TWO DECADES OF GREED – THE UNRAVELING

Courtesy of Jim Quinn at The Burning Platform

We are currently in the midst of a Fourth Turning. This twenty year Crisis began during the 2005 – 2008 timeframe with the collapse of the housing bubble and subsequent repercussions on the worldwide financial system. It is progressing as expected, with the financial crisis deepening and leading to tensions across the world. It will eventually morph into military conflict, as all prior Fourth Turnings have. The progression from High to Awakening through the Unraveling took from 1946 until 2006. The most treacherous period of the Saeculm is upon us. The intensity of a Crisis is very much dependent upon how a country and its citizens prepare for the Crisis during the final years of the Unraveling. The last Unraveling period in U.S. history from 1984 through 2005 was symbolized by Boomer greed, materialism, debt and selfishness. When Michael Lewis graduated from Princeton University in 1985 and joined Salomon Brothers, I’m sure he didn’t realize that he would end up book-ending the Unraveling period in his two best-selling books about Wall Street.

In his latest book, The Big Short: Inside the Doomsday Machine, Lewis seems bewildered by the fact that his first book Liar’s Poker, written in 1989, didn’t dissuade college students from pursuing careers on Wall Street. If Lewis had read The Fourth Turning by Strauss & Howe when it was published in 1997, he would have understood why the people on Wall Street couldn’t change. The generations were just acting out their part in a grand never ending cycle. Lewis explains what he thought would happen:

“I stumbled into a job at Salomon Brothers in 1985 and stumbled out much richer three years later, and even though I wrote a book about the experience, the whole thing still strikes me as preposterous—which is one of the reasons the money was so easy to walk away from. I figured the situation was unsustainable. Sooner rather than later, someone was going to identify me, along with a lot of people more or less like me, as a fraud. Sooner rather than later, there would come a Great Reckoning when Wall Street would wake up and hundreds if not thousands of young people like me, who had no business making huge bets with other people’s money, would be expelled from finance.”

Michael Lewis was a 24 year old Generation X Ivy League graduate who ended up on Wall Street at the outset of the Unraveling. He was flabbergasted by how clueless youngsters could pretend to know what they were doing while taking home phenomenal amounts of money. He was sure it would end in short order. But he was wrong. It built to a decadent crescendo two decades later. It took longer than he expected, but the rebellion is beginning now:

“I thought I was writing a period piece about the 1980s in America. Not for a moment did I suspect that the financial 1980s would last two full decades longer or that the difference in degree between Wall Street and ordinary life would swell into a difference in kind. In the two decades since then, I had been waiting for the end of Wall Street. The outrageous bonuses, the slender returns to shareholders, the never-ending scandals, the bursting of the internet bubble, the crisis following the collapse of Long-Term Capital Management: Over and over again, the big Wall Street investment banks would be, in some narrow way, discredited. Yet they just kept on growing, along with the sums of money that they doled out to 26-year-olds to perform tasks of no obvious social utility. The rebellion by American youth against the money culture never happened. Why bother to overturn your parents’ world when you can buy it, slice it up into tranches, and sell off the pieces? At some point, I gave up waiting for the end. There was no scandal or reversal, I assumed, that could sink the system.”

The period from 1984 until 2005 was classified by Strauss & Howe as the Third Turning Culture Wars. They describe this period in the following terms:

“The Unraveling opened with triumphant “Morning in America” individualism, and slowly drifted toward pessimism. Personal confidence remained high, and few national problems demanded immediate action. But the public reflected darkly on growing violence and incivility, widening inequality, pervasive distrust of institutions and leaders, and a debased popular culture. National consensus split into competing “values” camps.”

