This week I am going to be investigating four nations that I think have intriguing investment opportunities that are part of the World Cup 2010 in South Africa. We will start with Slovenia, move to Honduras, then to Nigeria, and finish up with Chile. These reports will talk about the nation, its history, its economy, and why it is an interesting investment moving forward. This will help us get into the spirit for the World Cup and connect it to investing!

This week I am going to be investigating four nations that I think have intriguing investment opportunities that are part of the World Cup 2010 in South Africa. We will start with Slovenia, move to Honduras, then to Nigeria, and finish up with Chile. These reports will talk about the nation, its history, its economy, and why it is an interesting investment moving forward. This will help us get into the spirit for the World Cup and connect it to investing!

When I was in college, I did a study abroad program in Washington, DC at American University, studying the breakup of Yugoslavia and the war in Bosnia, Serbia, and Croatia that followed. Slovenia or, more officially, the Republic of Slovenija, was a former member of the Yugoslav Republic, and it is actually the most successful nation that came out of that bloc. I actually traveled to the nation very briefly as part of the program, and while in Washington, DC, we met with the Slovenian Ambassador to America. It is a truly beautiful and fascinating nation that has a compelling future.

Slovenia has a rich history as being part of some of the most powerful empires in the world. It was a part of the Byzantine Empire, the Austrian/Ottoman Empire, and even the Roman Empire. The country was under Communist rule in Yugoslavia from the end of WWII until the 1980s. The country experienced four decades of rule under Marshall Tito, who helped link many different ethnic groups and religions under the Yugoslav flag for years. In January of 1990, Slovenia left the Communist Party of Yugoslavia and declared independence. The nation, in the same year, elected a new Christian Democrat Lojze Peterle, who began economic and political reforms that would introduce a market economy and liberal democracy. By 2004, Slovenia was able to join NATO and the European Union. In 2008, the nation was the first post-Communist nation to hold the Presidency of the Council of the EU.

The nation is quite small with only just over 2,000,000 citizens and only 20,273 square kilometers. The population is similar to the size of Nevada or Utah, while the area is similar to the state of New Jersey. The country is ranked 29th on the Human Developmental Index and is devoutly Roman Catholic. One of the most interesting things that you most likely did not know about Slovenia is that it is ranked 50th in GDP per capita right behind South Korea and above New Zealand.

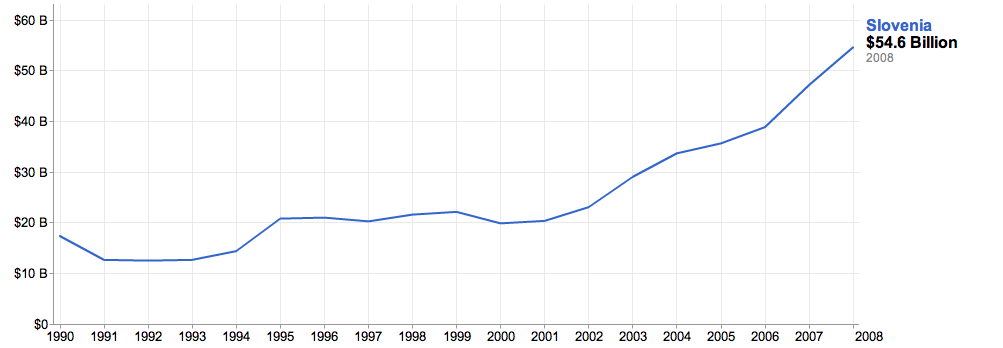

Economically, the nation has developed quite significantly since the breakup of Yugoslavia. At its inception, in 1992, the nation’s GDP was at $13 billion. As of 2008, the GDP had risen all the way to $54.6 billion. The nation was always the most prosperous part of Yugoslavia, accounting for a fifth of the nation’s entire economy. The nation has developed into a modern economy that benefits from a high level of education and productive work force. The country has low levels of debt below $1 billion and has a high credit rating.

