This is interesting:

This is interesting:

I was looking for this picture of Steve Martin as I like that joke for "The new Beige Book is here" but then I found this chart from my March 3rd Beige book post, which is very interesting. I had laid out our expected market range and this is a great reminder of why we flipped bearish after that April run as we were so far out of our range that we couldn't, in good conscience, hold onto our bullish positions any longer.

It also reminds us why we have been BUYBUYBUYing down here. As I keep saying to Members: THIS is the range we EXPECTED to be in, why would we panic when our expectations are being met?

Now, let's take a look at how the next 3 months went:

We went to cash BECAUSE we didn't like the last Beige Book. That wasn't the only reason, we had tons of geopolitical concerns (read April 25th's "Why Does This Rally Give Me The Creeps?") which led us to hedge for DISASTER on the 28th with "5 Plays that Make 500% if the Market Falls" and you can check them yourself to see how well they did (we dumped them this week). In yesterday's Member Chat, I put up one play that makes 700% if the market goes up so we are going to be happy, happy campers if we get back over the bounce levels we marked in Monday's post. As I mentioned the other day, we take profits on our 500% plays at 300%, just like we did on April 24th, when we took our previous set of super-bullish hedges off the table (see "Should We Take Profits At 300%?").

Will today's Beige Book confirm our belief that things are not all that bad in America? I watched Cramer last night and, frankly, I can't figure out what the guy is saying. He throws out so many numbers that no matter what the Dow does in the next few months, he'll have a number for it but at least his tone is in-line with what he's been reading on our board. I laid out my "Worst Case Scenario" over the weekend and said "THIS IS the worst case scenario!"

This is the bottom we expected as all of our long-held concerns ("Creeps" article) finally get the attention of the MSM but there is nothing NEW here to make us change our low-end target. That's the difference between fundamental and momentum traders – Cramer is like a weather vane and goes whichever way the market is blowing while we wait patiently for our long-held targets to be tested before we make big commitments. I called yesterday "Testy Tuesday" and we held our lines and now we are looking to re-take our WEAK bounce levels at: Dow 10,250, S&P 1,100, Nas 2,260, NYSE 6,820 and Russell 666. IF we fail to get those back and break below our lows – THEN it's time for a new round of disaster plays but, for now, we are well-hedged on our buys and, at 2:17 yesterday, I said to Members:

We are right on track to hit 10,000 tomorrow by the way… We’ll need good consumer confidence numbers at 5pm but then we have wholesale inventories and the Beige Book at 2pm that Bernanke thinks looks pretty good. Friday is May retail sales and expectation have now crashed for those (0.2%) but gas sales will drag them down. To me, it looks like a major seller, not major selling and when this guy is done, we can move up pretty quick.

Consumer Confidence came in at a not-so-great -43 in VERY slow improvement in the scale of -100 to +100. Still, it's 4 points higher than the 2010 average and 7 points up from -50 in April, due mainly to lower gas prices I assume so we're not sure that's going to last. The average since 1985 is -13, which is amazing because you would think the credit-crazed US consumers would be bursting with confidence but this shows you that the people are smarter than you think – they know they are screwed so they figure they may as well get that way on a nice couch!