Deregulation Decade

“The crew of the space shuttle Challenger honored us by the manner in which they lived their lives. We will never forget them, nor the last time we saw them, this morning, as they prepared for their journey and waved goodbye and slipped the surly bonds of earth to touch the face of God.” – Ronald Reagan

The Unraveling began during the 2nd Reagan term with the “Morning in America” feel good landslide re-election campaign. The Dow Jones Average on January 1,1984 was 1,259. The National Debt was $1.6 trillion. The oldest Baby Boomer turned forty-one in 1984, with the youngest just twenty-four years old. This generation of 76 million over-indulged spoiled social activists is the proverbial pig in a python. Whatever path this generation chooses to take transforms the country for better or worse. The term Yuppie was coined in the early 1980’s as the egocentric Boomers poured onto Wall Street beginning their upwardly mobile perfectionist careers. The country was exhausted from the 1960s turmoil and the depressing 1970s. Failed presidencies, oil shortages, raging inflation, and American hostages had left an America that was looking for a renaissance. Ronald Reagan’s first term required extreme measures by Federal Reserve Chairman Paul Volcker to break the back of inflation. By raising interest rates to 18%, Volcker set the stage for a 20 year bull market in stocks and bonds. Reagan survived an assassination attempt, the U.S. military conducted a successful operation in Grenada, Reagan fired 11,000 air traffic controllers, and an unprecedented peace time military buildup was initiated. This created an atmosphere for economic revival, led by the Boomers.

A new laissez faire era heralded by Ronald Reagan was based on his belief that government was the problem, not the solution. His goal was to cut the size of government while slashing taxes and unleashing the animal spirits of the free market. Reagan was a rhetorical genius. It is a shame that his soaring rhetoric did not match what actually ensued. The basis of Reaganomics was:

- Reduce government spending,

- Reduce income and capital gains marginal tax rates,

- Reduce government regulation of the economy,

- Control the money supply to reduce inflation.

Reagan undoubtedly succeeded in radically cutting the top rates on individuals from 70% to 28%. Of course, the only people affected by the top marginal rates are the rich. These tax cuts did not benefit the middle and lower classes. The benefits were supposed to trickle down to these people.

http://www.americanthinker.com/blog/Tax%20Rates%20and%20Revenue.jpg

Corporate tax rates were decreased from 50% to 38% by the end of Reagan’s term. Corporate America was delighted. The tax savings permitted profits to soar. This additional capital could have been used to invest in the business. The Harvard trained CEOs decided it was more beneficial to pay them outrageously high compensation and to buy back their own stock in order to inflate EPS.

http://dontmesswithtaxes.typepad.com/photos/uncategorized/2008/08/22/oecd_vs_us_tax_rates_2.jpg

The tone for the next twenty years had been set. Reagan’s policies did reignite the animal spirits of America. Reagan’s defense buildup increased annual spending from $303 billion in 1980 to $426 billion in 1988, a 40% surge. This most certainly contributed to the collapse of the Soviet Union. They were a hollowed out oak tree and Reagan’s defense buildup was the gust of wind that blew the rotting tree over. His achievements were great, but his failure to reduce government spending will haunt the country for decades and planted the seeds of economic disaster. The Federal Government spent $590 billion in 1980. In 1988, Federal Spending had grown to $1.064 trillion. Rhetoric did not translate into action. Politicians have always been good at following through on promises that buy them votes. The tough stuff can be pushed off to the next guy.

http://en.wikipedia.org/wiki/File:CBO_Revenues_Outlays_Percentage_GDP.svg

The reality is that government debt as a % of GDP was on a downward trajectory for 30 years, bottoming in the late 1970s at 45%. Reagan cut taxes and doubled spending during his eight year reign. This initiated the launch procedure for a US government debt rocket. It sent a message to the world and to its citizens that debt was not a bad thing. Interest rates were in the midst of a quarter century long decline, so the debt became more serviceable as time progressed. There was no reason to save and invest when government and consumers could borrow and buy what they wanted today. This was the attitude that began to emanate during the early 1980s. Total government debt as a % of GDP skyrocketed from 45% to 80% during Reagan’s eight year presidency. The National Debt grew from $908 billion to $2.6 trillion, a 286% increase. The massive increase in debt without apparent negative consequences gave politicians and Baby Boomers the green light to live it up today and not worry about tomorrow.

