Well, well, Happy Thursday to all! I am glad to have let Exide Technologies (XIDE) ride overnight yesterday. I got involved at 4.00 yesterday afternoon, and I had a meeting all afternoon that did not allow me to sell in the afternoon. Typically, I would have taken the 7% gain before earnings; however, am I glad I did not. Exide reported earnings at 0.53 EPS vs. the expected 0.04 and one year ago’s -0.83. The improvement year-over-year is a whopping 165%. Wow! But, the best part of the earnings is that the company is trading up over 20% in pre-market trading. 20%!!! I am going to sell as the market opens for gains of near 30% if it holds up going into the open. The chart to the left I thought was pretty interesting to see how various top nations rank on satisfaction. So, when you think that people around the world dislike us, in reality, they just really dislike their own nations.

Yesterday, our other position was in Hovnanian Enterprises (HOV), the residential construction company. HOV was able to make a solid 3% gain yesterday for our Buy Pick of the Day moving from our entry at 6.00 in the morning to 6.18 later in the morning after a big rise on the pending home sales news. Finally, our only other open position is Tuesday’s play of the week in Quiksilver Inc. (ZQK), which we entered at 4.60. The company reports earnings tonight and is already up to 4.75 in pre-market trading. We are looking for an exit of 4.78 – 4.87.

Good luck today and here are our new picks…

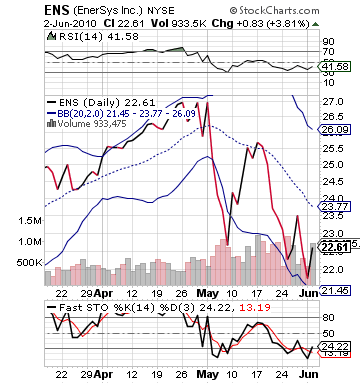

Buy Pick of the Day: EnerSys (ENS)

Analysis: To continue the success of Exide Technologies, I am turning my attention to one of Exide’s closest rivals in EnerSys (ENS). EnerSys makes industrial batteries. Exide does both industrial and automotive batteries. EnerSys is slightly larger than Exide, but with the earnings that Exide had, it should be giving a huge boost to an extremely undervalued company in EnerSys. ENS just released their own earnings on Tuesday, and they were slightly better than expected. The company did not get a huge boost from them, but these Exide earnings should really give this stock a nice nudge along with a market that is looking upwards.

The market is digesting several job indicators. The ADP Non-Farm Employment numbers came out just under expectations, but they were a great improvement from the month of April to May, and it shows that employment is increasing. Futures did not drop significantly after the report. The unemployment claims came back better than expected, showing a drop to 453,000 (2,000 under estimates), and while prodcutivity fell so did employment costs. Overall, employment did not really boost the futures for the market nor have they decreased them. The Dow has been up modestly around 30 points to 35 points for most of the morning. Oil is moving up, there are good earnings coming across the table, Asia and Europe are having big days, and I think we are set for another great day.

The market is digesting several job indicators. The ADP Non-Farm Employment numbers came out just under expectations, but they were a great improvement from the month of April to May, and it shows that employment is increasing. Futures did not drop significantly after the report. The unemployment claims came back better than expected, showing a drop to 453,000 (2,000 under estimates), and while prodcutivity fell so did employment costs. Overall, employment did not really boost the futures for the market nor have they decreased them. The Dow has been up modestly around 30 points to 35 points for most of the morning. Oil is moving up, there are good earnings coming across the table, Asia and Europe are having big days, and I think we are set for another great day.

This is both setting up EnerSys to kick it into gear today. The company has moved down over 10% in the past two weeks, and it heavily oversold on slow stochastics, RSI, and very close to its lower bollinger band. Yet, what I like to see is that its fast stochastic is starting to move upwards, which means that buyers are starting to reenter the stock and buyer demand is growing versus seller demand. With the good news from XIDE, sellers should be less than buyers, furthering this trend and increasing the stock price.

I have set my entry level for a slight gain to start the morning as I expect it to pop. ENS does not do any pre-market trading, so it is hard to gage exactly where that will come. If the stock opens below my levels, then buy it. If it is above the levels, I would still purchase it up to around 23.10 – 23.15. If it opens above those levels and does not come below them, this one is not for us.

Entry: We are looking to enter at 22.90 – 23.05.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Direxion Daily Energy Bear ETF (ERY)

Analysis: Oil is starting to make a move to the upside as it finally has gotten some news that it can use to "fuel" itself..png) The American Petroleum Institute commented that inventories of oil fell in the States by 1.4 million barrels. It is one of the first decreases in petroleum in some time. It most likely is simply a supply cut and not a rise in demand, but either way…lower supply will increase the price of oil. After the beating that oil has received as of late, this good news should really help the price of oil soar. Further, it sets up the EIA’s announcement of crude inventories to be bullish for the price of oil as well.

The American Petroleum Institute commented that inventories of oil fell in the States by 1.4 million barrels. It is one of the first decreases in petroleum in some time. It most likely is simply a supply cut and not a rise in demand, but either way…lower supply will increase the price of oil. After the beating that oil has received as of late, this good news should really help the price of oil soar. Further, it sets up the EIA’s announcement of crude inventories to be bullish for the price of oil as well.

"Oil prices are clearly at the mercy of jittery nerves and fragile sentiment," Barclays Capital said in a report. "Once the nerves calm down, and fundamentals reassert themselves, we would expect prices to move higher quickly."

For this reason, I want to short sell the Bear ETF ERY from Direxion. ERY has had an amazing run to the upside as oil prices fell with supply increases and BP’s scare. The stock increased nearly 30% from the beginning of May, but it a 3x ETF that has extreme volatility and can move downwards in a hurry. If the market picks up and oil prices continue to increase this morning, then ERY will be on its way down very quickly.

I definitely expect this one to move downwards quickly into 10AM when the EIA’s report comes out. Yet, if the EIA comes out and does not have the same kind of news that the API reported, I would worry about oil prices sustaining gains. So, watch out for that report at 10 AM. If it shows inventories increase, ERY may not make it down much further than where it is at at 10 AM.

Good luck and get in early with this one. If the ETF opens above 11.65, then grab a short sale there. I would not hesitate buying down to 11.50. Below 11.50, it probably is not for me.

Entry: We are looking to enter at 11.65 – 11.55 for a short sale.

Exit: We are looking to cover for a 2-3% gain.

Stop Loss: 3% on top of entry.

Good Investing,

David Ristau