Hope everyone had a wonderful weekend. Last week, The Oxen Report had a veery successful week, making four successful selections and no losers. Check out my recap of last week here. This week, the market faces a low amount of economic data and market moving earnings reports. Attention most likely will turn to overseas news, Europe’s recovery, the oil spill, and other developing stories. This morning the markets are little changed on the futures, but world markets are down on fears of Hungary becoming the next Greece and a reaction to Friday’s USA drop on jobs data. Lets look for some safe plays on this concerning day.

Hope everyone had a wonderful weekend. Last week, The Oxen Report had a veery successful week, making four successful selections and no losers. Check out my recap of last week here. This week, the market faces a low amount of economic data and market moving earnings reports. Attention most likely will turn to overseas news, Europe’s recovery, the oil spill, and other developing stories. This morning the markets are little changed on the futures, but world markets are down on fears of Hungary becoming the next Greece and a reaction to Friday’s USA drop on jobs data. Lets look for some safe plays on this concerning day.

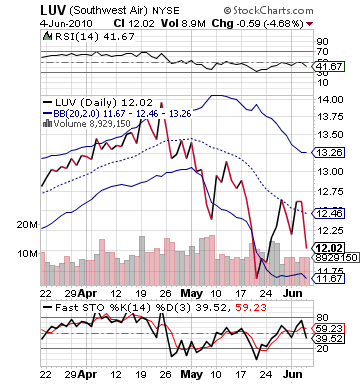

Buy Pick of the Day: Southwest Airlines Co. (LUV)

Analysis: This morning American airline companies got some stellar news from the IATA that for 2010 the organization is predicting that airline companies will be making a profit. While business is weak in Europe, the USA has strengthened its market enough to where the IATA predicts that close to $2 billion profits will be made in the economy here. Airlines have been doing fairly well over the past couple weeks despite the market’s turmoil. One company, however, that continues to be undervalued is Southwest Airlines Co. (LUV). With futures barely in the green, the Asian markets dropping over 3%, and new fears coming out that Hungary cannot cover its debt, the airlines may be one of the only outlets for safety.

Southwest Airlines over the past three weeks has dropped over 8%, but it appears ready to make a move back to the upside today with the release of the IATA news as well as some news from Friday that appears yet to have been priced into the stock. Friday was a simply awful day for stocks, and Southwest Airlines noted that they had seen a 3.5% increase year-over-year of traffic in May. The company got no boost or gain from the news whatsoever. A combination of the IATA news with the traffic news should help to pull up this undervalued company.

Southwest Airlines over the past three weeks has dropped over 8%, but it appears ready to make a move back to the upside today with the release of the IATA news as well as some news from Friday that appears yet to have been priced into the stock. Friday was a simply awful day for stocks, and Southwest Airlines noted that they had seen a 3.5% increase year-over-year of traffic in May. The company got no boost or gain from the news whatsoever. A combination of the IATA news with the traffic news should help to pull up this undervalued company.

Futures are continuing to rise this morning, and there appears to be more good news on the financial front than bad news. BP has said its efforts are starting to become successful at capping oil. A stronger market would definitely help to bolster Southwest’s move further.

Technically, LUV is ready to bounce on this news. The company is undervalued on RSI, oversold on fast stochastics, and near its lower bollinger band. The company has lots of upside to its upper band, and if it can get some interest going, then it will definitely move a lot higher. The comapny should definitely get a boost today, and we want to get involved early. I set a range for a higher open, but if it opens lower, buy there. If it is above our range past 12.40 then it is not worth it.

Good luck with LUV!

Entry: We are looking to enter LUV at 12.15 – 12.30.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

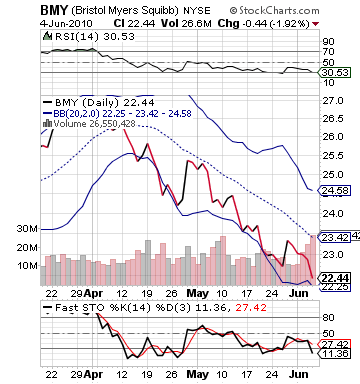

Short Sale of the Day: Bristol-Myers Squibb Co. (BMY)

Analysis: Bristol-Myers Squibb (BMY) received some very good news this morning on two fronts. For one, the company over the weekend announced that they had seen results from clinical trials on their melanoma drug Ipilimurnab had shown results of extending the life of patients with advanced forms of melanoma. The drug is being reviewed by the FDA and is thought to be released by the end of 2010. The company, according to Jeffries, could make up to $1 billion in sales for the company.

FDA and is thought to be released by the end of 2010. The company, according to Jeffries, could make up to $1 billion in sales for the company.

As a result of the news and other reasons, Goldman Sachs (GS) gave BMY an upgrade this morning to buy from neutral. The company commented on the new melanoma drug as well as the company having a solid pipeline. This all sounds very bullish for BMY and its future prospects; however, it appears to be for today a great short sale.

The stock is up over 7% in pre-market trading. Yet, the company has a beta of less than 1. The stock does not move at that rate to the upside very often. In fact, the movement has put the company rather close to its upper bollinger band because it trades in a tight 10% window. I think that it will definitely get a lot of resistance at it opens higher and moves up towards 24.50. The company most likely will be challenged to continue much higher and should get profit taking.

The market, additionally, is fairly unpredictable this morning, and it is doubtful it will move at an alarming rate upwards that will help to keep fueling BMY. I have set the entry for BMY near the top of the crest of where its bollinger bands are. If BMY gets to this range, then it will face a lot of resistance and will drop.

Wait for BMY to move up some this morning before shorting.

Entry: We are looking to short at 24.40 – 24.55.

Exit: We are looking to cover for a 2-3% gain.

Stop Loss: 3% on top.

Good Investing,

David Ristau