Yesterday, we opened three new positions. The last opened position was in a Long Term Investment in China Automotive Systems Inc. (CAAS). I have a fair value estimation in CAAS at over $28 based on a DCF and company analysis, but the stock is trading at under $20. We entered at 18.30 yesterday, since it did not dip into the range I had set. With these long term investments, it is important just to get shares rather than worry about a 0.5% here or there. We also got into our Weekly Play with Winnebago Industries (WGO). We opened out position at 11.25 and are looking for 4-6% for the week. Finally, our Buy Pick of the Day in Aviat Networks (AVNW) worked for a 2.75% gain. We got involved at 3.96 and sold minutes later at 4.06. It was a quick trade, but it worked very well.

Yesterday, we opened three new positions. The last opened position was in a Long Term Investment in China Automotive Systems Inc. (CAAS). I have a fair value estimation in CAAS at over $28 based on a DCF and company analysis, but the stock is trading at under $20. We entered at 18.30 yesterday, since it did not dip into the range I had set. With these long term investments, it is important just to get shares rather than worry about a 0.5% here or there. We also got into our Weekly Play with Winnebago Industries (WGO). We opened out position at 11.25 and are looking for 4-6% for the week. Finally, our Buy Pick of the Day in Aviat Networks (AVNW) worked for a 2.75% gain. We got involved at 3.96 and sold minutes later at 4.06. It was a quick trade, but it worked very well.

Today, the market is set to open higher, but I am worrisome about its ability to maintain gains. I am looking for a short sale…

Since we are going healthcare, I thought this image appeared approriate.

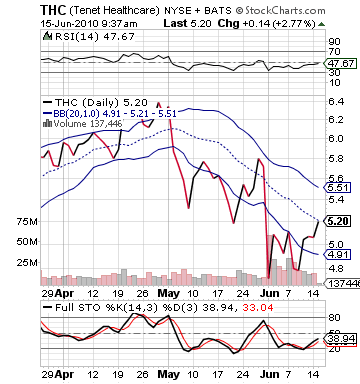

Short Sale of the Day: Tenet Healthcare Corp. (THC)

Analysis: While futures are pointing up today, this is one of those days where I think that futures are pointing upwards as aftershock from a strong run when the fundamentals are not there. This morning we got some poor news from Best Buy on earnings as they reported that they had to cut gains and missed expectations reporting a 0.36 EPS vs. the expected 0.50. Then, this morning, I noticed that there were twice as many downgrades as upgrades. With pretty good fundmentals for most stocks, it looks like some stocks have moved a bit too high for their fair valuations. The major economic data point of the morning was the NY Empire State Manufacturing Index, which came in lower than expected at 19.60 vs. the 20.00 analysts had estimated.

The good news was not there this morning, and I am not bullish moving into the day. That is why we are looking for an overvalued stock that would be a solid short sale. One company that has moved much too high on an upgrade it got this morning from Stifel Nicholaus is Tenet Healthcare Corp. (THC) along with an after hours company upgrade on future earnings.

Stifel Nicholaus analyst commented, "Shares fell to $3.90 and rebounded once bankruptcy rumors were refuted. The shares remain very risky, but using several valuation metrics, we believe the shares should remain in the $3.75-$4.75 range near term. We place fair value at $4.75, which is roughly 7.1x our 2009 EBITDA estimate of $896 million."

remain very risky, but using several valuation metrics, we believe the shares should remain in the $3.75-$4.75 range near term. We place fair value at $4.75, which is roughly 7.1x our 2009 EBITDA estimate of $896 million."

The upgrade from SN, therefore, actually puts the current price as an overvaluation since the stock is trading near 5.30 in pre-market trading. The earnings upgrade from THC saw that EBITDA should rise $50 million from its early view to $1.1 billion for 2010, and it raised its quarterly EPS estimates from 0.17 – 0.31 to 0.27 – 0.40 (a pretty large range might I add) for the year. The current estimate from analysts on Yahoo! Finance had an average at 0.29, so the estimates from the company already appeared pretty low. The top line at 0.40, though, is a strong improvement, which is why the stock jumped so much in pre-marekt.

The stock has seen a nice 8% gain over the past few days, and its upper band shows that it has not too much more room to grow past 5.40. The stock was trading at close to 5.30 in pre-market. The company has been looking for takeovers and has made comments on possible bankruptcy. This is a company that has lost a lot of its long term investors, and short term traders are going to take quick profits and get out. Therefore, I expect this one to drop…

Entry: We are looking to short THC at 5.30 – 5.40

Exit: We are looking to exit for a 2-3% gain.

Good Investing,

David Ristau