The nation’s top industry is actually in financial services, where they operate 60% of their entire economy. Industry and construction accounts for 1/3 of the GDP, while agriculture is very low. The nation’s top industries are in metallurgy, aluminum reduction, lead and zinc smelting, electronics, and wood products. The nation has an abundance of lead and zine, as well as, uranium and silver. Additionally, the nation has begun a strong organic farming initiative in the Alpe-Adria bioregion.

Slovenia has benefitted significantly from being oriented close the European Union, lying just below Austria and to the west of Italy. The nation has significant trade with those nations as well as Germany and France. Nearly two-thirds of all of Slovenia’s trade is with EU members. Therefore, the current state of the EU does threaten the stability of Slovenia as it highly dependent  on its EU counterparts.

on its EU counterparts.

The nation, though, continues to grow its GDP and still could increase its overall GDP significantly. It is only twenty years out of its Communist control, and it has only been a part of the EU for six years. While the nation may no longer be the emerging market it has been over the past twenty years, in which it increased its GDP by over 300%, Slovenia has taken a rough spill as of late due to the economic slowdown in the EU and since Slovenia has a strong export economy since internal demand is low due to low population.

The nation has seen its stock market, the Ljubljana Stock Exchange (LJSE), drop over 20% in the past year. The nation has been battered among the recession, but at its low right now, it presents great opportunity. The nation still has great development to undergo, and it is beginning to be invited and joining some of the top economies in the world. Just this week, for example, Slovenia joined the Organization for Economic and Cooperation Development (OECD), which is an organization of 30+ members of the richest economies in the world. The OECD thinks that the Slovenian economy will grow by nearly 3% this year, and it will be able to recover with lower government spending and wages. The nation, itself, has only a 1.5% increase in GDP this year with a 2.5% in 2011.

3% this year, and it will be able to recover with lower government spending and wages. The nation, itself, has only a 1.5% increase in GDP this year with a 2.5% in 2011.

Slovenia also has developed trade with China. The nation, like most other developed nations, uses China for manufacturing a number of goods from telecommunications, real estate products, electronics, and many other manufacturing routes. The trade relations between the nation slowed during the crisis and declined, but recently, Chinese Economic Advisor to the Chinese Embassy in Slovenia commented that Slovenian trade has improved significantly.

Finally, the nation is continually looking to diversify itself and build its economy. This is a nation that has kept deficits low and developed a very successful free market economy in less than twenty years. They are looking towards tourism, high-tech electronics, and more growth in other nations as the future. This is an economy that while having contracted in its Q1 of 2010 is poised for more growth.

Investing in Slovenia is not as easy as one would hope. Right now is the perfect time to get involved in this nation that is obviously no longer the emerging market it once was, but it is a reemerging developed market that has long-term growth potential. One of the best ways is to invest in the iShares Austria Investable ETF (EWO), which is a broad range ETF with exposure to Austria, Czech Republic, Slovakia, and Slovenia.

Another way to invest Slovenia is to invest in companies that are doing significant work in Slovenia. One company that is doing a lot of work in Slovenia through a subsidiary Lek is Novartis (NVS). Lek is a pharmaceuticals development company and is one of the top companies in Slovenia. Another company doing significant work in Slovenia is Goodyear, who obtained  Slovenia’s Sava Tires and operates now in the nation.

Slovenia’s Sava Tires and operates now in the nation.

Finally, if you have the ability, there is the Slovenian stock market – the LJSE or LJE. Getting involved at that level is actually the best way to get involved with this market. As the economy continues to grow, I suspect they will start some more ETFs directly for this nation, but for the time being, these are the best ways.

Finally, since this is a World Cup series, Slovenia is going to be taking place in its second ever World Cup. They qualified in 2002 but lost their first three games and were eliminated. The nation did not qualify in 2006, but they did in 2010 by beating Russia and taking second in their region. They play their first game on June 13th against Algeria. Slovenia is actually in the same group with the USA, and they will play them on the 18th.

Good Investing,

David Ristau