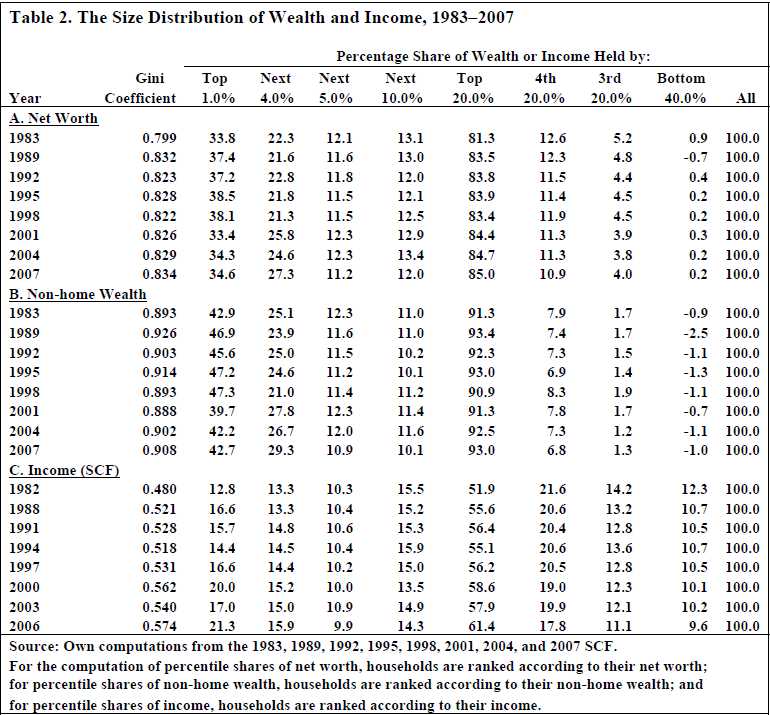

If you want to know why Consumers in the US are permanently depressed, you need look no further than this chart, which was part of our Monday night Member Chat discussion on wealth distribution and taxation:

It’s actually gotten much worse since 2007, of course. We’ve already driven the bottom 40% out of 99.8% of the net worth of this country and they are 1% of the country’s "non-home wealth" in debt. They simply can’t buy anything without taking on unsecured debt and no one is willing to give it to them so say goodbye to 40% of all potential shoppers. The top 20% have 93% of the wealth and if you should happen to fall from the top 20% to the next 20%, you have to fight over 6.8% while the 60% below you share the remaining 0.2%.

That's what's going on in the United States folks and, now that we've tapped out our lower classes, we are exporting our misery to other countries and we've already pushed our Chinese slaves too far and they are now asking for higher wages so they can go to McDonald's and buy a happy meal for less than a full day's pay. The Shanghai (China's mainland index) was happy about the idea of workers getting more money (and exports are rumored up 50%) and they jumped 2.8% this moring after bouncing along the 2,500 line. The Hang Seng was up just 0.7% and the Nikkei fell 1% on what seems to be concerns over the Fitch warning on the UK that we already shook off.

That's what's going on in the United States folks and, now that we've tapped out our lower classes, we are exporting our misery to other countries and we've already pushed our Chinese slaves too far and they are now asking for higher wages so they can go to McDonald's and buy a happy meal for less than a full day's pay. The Shanghai (China's mainland index) was happy about the idea of workers getting more money (and exports are rumored up 50%) and they jumped 2.8% this moring after bouncing along the 2,500 line. The Hang Seng was up just 0.7% and the Nikkei fell 1% on what seems to be concerns over the Fitch warning on the UK that we already shook off.

Mainland China can afford to be happy about higher wages because they are not paying them, we are. Raising the standard of living for 100M Chinese factory workers by 50% ($1,000) will cost the World $100Bn a year in fair wages paid, that's a whopping 0.17% of Global GDP to help create a real fledgling consumer class in China – THAT's what I call a stimulus!

Europe has been all over the place this morning, opening up nearly 2%, falling flat and now (9am) back up about 1% as rumors drive the markets there up and down. The IMF says risks to the Global Economy have risen significantly while 75% of the people in Europe surveyed think Greece will default on their $175Bn debt, despite the $1Tn line of credit and the people, shockingly, have lost faith in Trichet. There doesn't have to be any logic to these attacks – as long as someone believes it and Cramer can spin it to the sheeple.

I warned that hyena attacks market the end of the bear's feeding frenzy yesterday but that doesn't stop them from trying until the bitter end. They are pulling out all the stops to try to keep the Euro under $1.20 and the Pound under $1.45 and the new attack was started by our own favorite banker's tool, Ben Bernanke, who's veiled comment about possibly raising rates the other day allowed may of his cohorts to exit their Euro shorts on the cheap. Ben testifies to the House Budget committee this morning so it's going to be an interesting day to say the least.

We're very bullish here UNLESS we fail to retake our weak bounce levels – then we'll be getting the hell out of our short-term bullish positions and thinking long and hard about the next move. Copper zoomed up to $2.87 and oil is up to $74 pre-market so congrats to all who played there but – DON'T BE GREEDY!!! Use stops and remember that cash is still king – we are finding great opportunities every single day in this crazy market so why lock into one-way bets until things settle down?