TALKING OURSELVES OFF THE EDGE OF THE CLIFF

Courtesy of The Pragmatic Capitalist

Yesterday’s WSJ MarketBeat blog took David Einhorn to task for his op-ed in the NY Times titled “Easy Money, Hard Truths“. They make the argument that Einhorn is simply pushing his massive gold position. I fear Einhorn is doing something much worse – helping to scare us all into continued recession.

First off, I have no problem when someone talks their book. In fact, I almost prefer for people to talk their book. There’s a certain trust in someone who is willing to “put their money where their mouth is”. It’s the primary reason why I believe the hedge fund business is such a wonderful advancement beyond traditional mutual funds – the manager’s interests are generally aligned with those of the investor. If you can find a manager who is not only intelligent, but has a sound moral compass you’ve wandered upon quite a gem. From all accounts David Einhorn appears to fit the mold. But I take very serious issue with his recent comments which I believe are filled with half-truths and propaganda that we continually hear from the inflationistas (all of whom have been terribly wrong thus far in terms of their macroeconomic outlook) who are driving the country towards the edge of the cliff.

Einhorn is a great investor and clearly a brilliant man, but for two years I have watched policymakers and fear mongerers misdiagnose the problems that we confront and this is, in my opinion, why we are still wrangling with these issues. In 2008 I wrote a letter to the Federal Reserve saying that this was a classic “balance sheet recession” with problems rooted in the private sector – specifically the consumer. I told them that saving banks was not the solution and that monetary policy would prove as fruitless in the U.S. as it has in Japan. I was shocked to receive a friendly response to my letter but not shocked to see Mr. Bernanke implement his Friedman-like monetarist campaign of “saving the world”. Obviously it hasn’t worked (unless you’re a banker) as we sit here two years later still discussing this wretched credit crisis and the ranks of the unemployed continue to climb. If we cannot properly diagnose the problems we cannot find a proper cure. Thus far, we have failed.

In yesterday’s op-ed in the NY Times Mr. Einhorn wrote:

“I don’t believe a United States debt default is inevitable. On the other hand, I don’t see the political will to steer the country away from crisis. If we wait until the markets force action, as they have in Greece, we might find ourselves negotiating austerity programs with foreign creditors.”

This gets right to the crux of the issue that the fear mongerers and inflationistas keep beating on. The United States is a monopoly supplier of currency in a floating exchange rate system. Greece is not. This is vitally important to understand because the United States issues no foreign denominated debt. Aside from a few Fed programs (such as the Euro swap lines) the United States has zero foreign debt risk. We have no creditors. No one funds our spending. Our spending is 100% internally “funded”.

Investors wonder why Japan has been able to run-up such massive deficits over the course of the last 20 years while the bond vigilantes sat idly by, got drunk and ignored them. Why is this? Because Japan has the exact same currency system as the United States. The bond vigilantes can’t come knocking on Japan’s door because there are no bond vigilantes to knock on their door! China is not our banker. Japan is not our banker. The United States is our banker and as Mr Bernanke recently stated – the United States cannot go bankrupt unless we decide to! It will sound odd to those of you with a traditional economics education, but the US government balance sheet is not like that of a household or state.

Mr. Einhorn continued:

“The current upset in the European sovereign debt market is a prequel to what might happen here.”

No, it absolutely is not. The irony here is so thick I am nearly choking on it. What Greece has essentially gotten themselves into a single currency system akin to the gold standard. There is no flexibility within such a currency system. There is no floating exchange between economies. So while Mr. Einhorn talks up his positions in gold he is actually justifying his actual portfolio composition without realizing that the piece of metal he is so heavily invested in is effectively the cause of the Greek crisis! This is exactly the kind of crises the world used to confront under the gold standard when there was no currency float. As I’ve previously explained, trade deficit nations (such as Greece) are at an inherent disadvantage in such a system because there is no room to devalue or utilize fiscal/monetary policy to alleviate pressures. Because they are not the issuer of their own currency they are forced to beggar thy neighbor and turn to the bond markets to “finance” their spending. The great irony here is that the Greek crisis is not a condemnation of the US dollar or the British Pound (though the Brits clearly think so) or any fiat money system. If anything, it is a condemnation of the gold standard.