The 1980’s proved to be a confidence building decade after two decades of tumult. With the most egocentric self centered generation in the history of the world entering the prime of their careers, a double shot of renewed confidence and debt accumulation began a cycle of greed and hubris like none ever seen on earth.

Fragmenting Culture

“I am not a destroyer of companies. I am a liberator of them! The point is, ladies and gentleman, that greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love, knowledge has marked the upward surge of mankind. And greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA” – Michael Douglas as Gordon Gekko

|

|

The self-absorbed yuppies’ goal of wealth, power, and material possessions was captured accurately in the 1987 movie Wall Street and Thomas Wolfe’s fantastic 1987 novel Bonfire of the Vanities. It seems that 1987 marked the high point of the Unraveling period. The Dow Jones Industrial Average had grown from 824 at the beginning of the decade to 2,700 by September 1987. The Boomer heroes of unbridled greed were Michael Milken, Ivan Boesky, Carl Icahn and Boone Pickens. Leveraged buyouts, where corporate raiders used huge amounts of debt to takeover companies, taking them private, firing thousands of workers, spinning it off as an IPO, and reaping enormous profits, were hailed as the savior of free markets by Wall Street. These deals generated gigantic fees for the firms advising on the LBOs. This Boomer led societal mood of wealth accumulation at the cost of gutting corporations and screwing the working class became ingrained in the fabric of America.

More Wall Street “inventions” like program trading, portfolio insurance, and arbitrage combined with hype and hubris to cause a 508 point crash on October 19, 1987. This 22.6% one day drop was the largest percentage decline in history. This once in a lifetime event scared the average investor out of the market for years. This event also unleashed a 20 year reign of banking terror, as the Greenspan Put was born. Alan Greenspan became Federal Reserve Chairman in August 1987. His 1st major act was to pour billions of liquidity into the market after the Crash. This was the 1st of many risk enhancing acts by Greenspan over the next two decades.

http://en.wikipedia.org/wiki/File:Black_Monday_Dow_Jones.svg

Oliver Stone completed his film Wall Street before the crash. He captured the battle between Boomer gluttony and the work ethic of the average American worker. It was essentially a morality play between the slick oily Gordon Gekko and the old union leader looking out for the best interests of his fellow workers. They battle for the soul of Charlie Sheen’s Bud Fox character. The film goes in depth into the immoral culture of Wall Street. Inside trading on non-public information is business as usual. Companies aren’t seen as a productive part of society, but as pawns in a giant game of chess played by the “Big Swinging Dicks” on Wall Street. The workers are seen as liabilities that can be shed in order to boost short-term profits. Maximizing returns as soon as possible was all that mattered to Gekko and real life sharks on Wall Street. The movie’s message was clear. Unrestrained free-market capitalism with no principles is destructive for society. The movie isn’t anti-capitalism. It distinguishes between the cynical, quick buck culture of the Boomers and the moral hard working culture which had built America. Both Oliver Stone and Michael Lewis thought that their works of art would deter young people from vapid careers on Wall Street. Instead, young MBA students saw these stories of greed as an exciting beckoning to riches, morality be damned.

Thomas Wolfe’s novel Bonfire of the Vanities addresses the lack of control anyone has over their lives regardless of their wealth, wisdom or success. He captured the yuppie Boomer excesses of New York City and Wall Street in his brilliant novel. Beneath Wall Street’s veneer of achievement, the New York City was a hot-bed of racial and cultural tension. Homelessness and crime in the city were soaring. Several high-profile racial incidents polarized the city, particularly two black men who were murdered in white neighborhoods. Bernie Goetz became a folk-hero in the city for shooting a group of black punks who tried to rob him in the subway. The chasm between the haves and have-nots had grown immense. In Wolfe’s New York, venal self-interest motivates everyone but the suckers, while ethnic and racial bigotry is extreme. Men use women for little other than sexual gratification, and women use men almost entirely for monetary or social gain.

