Consumer Metrics Institute Personal Finance Index Continues to Deteriorat

Courtesy of Rick Davis at Consumer Metrics Institute

Courtesy of Rick Davis at Consumer Metrics Institute

Below is an addendum to the update sent out on Tuesday, addressing new data reflecting changes in consumer behavior concerning their debt:

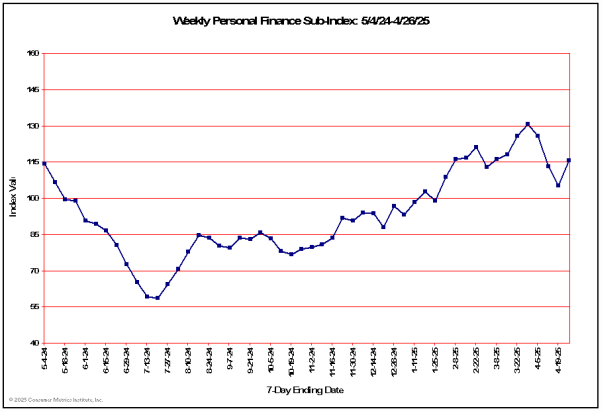

The Consumer Metrics Institute’s Personal Finance Index continued its decline for the sixth consecutive week, with it now showing a year-over-year decline in consumer confidence in excess of 40%.

This contrasted sharply with the situation as recently as the end of January 2010, when the same measure of confidence was showing a year-over-year gain in excess of 7%. The Consumer Metrics Institute’s Personal Finance Index is composed of a number of data series, some of which collect transactions that are precursors to the initiation of default and/or foreclosure activities. The levels of these negative activities are inverted before being included in the ‘Personal Finance Index’, so that a rapid rise in Consumer transactions with default and foreclosure counseling services, for example, will drive that particular index down.

[http://www.consumerindexes.

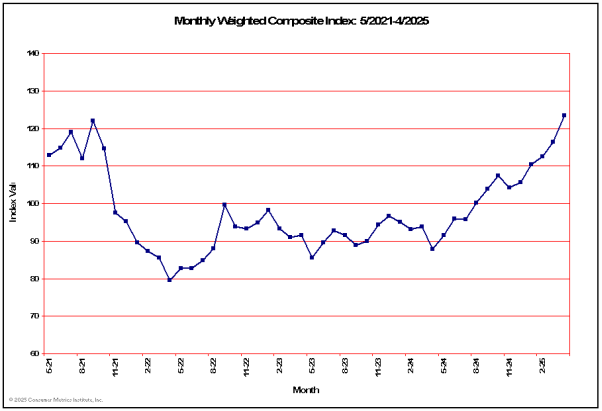

The Personal Finance Index is not alone in reflecting continued weakness. In fact, our ‘Weighted Composite Index’ (which is by far our best daily aggregate measure of the consumer ‘demand’ side of the economy) has shown a relatively steady deterioration since peaking in August 2009, with the trailing month now recording contraction in excess of 2%.

[http://www.consumerindexes.

The sliding ‘trailing quarter’ as reflected in our ‘Daily Growth Index’ has also reached a level consistent with a year-over-year contraction rate of about 2%, after initially dropping into net contraction on January 15th. When compared to previous contraction events in 2006 an 2008 this particular episode of contraction in consumer demand is following a unique profile: at it’s worst it is still milder than the mild 2006 event but it has gone on longer than even the 2008 event without forming a clear bottom.

[http://www.consumerindexes.

