when, according to this article, you might think they’d be rising. After all, we do have to “fund” that deficit right? If sovereign debt fears were expanding then surely the United States would be culprit # 1, right?

The problem is we’ve been hearing about low interest rates for years now. Long-term government bonds have been between 2% and 4.3% for the past 2 years. And mortgage rates have been beneath 5.5% for most of the last decade – “record lows!”. Meanwhile, we’ve been running budget deficits for most of the last 50 years. Of course, this is all sounding very familiar. In the 90’s Japan suffered the exact same scenario. High budget deficits, crushing deflation, tumbling government bond yields, “record low interest rates” AND tumbling real estate prices:

10 Year JGB

Japanese Real Estate Prices

Interest rates in Japan declined throughout the entirety of the 90’s and remained very low throughout all of the 2000’s as deflation continued to be the primary economic risk. No amount of pump priming, quantitative easing, interest rate tinkering or stimulus was enough to offset the supply/demand imbalance in the real estate market. What was the overriding similarity between Japan and the United States? MASSIVE private sector debt levels.

As we’ve mentioned before, no bond vigilantes came after Japan despite record high budget deficits and fear mongering over government bankruptcy. Of course, bankruptcy is impossible in a nation who is the monopoly supplier of currency in a floating exchange rate system. That is why Japan has never confronted these evil “bond vigilantes”. But enough about that – we’ve beat this dead horse plenty in recent months. There is a much more important phenomenon occurring here which the economics textbooks don’t teach us about. And that is that monetary policy is ineffective when the private sector is paying down debt. If there is no demand for borrowing it doesn’t matter what interest rates are at.

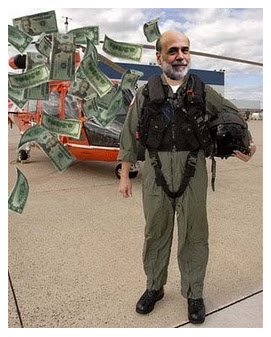

This is the monetarist gaffe that Ben Bernanke now finds himself in. Like his predecessor, Bernanke believes he controls the world with the issuance of a press release on interest rates. But he is pushing on a string (and I don’t even think he realizes it!). Interest rate policy has had almost zero impact on the real economy (although it’s certainly helping boost bank profits!). It’s classic Japan syndrome. Low interest rates are having almost no impact on the economy because the private sector continues to de-leverage. Without borrowing the excess reserves are just sitting at the banks unused. It’s trickle down economics at its absolute least effective.

The equation has been and remains simple – as long as private sector debt levels remain high Ben and Co. will continue pushing on a string. There is no inflation and there is no reflation on Main Street. Monetary policy is useless during a balance sheet recession.

Make no mistake – we are Japan. Unfortunately, we have implemented many of the same remedies implemented in Japan at the time (though admittedly a bit faster). Lower interest rates are not a solution in the current environment. Lower interest rates are not a reason to run out and purchase a home. This is not a once in a lifetime buying opportunity in real estate. This has been and continues to be an environment where consumers and corporations need to repair their balance sheets. The United States is not going to suffer higher interest rates when the bond market wakes up one day and sends a platoon of “vigilantes” to attack the Federal Reserve. The message here is not to be fooled by the low interest rate environment – it is merely a sign of the times and not a “once in a lifetime opportunity”.

Make no mistake – we are Japan. Unfortunately, we have implemented many of the same remedies implemented in Japan at the time (though admittedly a bit faster). Lower interest rates are not a solution in the current environment. Lower interest rates are not a reason to run out and purchase a home. This is not a once in a lifetime buying opportunity in real estate. This has been and continues to be an environment where consumers and corporations need to repair their balance sheets. The United States is not going to suffer higher interest rates when the bond market wakes up one day and sends a platoon of “vigilantes” to attack the Federal Reserve. The message here is not to be fooled by the low interest rate environment – it is merely a sign of the times and not a “once in a lifetime opportunity”.

It’s so vitally important that both the private sector AND public sector properly diagnose this crisis. We have misdiagnosed it for well over two years thanks in large part to a Federal Reserve Chairman who was convinced that Milton Friedman had handed him the playbook for success. If you’re wondering why we have seen almost no recovery on Main Street then you need look no further than the policies of Bernanke & Co.