Those in power fail to represent the disinterested abstractions (justice, civil rights, truth) that they ostensibly represent. The manipulation of truth and justice by the news media, show Wolfe’s cynical view of these flawed apparatuses of human society. Tom Wolfe ruthlessly exposes the superficiality of 1980s culture. Wolfe directs his most serious criticism to the very rich, with their extravagant dinner parties, 6-block hired-car rides which cost $250, and thousand-dollar flower arrangements. Hypocrisy is rife in this novel, and most evident in the two leaders depicted on opposing sides, Reverend Bacon and the Mayor of New York. Neither of these men is truly concerned with the people of New York, but rather with their own advancement and profit. Each, in his way, is racist, but decries racism at every turn. Each purports to be “of the people” but uses his position of power for monetary gain. Wolfe captured the worst traits of America during the early years of the Unraveling.

The 1980’s proceeded as expected with strengthening individualism and weakening institutions. The GI Generation Heroes began to depart from the scene. This steady, cautious, risk adverse generation that built American industry and finance were being pushed into retirement by the Baby Boomer Generation. The old civic order was cast aside and the cultural revolutionaries stormed the gates. Baby Boomers seized control of Wall Street, having never experienced a bear market, never faced adversity, and never having to care about anyone but themselves. A brooding sense of pessimism began to creep into the mood of the country. Fiduciary responsibility towards your clients and proper risk management was considered old school. Maximizing profits, generating fees, and getting rich was the mantra of the new Wall Street generation. As the Boomers grew rich and cynical on the street of dreams, moralistic charlatan frauds like Jesse Jackson and Al Sharpton exacted their share of profits for themselves and their constituents. The working middle class sunk deeper into despair as their wages continued a two decade long stagnation. Real hourly earnings were the same in 2005 as they were in 1984, and 10% below the level of 1972.

The trickle down crowd, mostly Republicans, contended that a rising tide lifts all boats. In theory that sounds great. In practice, it has proven to be a lie. During the 1980s and 1990s, all boundaries regarding compensation were obliterated by the “Me Generation”. Executive pay packages began to skyrocket as they were viewed as rock stars and masters of the universe. The ratio of CEO’s pay to the average worker’s pay leaped from 30 to 1 in 1980 to 250 to 1 by 2005. If CEOs had performed phenomenally over this time period, a case could be made for this leap. But, corporate America and certainly Wall Street had brought the US economy to the brink of disaster by 2005. This outrageous pay disparity contributed to the deepening anger in the country simmering below the surface.

http://www.cbpp.org/images/cms/4-17-09inc-f1.jpg

Strauss & Howe aptly described the mood:

“Personal confidence remains high, and few national problems demand immediate action. But the public reflects darkly on growing violence and incivility, widening inequality, pervasive distrust of institutions and leaders, and a debased popular culture. People fear that the national consensus is splitting into competing “values” camps.”

Cynical Alienation

“Now, I have to go back to work on my State of the Union speech. And I worked on it until pretty late last night. But I want to say one thing to the American people. I want you to listen to me. I’m going to say this again: I did not have sexual relations with that woman, Miss Lewinsky. I never told anybody to lie, not a single time; never. These allegations are false. And I need to go back to work for the American people.” –President Bill Clinton, January 26, 1998

“The great story here for anybody willing to find it, write about it and explain it is this vast right-wing conspiracy that has been conspiring against my husband since the day he announced for president.” – First Lady Hillary Clinton, January 27, 1998

