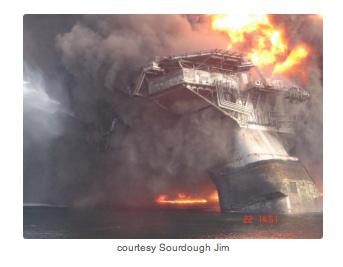

Oil Drilling Liability Cap Led To The Gulf Spill

Courtesy of Jeff Harding, The Daily Capitalist

I never ever thought I would agree with Nancy Pelosi on anything, yet here it is:

U.S. House Speaker Nancy Pelosi said Congress should consider eliminating any cap on the damages a company such as BP Plc might have to pay for harm caused by oil spills.

“There is a movement afoot in Congress for that. Why have a cap?” Pelosi said in an interview on Bloomberg Television’s “Political Capital with Al Hunt” to air this weekend.

Pelosi had previously voiced support for a proposal under consideration to raise the existing $75 million cap to $10 billion for economic damages caused by each environmental disaster. After being thwarted March 13 in the Senate, backers of that legislation have vowed to renew efforts to win passage.

“You would hope that there would not be more than $10 billion of damage, but understand it is for each episode,” she said. Asked about eliminating the cap altogether, Pelosi said: “I think it’s worthy of looking at.”

I’m not against Big Oil, Little Oil, or anyone in the Oil Patch, but the liability cap is just another example of how industry uses the government to gain market advantages at the expense of someone else. In this case it is the Gulf Coast inhabitants and those that live off of that huge resource.

As I understand the law, BP is responsible to pay 100% of the cost of the clean-up. What the liability cap does is to cap economic damages to $75 million. What that means is if anyone suffers a loss of income or property as a result of a spill, BP is only obligated to pay $75 million even though the losses may be in the billions. That is not right.

Businesses seeking advantages from legislators is not news. While lobbying is often a proper and necessary response of business to legislation that would be harmful to them, it is a two-edged sword when they try to gain economic or competitive advantage. Our history is full of examples, most recently, tire import tariffs. While it is right to condemn business for this we should blame legislators who have the primary duty to act in the best interests of all the people. At least one could say that we understand that business is motivated by self-interest, but Congress is held to a higher ideal. While politicians preach this principle they rarely live up to it.

In free market capitalism, no one has a legal or a coercive advantage over anyone else. If I commit a civil wrong, in this case the tort of property damage and the resulting economic loss, I should be fully liable for it. That is, I should pay the cost. If I go broke, so be it. If I do something with willful, wanton disregard for safety I may be grossly negligent which may allow a court to impose punitive damages.

In my view, the liability cap was a major cause of this environmental disaster.

Assume for a minute that there was no liability cap in place. BP was engaged in very risky drilling activity that posed potentially huge losses if they acted negligently. Drilling at 5,000′, I am informed, is not like drilling at 500′. Like all businesses, BP must weigh the potential risks against the potential gain of any enterprise. Like most businesses, they lay off as much risk as they can by buying insurance. If they didn’t buy insurance then they weighed the risk against their assets and net worth.

I am going to guess here that the economic loss of the BP spill will be far more than the cost of the clean-up. I assume that is always the case or otherwise oil companies would not have sought a liability cap. When they evaluate the risk of such risky activity, then they know that whatever damage they cause, their liability will not exceed $75 million. That is a drop in the bucket for a company whose after-tax earnings were $6.1 billion in Q1.

Thus I believe that liability is a significant deterrent to companies involved in risky activities. Their response to such liability could be:

1. Determination to not undertake a risky project because of the potential liability.

This happens all the time in industry. Projects such as chemical plants, nuclear research, nuclear energy, may be too risky in light of the potential reward. It may be beyond the company’s ability to respond in damages, thus risking the company’s future. It may be impossible or prohibitively expensive to get insurance.

2. Determination to engage in the project but with added safety protocols.

This is certainly possible with a large company such as BP. They may evaluate the risk and decide they can safely undertake the project. Obviously this was BP’s choice here. But they were negligent and they should pay all damages they cause. If they go broke, they understood the risks going in.

3. Determination to engage in the project but with additional insurance to cover potential losses.

If the project is undertaken because it is risky but determined to be within their ability to manage the risk but not to withstand damages, they could obtain insurance. If the insurance company determined that the risk was too high and refused coverage, the company would most likely decide to not undertake the project.

Insurance companies have a lot at stake because they bear much of the risk involved in such projects. They exercise great care by investigating their underwriting risk and require companies to satisfy many conditions related to safety. The breach of any policy safety condition may invalidate the insurance. Thus there are market forces that try to eliminate risky projects.

4. Determine to engage in the project but with no insurance or other risk-related safety protocols.

This would be foolish business behavior by any company. Assume rational players in the industry, the project would not be undertaken. Most oil companies have risk-reward protocols to minimize risk because, as public companies, no one would invest in them since risky projects would jeopardize investors’ capital much less the future of their company.

I think it will be shown that BP was not only negligent, but perhaps grossly negligent and there is no way to punish them for their behavior. I understand that they may voluntarily agree to compensate people with economic losses. To not do so would effectively end any future drilling in U.S. waters or perhaps worldwide. But that was not a deterrent preventing them from entering into such projects.

Let the lawyers have at them.