Our Play of the Week worked out brilliantly for us. We got involved on Monday in Winnebago Industries Inc. (WGO) liking a number of financial fundamentals and chances for an earnings beat. The company looked to be a strong play over the week, but it played pretty flat all week as we continued to hold. My entry was at 11.25. The company reported earnings of 0.21 per share while estimates were consensus at 0.03. It was a gigantic 600% earnings beat. I am going to sell half at the open and wait and see what happens for another half to get a hedged final price. Since the market is looking upwards, I think we can get a couple or few more percentages, but I am looking at selling at the open around 12.70 – 12.80 currently (that could go up or down). That would be an increase of about 12%.

Our Play of the Week worked out brilliantly for us. We got involved on Monday in Winnebago Industries Inc. (WGO) liking a number of financial fundamentals and chances for an earnings beat. The company looked to be a strong play over the week, but it played pretty flat all week as we continued to hold. My entry was at 11.25. The company reported earnings of 0.21 per share while estimates were consensus at 0.03. It was a gigantic 600% earnings beat. I am going to sell half at the open and wait and see what happens for another half to get a hedged final price. Since the market is looking upwards, I think we can get a couple or few more percentages, but I am looking at selling at the open around 12.70 – 12.80 currently (that could go up or down). That would be an increase of about 12%.

Yesterday, we got involved in two positions for day trades. The first was Direxion Daily Real Estate ETF (DRV). This ETF worked out for a nice gain for us as we got in at 6.10 and exited at 6.22 for a solid 2%. Our Short Sale of the Day was in agricultural company BHP Hillition Ltd. (BHP). We decided to hold BHP after we got very little movement in it yesterday in either direction after the company saw a severe downgrade from JP Morgan to "Underperform." I opened my position at 67.25, and I am a bit underwater currently about 1%. This one is definitely getting very toppy though.

The chart on the left is pretty funny as it shows that the only thing that we want to cut is foreign aid, which is one of the smallest parts of the American deficit.

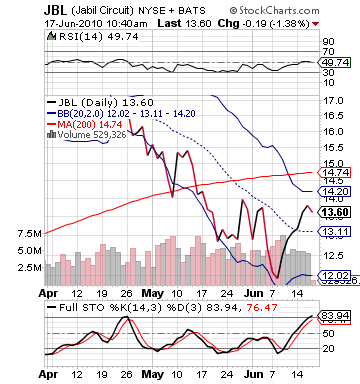

Midterm Buy Pick: Jabil Circuit Inc. (JBL)

Analysis: Jabil is going to work somewhat like my Play of the Weeks normally work, but it will be a Play of the Week from the end of one week towards the beginning/middle of the next. When I do my Plays of the Week, anything reportingin the first two and a half days is out, so we lose a lot of companies. These positions have been pretty successful, so I am wanting to continue the tradition.

Jabil Circuits makes circuit boards and other electronic manufacturing devices in many fields, such as aerospace, automotive, defense, medical, and more. The company is based in St. Petersburg, Floria and will be releasing earnings on Tuesday evening. They are projected to report earnings per share of 0.34, which will be a 750% improvement from one year ago in EPS. The EPS will also be an improvement month-over-month, and it will be the company’s top EPS (if hit or better) since 2006-2007.

The only problem with JBL is that the company has had some strong movement over the past two weeks with the bullish market run. The company has improved 15% since the beginning of last week. Therefore, in the short term, it has become overbought and is nearing its upper bollinger band. There is still room to the upside, but it is only a few percentages. Therefore, I have put my position to open at a lower entry price than JBL is currently trading. We can only get involved if JBL moves down to the prices that I have set, and it should move down there between today and tomorrow.

The company, first off, is going to be turning a profit from one year ago. It is always a huge hit with investors when a company can move from a quarterly loss to gain year-over-year. They buy into that headline, and JBL will definitely be able to provide a major gain like that. The entire electronics sector has been able to see a great improvement in 2010 as companies have begun to look at new technologies and install new electronics to get back up to speed with the times. Especially since free cash flow has become available for a lot of companies as they cut costs, jobs, and supplies.

One of the things I always like to see is whether a company is on its way up and analysts are upgrading the company or is getting downgraded, and people do not believe in it in the long term. JBL got a great upgrade from the S&P at the end of the May to a "Buy" rating based on the fact that the sector was seeing a lot of good news and reports and JBL was undervalued.  In the quarter, which was March through May, Jabil started up outsourcing Nokia production of cellular telephones as the company is expecting 10% growth in their handset sales this year and a deal with iRobot to help produce the Roomba vacuum. Both are great signs, as well, for more future growth and good forecasting.

In the quarter, which was March through May, Jabil started up outsourcing Nokia production of cellular telephones as the company is expecting 10% growth in their handset sales this year and a deal with iRobot to help produce the Roomba vacuum. Both are great signs, as well, for more future growth and good forecasting.

Last quarter, the company was hit with a solid 10% loss despite beating earnings because of a concern over costs rising for the company with the increase in demand, but I would not be too concerned about this as the company has had ample free cash flow since 2007. I think the rise in demand will neutralize any rise in working capital. The rest of the industry has shown that continued growth. Since JBL reported earnings in March, all eight of the other companies in the printed circuit board industry reported earnings beats. Close competitor Flextronics and Sanmina-SCI both reported solid earnings in the prior quarter, and things look to be very good for them moving forward.

The company has seen a number of new deals being brokered throughout this year, and it is expecting a rise of revenue up to 10% sequentially from Q2 to Q3. The company has its revenue estimates at $310 – $330 billion, and current EPS projections are at $320 billion. If the company can beat that then they will blow the EPS estimates out of the water. I think the stock, if it can get some dip, will definitely have some potential going into next week. The industry is looking strong, and JBL is looking for one of its best quarters in years.

Entry: We are looking to open our position at 13.50 – 13.60.

Exit: We are looking to gain 4-6% through Tuesday. If not reached, then we are looking to exit JBL on Wednesday’s open

Stop Loss: 4% on bottom of entry.

Good Investing,

David Ristau