The appearance of progress on some issues overshadowed the underlying deterioration of societal institutions and practices. Social Security was “saved” by Alan Greenspan and his commission. Essentially he manipulated the CPI calculation downward, screwing future generations of seniors out of their rightful payouts. Politically difficult decisions regarding Medicare and Medicaid were deferred to sometime in the distant future. With oil prices averaging $20 per barrel through the 1980s and 1990s, a coherent long-term energy strategy seemed unnecessary to the next election cycle politicians who control this country. The deregulation of the Savings & Loan Industry gave them many of the capabilities of banks, without the same regulations as banks. Imprudent real estate lending, fraud and insider transactions by S&L executives, protected by high powered Washington politicians, led to the first financial crisis. The failure of 747 thrifts and losses of $160 billion to the taxpayer can be attributed to lax oversight and fraud.

The Berlin Wall fell as communism collapsed under the weight of central planning, corruption, and fraud. Academics like Francis Fukuyama foolishly declared “The End of History”. According to Fukuyama, Democracy had won over all other forms of government:

“What we may be witnessing is not just the end of the Cold War, or the passing of a particular period of post-war history, but the end of history as such: that is, the end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government.”

Only a Harvard academic could spout such claptrap. By 1991, the U.S. was again at war. The 1st Gulf War was considered a moral war as the U.S. came to the rescue of Kuwait and Saudi Arabia. Using traditional military maneuvers, General Schwarzkopf obliterated Sadaam Hussein’s Republican Guard. But, there was no consensus to follow through and eliminate Hussein. Unwittingly, we planted the seeds for the bleak later stages of the Unraveling by leaving military bases in Saudi Arabia. There were not many more feel good national experiences after the 1st Gulf War. A recession in 1991 (remember George Bush Sr. buying 4 pairs of socks at JC Penney to exhort Americans to shop America out of recession) caused by the S&L Crisis allowed an obscure Arkansas Governor to win the Presidency. The election of Bill Clinton ushered in the culture wars of the 1990s. The conservative religious right fought scorched earth battles with the liberal left wing elite who control the media. Pat Buchanan captured the animosity of this conflict:

“There is a religious war going on in our country for the soul of America. It is a cultural war, as critical to the kind of nation we will one day be as was the Cold War itself. Who is in your face here? Who started this? Who is on the offensive? Who is pushing the envelope? The answer is obvious. A radical Left aided by a cultural elite that detests Christianity and finds Christian moral tenets reactionary and repressive is hell-bent on pushing its amoral values and imposing its ideology on our nation. The un-wisdom of what the Hollywood and the Left are about should be transparent to all.”

As ideologues fought wars over morality, religion, and abortion, unbridled corporate fascism and individual greed ran rampant. The unholy alliance between mega banks, mega-corporations, the Federal Reserve and Washington DC led to a widening chasm between the haves and have-nots. The 1990s were rooted in three poisons: anger, greed, and delusion. The Presidency of Bill Clinton was marked by a strong economy, political gridlock, declining moral values and relatively minor military skirmishes. Society glorified individuals, their wealth, power and lifestyles. The TV show Lifestyles of the Rich and Famous,hosted by Robin Leach, ran from 1984 until 1995. The show featured the extravagant lifestyles of wealthy entertainers, athletes and business moguls. Glorification of the rich and their profligate lifestyles, spurred the superficial self-centered Boomer generation to idolize and emulate this lifestyle. There was one big problem with emulating this lifestyle. The Boomers didn’t have the money to live this lifestyle. Wall Street stepped in to supply the fuel for the two decades of decadence. Household debt grew from $2 trillion in 1984 to $14 trillion in the mid 2000s.

