The market has been having a great run over the past week, and we have been able to make a lot of great trades along with the movement. Today, however, the market appears ready to decline heading into a number of important economic announcements. Yesterday, our Short Sale of the Day did not work out to any avail. We missed our entry range by two cents in the morning in Tenet Healthcare Corp. (THC). The company dropped 5% intraday but our levels were just a bit too high. Our open position comes from Winnebago Industries (WGO), which is our Play of the Week. WGO has lost some ground since our entry at 11.25, but I am hoping for a big day from the company since they report tomorrow morning.

Let’s get started with two plays for today…

Buy Pick of the Day: Direxion Daily Real Estate Bear ETF (DRV)

Analysis: It appears that the answer to the title will be most likely not. We got some very poor news out of the housing market that is telling us what everyone was expecting and worse. Housing starts dropped 12% from last month and .png) building permits dropped 6% after the housing tax credit expired in the month of April. May results were down from April. Further, it was worse than was expected as both hosing starts and permits came in below analyst expectations. The news quickly has driven futures down even further this morning. Core Producer Price Index stayed the same from last month, and most of the focus will be, therefore, on the housing data. Additionally, this morning FedEx reported weak 2010 FY outlook along with unexciting earnings, and the market looks ready to take some profits after a strong three out of four day run-up.

building permits dropped 6% after the housing tax credit expired in the month of April. May results were down from April. Further, it was worse than was expected as both hosing starts and permits came in below analyst expectations. The news quickly has driven futures down even further this morning. Core Producer Price Index stayed the same from last month, and most of the focus will be, therefore, on the housing data. Additionally, this morning FedEx reported weak 2010 FY outlook along with unexciting earnings, and the market looks ready to take some profits after a strong three out of four day run-up.

Therefore, we want to look towards an inverse housing ETF for our play of the day. Direxion Daily Real Estate Bear ETF (DRV) follows real estate REITs, but it is highly affected by housing starts and building permit news because most people associate it with the housing market. REITs will be weak if building permits are down because that means they are not building new properties. DRV has taken quite a stumble over the past week and a half, dropping over 25% in value. DRV has moved below its lower bollinger band, and it is heavily oversold on fast stochastics. The news, today, could propel this highly volatile stock much higher as the market sells off.

DRV is up pretty heavily at 3% this morning, but considering the drop it has had in seven trading sessions, this sort of reactionary gain seems normal. The question will be is will the market drop from the open. The answer is definitely not for sure yes, but it is hard to imagine it gaining any ground. Most stocks have taken lots of gains, and profit taking should be on the agenda.

Industrial production at 9:15 AM and crude inventories will be important to continue a bearish line today, but DRV looks very solid to make some gains out of the gate. We want to buy right out of the open. I have set a range I think it can open in, but if it opens lower definitely buy. Much higher than the upper part of the range, and we have a no play.

Entry: We are looking to get involved at 6.15 – 6.30.

Exit:: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom of entry.

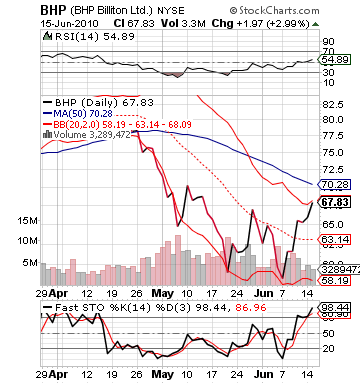

Short Sale of the Day: BHP Billiton Ltd. (BHP)

Analysis: BHP Billiton may be on its way down this morning after receiving a downgrade from JP Morgan from neutral to under perform. The company has popped 20% over the past week and a half, moving to the top of its bollinger band and becoming heavily overbought. With the market looming down and the downgrade from JP Morgan, one would expect some large selling in pre-market and to open the day like other downgraded companies. Yet, BHP is down just over 1%, similar to the market. This should not last and represents a company with low value for the day and too little movement.

similar to the market. This should not last and represents a company with low value for the day and too little movement.

BHP was downgraded according to Marketwatch by JP Morgan because:

"the firm’s valuation (is) premium to peers and (has a) lack of operational and financial leverage to any one commodity. It also reflects the broker’s belief in a continuation of a bounceback for higher-beta stocks."

JP Morgan believes that BHP has made its move for 20%, holds high beta, and is time to snap back because the fundamentals are not there to sustain such prices over the long term. The company should not be as high as it is in pre-market. Part of the reason the company has been able to sustain gains is because it was up in London 0.6% as commodities were the leading sector in London this morning. The downgrade from JPM came, however, and the stock has dropped ever since.

As the market loses value this morning, BHP presents a perfect short selling opportunity for us to take advantage of that has not had the proper movement.

Entry: We are looking to short BHP starting at 66.45 – 66.65.

Exit: We are looking to cover for a 2-3% gain.

Stop Buy: 3% on top.

Good Investing,

David Ristau