The Oxen Report Long Term Virtual Portfolio has been doing fairly well thus far in its short existence. Our first position that was opened at the end of May was with Trina Solar (TSL). We got involved at 17.65. The stock is at 18.37 currently. We have moved up about 4% thus far on Trina. Our long term short in Green Mountain Coffee Roasters Inc. (GMCR) is currently down about 2%. We were up as much as 5% from our entry of 24.05, but the stock has rebounded well in the market’s upwards movement. We now turn our attention to a new sector away from solar and food/beverage. This week we are looking at a foreign auto parts supplier that has some great long term potential.

upwards movement. We now turn our attention to a new sector away from solar and food/beverage. This week we are looking at a foreign auto parts supplier that has some great long term potential.

Long Term Position: China Automotive Systems Inc. (CAAS)

Thesis

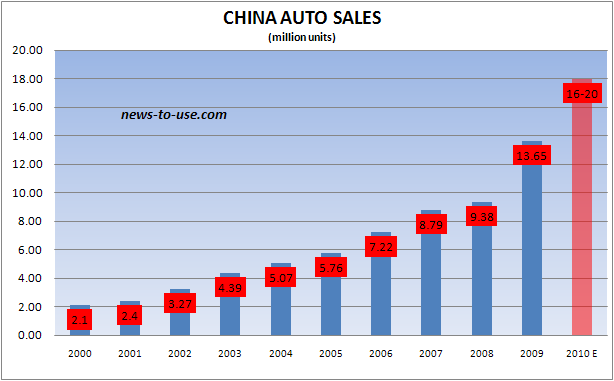

One of the most vibrant industries in the world today is the Chinese automotive industry. The nation has become the leader of automotive sales in 2010, and it looks poised to continue to grow throughout the coming years. Many have read or heard the statistic that the Chinese add some 1,500 cars per day to the streets. Chinese auto sales are estimated to grow 55% by 2015, according to JDPower.com, from nearly nine million to over 13.5 million sales. The industry looks poised for significant growth, and between all the buzz that surrounds this entry, one opportunity stands out to take advantage of this growing industry with an undervalued company.

China Automotive Systems Inc. (CAAS) has become one of the leading auto parts suppliers in the auto parts industry of China and as of January 2010 began a venture with its first North American company (the company has done business with North American companies that have Chinese subsidiaries) in Chrysler LLC. The company has grown its sales over 300% in the past five year, and the company has increased its revenue over 20% every year for the past five years. The company has  positioned itself very well to continue to see growth at these levels as it distributes over sixty Chinese automobile manufacturers including two of the five largest in FAW and Fongdeng. The company’s move into the USA via Chrysler is another terrific sign for more growth as the North American market is beginning to see strong recovery as well.

positioned itself very well to continue to see growth at these levels as it distributes over sixty Chinese automobile manufacturers including two of the five largest in FAW and Fongdeng. The company’s move into the USA via Chrysler is another terrific sign for more growth as the North American market is beginning to see strong recovery as well.

One greatest asset that the company has is significant free cash flow. The company has increased its free cash flow each year for the past three years, and it has increased its free cash flow 700% in the past five years much better than their revenue increase. This cash flow is important for an auto supplier to be able continuously research new products and open new distribution channels throughout China and countries. As the company sees continuous increase in sales volume it will need good cash flow and working capital. Working capital for the company has continuously been good, increasing over the past three years with approximately $60 million in working capital at the end of 2009. These two factors will help the company remain financially healthy and be able to take advantage of the cyclical nature of the automotive industry.

Over the long term, CAAS will not only benefit from the excellent domestic sales increases it is expected to see, but it also has the potential to benefit from what will become the Chinese aftermarket – auto parts repair and replacements on used cars. Further, Chinese companies are looking to enter Western markets throughout Europe and the USA in the coming years. FAW Group and Fongdeng both have joint ventures with VW, GM, Mazda, and Audi. These companies could be avenues for more production in Western markets and more opportunity for CAAS. Another emerging company that CAAS works with is BYD, which is a Warren Buffett-funded electric car manufacturer. The company recently signed a joint venture with Daimler to produce an electric car by 2013.