http://www.swifteconomics.com/wp-content/uploads/2009/06/Debt.png

The United States has experienced a three decade long “expenditure cascade”. An expenditure cascade occurs when the rapid income growth of top earners fuels additional spending by the lower earners. The cascade begins among top earners, which encourages the middle class to spend more which, in turn, encourages the lower class to spend more. Ultimately, these expenditure cascades reduce the amount that each family saves, as there is less money available to save due to extra spending. Expenditure cascades are triggered by consumption. The consumption of the wealthy triggers increased spending in the class directly below them and the chain continues down to the bottom. This is a dangerous reaction for those at the bottom who have little disposable income originally and even less after they attempt to keep up with others spending habits. The personal savings rate was 12% in the early 1980s and declined to negative 1% by 2005. The expenditure cascade couldn’t have occurred without easy access to debt. The question that must be asked is, who benefits from debt and who pays?

http://wallstreetpit.com/wp-content/uploads/2010/01/image016.png

The delusion of the American populace cannot be underestimated. Their worshipping at the altar of materialism and adoration of Hollywood created pop culture was crucial to the societal delusion. Without the corporate consumerism marketing machine, an unlimited amount of credit provided by bankers, and ultra-low interest rates supplied by the Federal Reserve, the delusions of grandeur could not have been realized. Credit cards didn’t even exist until 1968. Until the 1990s mortgage lenders followed the 28/36 rule. Your mortgage payment, including taxes and insurance, couldn’t exceed 28% of your monthly gross income. All of your debt payments couldn’t exceed 36% of your monthly gross income. Homebuyers rarely put down less than 10% of the home’s value. Home equity loans were virtually non-existent. The subprime loan market for homes and automobiles was miniscule. In the early 1980s auto loans averaged 45 months and buyers put 12% down on the purchase. By the mid 2000s auto loans averaged 64 months with only 5% down on the purchase. By 1999, 40% of all cars on the highway were leased. The proliferation of easy credit allowed average people to live a life of excessive opulence, occupying 7,000 sq ft McMansions, driving BMWs, and wearing Rolex watches. Americans bought so much stuff on credit they couldn’t fit it all in their oversized abodes. So they needed to rent outside storage for their stuff. In 1984 there were 6,601 facilities with 290 million square feet of rentable self storage in the U.S. In 2009, there were 46,000 self storage facilities with 2.21 billion square feet, a 762% increase.

http://www.marketoracle.co.uk/images/2009/May/uk-housing-size.gif

The delusional middle and lower class Boomers believed they were equal to the top 1% of ultra-wealthy, because they were living like them. As Orwell noted, “all animals are created equal but some animals are more equal than others”. Those that were “more equal” worked on Wall Street. The repeal of the Glass-Steagall act in 1999 with overwhelming majorities in both Houses of Congress and cheered on by Wall Street groomed Secretary of the Treasury Robert Rubin, opened Pandora’s Box. Bank holding companies started dealing in mortgage-backed securities, credit default swaps, and structured investment vehicles. A blizzard of products solely designed to generate fees while ignoring the banks’ fiduciary duty to their clients was unleashed. Subprime mortgages surged from 5% of all mortgages to 30% by 2008, as issuing the mortgage became detached from the risk of the mortgage. The issuer of the loan had no risk, since the mortgages were immediately bundled and sold off to investors (suckers). No doc, Alt-A, and Option ARM mortgages proliferated as fraud ran rampant on Wall Street and throughout the financial services industry. The Federal Reserve, led by Alan Greenspan, aided and abetted the delusional debt bubble through its non-existent regulation of the banks and mortgage brokers, and unnecessarily keeping interest rates extraordinarily low from 2001 through 2005.