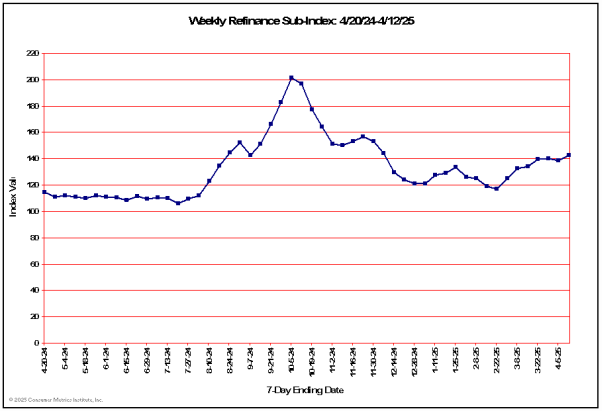

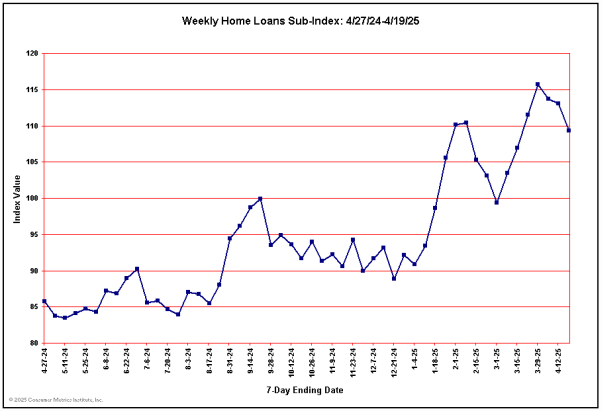

If the housing market is expected to recover soon, a significant increase in demand for residential real estate loans will need to be occurring in the near future. Although there has been a recent minor upturn in consumer interest in refinancing on a year-over-year basis, it may only be a sign that consumers are beginning to expect that the historically low mortgage rates are nearing an end.

[http://www.consumerindexes.

A more telling development would be for a similar upturn in consumer interest in new loans, which we have not seen. In fact the year-over-year change in consumer interest in new loans has dropped to the lowest level we have ever recorded, slightly surpassing the previous low set back in August of 2008.

http://www.consumerindexes.

If there is a strengthening recovery, we are not seeing clear signs of it. In fact, we could argue that most consumers are increasing their already substantial caution about taking on new debt, while others are exploring their legal options should their current debt loads become harder to manage.

Our data is significantly upstream economically from the factories and the products measured by the GDP, putting us far ahead of the traditional economic reports.

A PDF covering our methodologies is at http://www.consumerindexes.

Thank you,

Richard Davis

Consumer Metrics Institute, Inc.

******

As another addendum, I asked Rick to comment on a post at The Pragmatic Capitalist that seems to conflict with the no green shoot theory:

STOCKS RALLY AFTER STRONG ISM REPORT

Signs of weakness in the global economy were not apparent in this morning’s ISM

“Robust month-to-month growth for new orders and

employment highlight another very strong ISM manufacturing report. New orders held steady at 65.7, a reading well over breakeven 50 and the third in a row over 60. Employment index was last above 60 back in May in 2004. May’s reading came in at 59.8 for a 1.3 point gain to indicate significant acceleration in hiring.Other readings include strength for production, backlogs, export orders and continued delays for deliveries. Input prices continue to show significant pressure. The activity in production appears to be drawing inventories which points to a rising necessity for inventory restocking and a future boost for production and employment.

This report is very positive and should help bolster the optimists who say the U.S. economy is on the mend.”

Robert Ore, chairman of the ISM Manufacturing Business Survey Committee is quite confident in the strength of the recovery:

“The manufacturing sector grew for the 10th consecutive month during May. The rate of growth as indicated by the PMI is driven by continued strength in new orders and production. Employment continues to grow as manufacturers have added to payrolls for six consecutive months. The recovery continues to broaden as 16 of 18 industries report growth. There are a number of reports, particularly in the tech sector, of shortages of components; this is the result of excessive inventory de-stocking during the downturn.”

Rick responds to Robert Ore:

Ilene:

I think that the quote that you captured from Robert Ore says a lot more about factories than he really intended, particularly when he indicated that a significant portion of the current upturn "is the result of excessive inventory de-stocking during the downturn” — suggesting that factories generally overcompensate in their inventory adjustments.

If factories are really doing what his numbers say, I would argue that factories are experiencing excessive inventory re-stocking on the expectation that consumers are going to spend like crazy through the second half of the year.

But our data would suggest that such factory expectations are seriously misinformed.

Rick

Cartoon at the top from Jr. Deputy Accountant