Mr. Einhorn continues his rant while evoking the ageless fear mongering visualization of “money printing” and “debt monetization”. Both terms are not truly applicable to a monetary system in which the sovereign nation has a monopoly supply of currency in a floating exchange rate system, but believers in the gold standard like to invoke these images because they give the appearance that the government is simply creating money out of thin air and being totally reckless. Einhorn says:

“Some believe this could be avoided by printing money. Despite the promises by the Federal Reserve chairman, Ben Bernanke, not to print money or “monetize” the debt, when push comes to shove, there is a good chance the Fed will do so, at least to the point where significant inflation shows up even in government statistics….That the recent round of money printing has not led to headline inflation may give central bankers the confidence that they can pursue this course without inflationary consequences.”

This paragraph is loaded with false claims. First, the government doesn’t actually print money (at least not in terms of money creation). They simply press a button on a computer that changes accounts up and down. It’s not like they find a gold miner and print up a note and “monetize” anything. Most importantly though the government never actually has nor doesn’t have dollars. They simply change accounts up and down as they tax and spend. So what does the Fed do? They target the Fed Funds Rate via monetary operations with the belief that they are the grand wizard behind the whole operation. The Fed’s interest rate mandate or target of “price stability” actually means they can’t monetize the debt. In a Q&A session last year Mr. Bernanke admitted as much:

“As far as the Fed is concerned, we will not monetize the debt. We will maintain price stability.”

Now, this is generally the point in the conversation where the inflationistas begin talking about the “effective default” of the USA via dollar devaluation. The problem is, each time the crisis flares up the price action in markets makes it abundantly clear that there is no inflation, but rather continuing deflationary fears. Einhorn’s comments regarding inflation are no different than the other inflationistas who continue to scream “fire” in a crowded theater despite no signs of fire. Of course, there has been no inflation because there is none. The inflationistas have made the same error that Mr. Bernanke made when he supposedly “saved the world” in 2008. Mr. Bernanke assumed that banks were reserve constrained while Mr. Einhorn assumes that adding to reserves is inherently inflationary. But as we see very low levels of borrowing (due to the private sector’s lack of debt demand – caused by the continuing balance sheet recession and de-leveraging) we see zero signs of inflation.

The essay continues with a subtle jab at Keynesianism:

“Modern Keynesianism works great until it doesn’t.”

I am not sure why the world is so black and white to most. I refer to myself as an “opportunistic Austro-Keynesian”. I never pigeon-hole myself. Not in my investment strategies (which is why they are multi), not in my politics, and certainly not in my economics. Each economic environment is its own unique situation. Economists and portfolio strategists should view each economic scenario like an ER doctor – never expect that the exact same surgery will work on every patient. But for some reason certain economists prefer to claim that all government intervention is bad and others prefer to claim that all government intervention is good. The truth lies somewhere inbetween.

In terms of government spending (or blanket Keynesianism as most doubters prefer to call it) it’s largely an accounting identity. Private sector deficit is public sector surplus. If government never spends private sector funds are slowly drained. Just imagine a one time 100% asset tax. What would happen to the economy? It would die of course. Contrary to popular opinion, government must spend before it can tax. Not vice versa. Therefore, a certain level of government spending is necessary. The recent CBO findings show that government spending was the primary reason why the economy didn’t sink into a black hole over the last year. We also know from borrowing data and bank conditions that monetary policy has failed entirely. Of course, I have argued that the government spending has been very poorly targeted and resulted in more malinvestment and ineffective output than should have been the case, but that shouldn’t surprise anyone when you allow the bank lobbyists to control legislation. Spending is not the answer, but we must understand that spending at the government level also isn’t the enemy. Regardless, these blanket statements that government spending is always bad is flat out wrong.