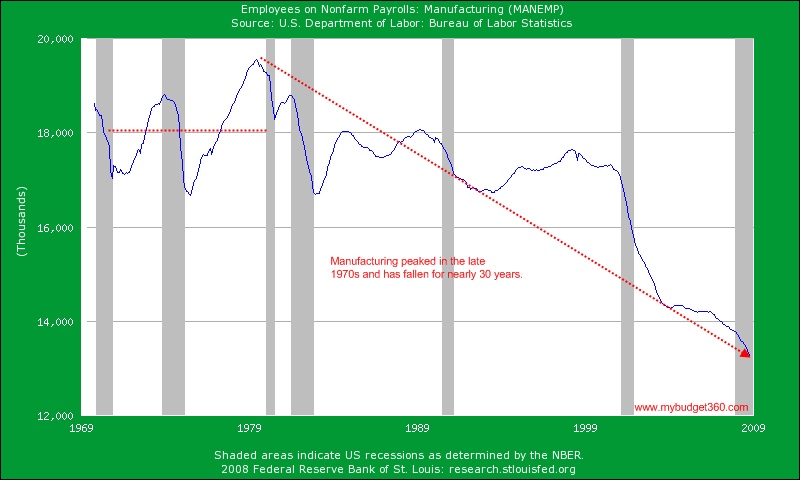

As the average American middle class worker fell further behind, without realizing it, the financial sector grew ever more powerful and malevolent. A country that had once produced its way to world domination degenerated into a paper kingdom run by Harvard MBAs, lawyers, tax accountants and central bankers. They “create” pieces of paper with terms that no one understands, packages worthless pieces of debt obligations and sell it to other clueless financial experts, borrow 40 times their capital and gambles it based on models that told them they couldn’t lose, and rewards themselves with obscene pay packages and bonuses.

|

http://my.caseyresearch.com/displayTcr.php?id=21#cc1

The “creativity” of Wall Street was complimented by corporate America instituting “free trade” and “globalization” policies (NAFTA) supported by politicians in Washington DC. The terms free trade and globalization were code for corporate CEOs shipping US manufacturing jobs to China, India, and Vietnam, while expanding their corporate earnings per share 3 cents above analyst expectations per quarter. As reward for gutting American industry, the CEOs demanded their Board of Director toadies give them stock options for 1 million shares and $10 million raises. Does it require a Harvard degree and ingenious brilliance to fire 100,000 American workers making $20 per hour and build a plant in China paying peasants $1 per hour and depending on cheap oil to inexpensively ship the goods back to America? Only one problem, people without jobs have trouble buying stuff. Without middle class jobs, corporate CEOs turned to their Harvard buddies on Wall Street to create $1.2 quadrillion of financial derivatives to convince the middle class they really had wealth to spend on cheap Chinese goods. This corporate/banking collusion was fully supported by their paid for representatives in Washington DC. This unholy alliance between big business and big government enriched the ruling elite, while impoverishing the middle class.

Once In A Lifetime

“Indeed, recent research within the Federal Reserve suggests that many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade, though this would not have been the case, of course, had interest rates trended sharply upward.” – Alan Greenspan, February 2004

“Even though some down payments are borrowed, it would take a large, and historically most unusual, fall in home prices to wipe out a significant part of home equity. Many of those who purchased their residence more than a year ago have equity buffers in their homes adequate to withstand any price decline other than a very deep one.” – Alan Greenspan, October 2004

“Improvements in lending practices driven by information technology have enabled lenders to reach out to households with previously unrecognized borrowing capacities.” – Alan Greenspan, October 2004

“The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions …. Derivatives have permitted the unbundling of financial risks.” – Alan Greenspan, May 2005

You may find yourself living in a shotgun shack

You may find yourself in another part of the world

You may find yourself behind the wheel of a large automobile

You may find yourself in a beautiful house, with a beautiful wife

You may ask yourself: well… how did I get here?

Letting the days go by/let the water hold me down

Letting the days go by/water flowing underground

Into the blue again/after the money’s gone

Once in a lifetime/water flowing underground

You may ask yourself

How do I work this?

You may ask yourself

Where is that large automobile?

You may tell yourself

This is not my beautiful house!

You may tell yourself

This is not my beautiful wife!

You may ask yourself

What is that beautiful house?

You may ask yourself

Where does that highway lead to?

You may ask yourself

Am I right?… Am I wrong?

You may say to yourself

My God!… what have I done?