FAW Group and Fongdeng both have joint ventures with VW, GM, Mazda, and Audi. These companies could be avenues for more production in Western markets and more opportunity for CAAS. Another emerging company that CAAS works with is BYD, which is a Warren Buffett-funded electric car manufacturer. The company recently signed a joint venture with Daimler to produce an electric car by 2013.

The latest quarter of 2010 was another bright spot for Chinese Automotive. The company reported net sale increases of 88% year-over-year. The company increased its gross margings to an outstanding 26.8% versus 24.4% in Q1 of 2009. The company increased its operating income 124%, and its net income rose 358%. That sort of growth obviously will be tough to continue in the long term, but there is no reason to expect anything but more growth. The fact of the matter is that even slowed growth will be good for CAAS, who has only a P/E ratio of 17.74 currently. Continued growth like this should actually raise that P/E ratio.

The following comment from China Automotive’s CEO Wu Qizhou sum up the prospects for CAAS:

"China Automotive Systems’ near-term execution and long-term tactics remain intact. We continue to focus on expansion within existing customers and penetration into new customers. Our closer relationships with large OEMs help improve their margins and enhance their competitiveness in the marketplace. Our track record and progression with Chery Auto, BYD, Geely and Brilliance, all speak volumes for the successful implementation of our growth strategy. As we continue to win contracts from more high-quality OEMs who have proven growth records, we have gradually established a large customer base and ability to optimize production cycles to meet the surging needs of the top sellers. This is the reason why we can consistently outgrow the overall auto market in China," Mr. Wu ended.

Competition for Chinese Automotive Systems comes from several companies in mostly other markets. The Japanese JTEKT Corporation is the leading supplier for Toyota and also supplies other companies internationally. In China, the leading car  producer SAIC is supplied by Shanghai ZF. Further, First Auto FKS makes steering systems in China, as well. The company, though, has made itself a market leader, and that gives the company a small economic moat. Additionally, the company has gained market share and brand name with its largest distribution line, but they do continuously face competition from other small producers and the aforementioned.Moving forward, the company is producing an electronic power steering system, which will be the first of its kind in China if it can be well received. The company is already sending this to Suzuki Auto, and it would help to widen the company’s economic moat.

producer SAIC is supplied by Shanghai ZF. Further, First Auto FKS makes steering systems in China, as well. The company, though, has made itself a market leader, and that gives the company a small economic moat. Additionally, the company has gained market share and brand name with its largest distribution line, but they do continuously face competition from other small producers and the aforementioned.Moving forward, the company is producing an electronic power steering system, which will be the first of its kind in China if it can be well received. The company is already sending this to Suzuki Auto, and it would help to widen the company’s economic moat.

Valuation

My fair value estimate for China Automotive Systems (CAAS) is $28.78 per share based on a discounted cash-flow analysis. The company has seen incredible growth in its operating income in the past five years, and there is really no worry that the.png) industry cannot continue to grow as demand continues to grow in China and other markets. Given the development of new markets, the company’s wide distribution market, and development into new markets, the company is continuing to offer growth in its income. My estimated available cash flow starts at $23 million for this year, which is somewhat cautious in estimations of operating income versus decreases in capital expenditures.

industry cannot continue to grow as demand continues to grow in China and other markets. Given the development of new markets, the company’s wide distribution market, and development into new markets, the company is continuing to offer growth in its income. My estimated available cash flow starts at $23 million for this year, which is somewhat cautious in estimations of operating income versus decreases in capital expenditures.

Risk

Risk is low – medium with China Automotive Systems. The company, in the last five years, has been able to develop definitely itself as a leader in China, but it is in a new industry that has great potential for new competitors. The company, additionally, will need to establish more international presence to continue to dominate as it has thus far in its young life. Further, the company will need to have significant free cash flow and working capital to maintain successful as high volume increases.

Management & Stewardship

The company’s CEO Wu Qizhou has been with the company since its inception as the COO. In the Fall of 2007, Wu took over as the company’s CEO. Wu has a Master’s in automobile engineering, which may lend itself to the fact that the company has developed the EPS system as of late. The company does have a bit of a problem with its board as the Chairman’s brother-in-law is the Senior VP. Too much family on the board lends itself to less capable individuals. The company has very low compensation for its executives.

Entry: We are looking to enter at 18.00 – 18.20.

Exit: We are looking to exit for gains near $28

Stop Loss: None set.

Good Investing,

David Ristau