Like most inflationistas Mr. Einhorn justifies his inaccurate macroeconomic outlook by claiming that it is a big government conspiracy to conceal the facts. He says the inflationistas haven’t been wrong (even though the markets vehemently disagree), but that the government is just lying to us all:

“Government statistics are about the last place one should look to find inflation, as they are designed to not show much. Over the last 35 years the government has changed the way it calculates inflation several times.”

Now, I don’t entirely disagree here. No one should rely solely on the government for all of their facts but in defense of the government, they do confront these exact questions on the BLS website. And second, there are plenty of sources for unbiased inflation data. The first and foremost is the market itself. US bond yields continue to tick lower despite these supposedly increasing signs of inflation. Any investor who has been positioned for inflation (even the uber bearish ones) have been terribly wrong.

Mr. Einhorn then takes the credit rating agencies to task. This is the point where the article really begins to gainsome traction. These companies have proven themselves mostly useless over the last few years. Unfortunately, he takes issue with the AAA rating of the United States. Luckily for us, Moody’s recently affirmed our Aaa rating – whew! We really dodged a bullet there. Of course, Moody’s doesn’t exactly understand the monetary system either as they view our “foreign debt” (of which there is none) as a potentially crippling fiscal hurdle. The very fact that this ignorant institution can even impact the trust in the national currency should be viewed as a national security issue.

Mr. Einhorn continues his essay by stating that easy money has not solved the crisis. Of course it hasn’t. In a balance sheet recession monetary policy becomes useless. I’ve been beating on this dead horse since well before Bernanke initiated his insane “trickle down” monetary approach. Mr. Einhorn said:

“EASY money has negative consequences in addition to the risk of inflation and devaluing the dollar. It can also feed asset bubbles. In recent years, we have gone from one bubble and bailout to the next. Each bailout has rewarded those who acted imprudently. This has encouraged additional risky behavior, feeding the creation of new, larger bubbles.”

Truer words have never been spoken. The Fed has been pushing on a string for two years while encouraging the speculators and punishing the prudent. But no level of Fed herding into risk assets has saved the economy. Bernanke saved the banks and ignored the people that actually needed aid – Main Street. Despite stronger bank balance sheets they still don’t lend. Why? Because there is still very low demand for loans. Thus, the root of the problem persists – the consumer and thus the private sector remains weak. In fact, based on employment (in my opinion the only true gauge of economic health) the country is worse off than it was two years ago.

Truer words have never been spoken. The Fed has been pushing on a string for two years while encouraging the speculators and punishing the prudent. But no level of Fed herding into risk assets has saved the economy. Bernanke saved the banks and ignored the people that actually needed aid – Main Street. Despite stronger bank balance sheets they still don’t lend. Why? Because there is still very low demand for loans. Thus, the root of the problem persists – the consumer and thus the private sector remains weak. In fact, based on employment (in my opinion the only true gauge of economic health) the country is worse off than it was two years ago.

I don’t write all of this because I am trying to make any particular person look bad or make myself look good (which is virtually impossible), but because I have a keen understanding of the current economic conditions and thus far have called them with a fair amount of accuracy. My greatest fear now is that we are talking ourselves into a depression and articles like this only compound that fear. It’s clear in my mind that the Europeans are already talking (and forcing) themselves into recession because they have failed to grasp the true underlying causes of their own crisis. It’s also clear that the British have allowed themselves to be scared into harsh austerity measures which will substantially increase the odds of a downturn there. The recent austerity measures in California are the first sign of the same occurring here in the states. We cannot allow ourselves to be convinced that the United States is this bankrupt fragile nation which is sitting at death’s doorstep. If we allow this fear mongering to grip the nation Richard Koo will certainly be correct and the second downturn will be substantially worse than the first.

****

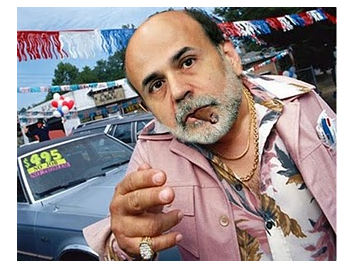

Final image courtesy of Jr. Deputy Accountant.