The Talking Heads – Once in a Lifetime

David Byrne’s lyrics are reflective of how Americans have operated in a largely unconscious state for the last twenty years, operating on debt-oriented auto-pilot, and waking up from their materialistic stupor asking, “How did I get here?” We have taken the acquisition of material belongings so seriously that it became what we worked for. Material possessions defined who we are. When we lose these possessions we no longer have the identity that we have blindly created by collecting “things”. My God, what have we done? Charles Mackay in his book Extraordinary Popular Delusions and the Madness of Crowds , written in 1841, captures the essence of what has happened in the US:

“Money, again, has often been a cause of the delusion of the multitudes. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper.”

The nation had an opportunity to come to our senses with the election of George Bush in 2000. The gravity of the coming Saecular Winter could have been moderated through prudent actions taken on the fiscal, political, and defense fronts. The autumnal Unraveling is a time of foreboding and a brooding pessimism. As a howling wind begins to blow, leaves turn brown and wither, determined squirrels scurry around collecting acorns in preparation for the bitter snowy Winter ahead. The opportunity to judiciously prepare was wasted after the September 11, 2001 terrorist attack on America. The colossal overreaction to an attack by a terrorist organization consisting of a few thousand members, ensured that the coming Winter will be harsh, deadly, and more bitter than any ever experienced in U.S. history. Prudence, caution, intelligence, and sound judgment were required. Recklessness, haste, stupidity, and hubris were employed. The result was that the Crisis that arrived in 2005-2008 will be more painful and possibly fatal for the United States. The multiple wars of choice, immense housing bubble, stunning government deficits and unaddressed unfunded liabilities have created a nation weakened and unprepared for the harsh reality ahead. The Empire of Debt has reached epic proportions.

http://www.profitscore.com/articles/prof_TCMD-Mar10.jpg

The recklessness of our lack of preparation is reflected in the following facts:

- Total US credit market debt increased from 275% of GDP in 2000 to 365% of GDP in 2009.

- The National Debt increased from $5.7 trillion in 2000 to $13 trillion today. It is projected to reach $20 billion by 2015.

- Consumer debt has increased from $1.5 trillion in 2000 to $2.4 trillion today.

- The U.S. has spent $1 trillion since 2003 on wars of choice in Iraq and Afghanistan.

- Annual defense spending has risen from $359 billion in 2000 to $896 billion in 2010.

- Unfunded liabilities for Social Security, Medicare, and Medicaid total $106 trillion.

- There are 7 million less Americans employed today than there were in 2007.

- In 2008, Wall Street lost $42.6 billion and required middle class taxpayers to bail them out. Total compensation on Wall Street in 2009 totaled $55 billion, three times the previous high.

Michael Lewis was befuddled that his tale of greed, hubris and recklessness, written in 1987, did not deter college graduates from heading to Wall Street. It took two more decades, but the Wall Street money culture is in the process of being discredited. Americans are slowly coming to the realization that unbridled greed is not the same as capitalism. Excessively low interest rates punish savers and senior citizens, while benefitting borrowers, risk takers and Wall Street. Savings leads to investment, while borrowing leads to impoverishment. The actions taken thus far by politicians, government bureaucrats, and the Federal Reserve are the exact opposite of what was required. The next leg down in this Greater Depression will thoroughly discredit those who have promoted a money culture over those virtues that will benefit society in the long run. The current Crisis will require personal sacrifice, renewed community spirit, public consensus, and truth. Failure could prove fatal for our nation. The best of human nature must win out over greed, ignorance, and love of power. Our future hangs in the balance.

“It has always seemed strange to me… the things we admire in men, kindness and generosity, openness, honesty, understanding and feeling, are the concomitants of failure in our system. And those traits we detest, sharpness, greed, acquisitiveness, meanness, egotism and self-interest, are the traits of success. And while men admire the quality of the first they love the produce of the second.” – John Steinbeck