Good Monday to all. Hope everyone had a great weekend. As Monday tradition would have it, we are going to look at a weekly position for a stock that I think has potential to move up all week long. Last week, our long term position in Winnebago Industries (WGO) was worth 13% for us. This week we are hoping to find another diamond in the rough. Our only other open position from last week was JBL. We entered at 13.56, and we were looking to exit at 14.10 – 14.37. The stock is in that range this morning, and we are looking to exit today. Additionally, we opened a position in Nordstrom Inc. (JWN) at 38.61 for our Long Term Investment Virtual Portfolio on Friday.

Good Monday to all. Hope everyone had a great weekend. As Monday tradition would have it, we are going to look at a weekly position for a stock that I think has potential to move up all week long. Last week, our long term position in Winnebago Industries (WGO) was worth 13% for us. This week we are hoping to find another diamond in the rough. Our only other open position from last week was JBL. We entered at 13.56, and we were looking to exit at 14.10 – 14.37. The stock is in that range this morning, and we are looking to exit today. Additionally, we opened a position in Nordstrom Inc. (JWN) at 38.61 for our Long Term Investment Virtual Portfolio on Friday.

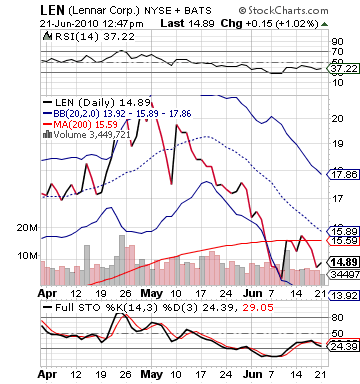

Play of the Week: Lennar Corp. (LEN)

Analysis: Residential construction is obviously not one of the most vibrant industries out there, and it is full of lots of risk. One thing is for sure, though, is that residential construction had its best three months since 2007 in the March – May 2010 run (as can be seen on the graph above). The reason for the return to buying new homes and existing homes – the homebuyer tax credit. The credit has worn off, but the results for companies like Lennar, KB Homes (KBH), and other are still to be seen. Some companies have shown how the vibrant January – March helped, such as Hovnanian’s (HOB) 500% profits beat. Lennar Corp.’s (LEN) Q2 2010 runs March – May, and it was a great time for the company. The company will report profits on Wednesday evening, and I am expecting big things. They are projected to report a 0.00 profit per share with top line estimates reaching 0.18 per share.

The first reason I am excited by LEN is that the company may be turning a loss of 0.76 EPS from one year ago into profits this quarter. It would also be a sequential loss to profit for the company. Those two indicators could send this stock skyrocketing. The company has been underestimated in both Q1 2010 and Q4 2009 when the taxbuyer credit has been in full swing, showing profit beats of 87% and 147%, respectively. The entire sector has had a great start to the year. Lennar’s close competitors, DR Horton (DHI) and Pulte Homes (PHM), both reported their last earnings for January – March and saw earnings beats of 500% and 86%, respectively. In fact, since the beginning of May five out of seven residential construction companies have beat estimates. The two that missed were Toll Brothers (TOL), a luxury homebuilder not impacted by the first time credit and a Brazilian homebuilder (GFA).

showing profit beats of 87% and 147%, respectively. The entire sector has had a great start to the year. Lennar’s close competitors, DR Horton (DHI) and Pulte Homes (PHM), both reported their last earnings for January – March and saw earnings beats of 500% and 86%, respectively. In fact, since the beginning of May five out of seven residential construction companies have beat estimates. The two that missed were Toll Brothers (TOL), a luxury homebuilder not impacted by the first time credit and a Brazilian homebuilder (GFA).

The new home sales for the sector came close to March – May 2003. In that time, there were nearly 300,000 new homes sold. In March – May of 2010, there were 240,000 new homes sold. It is about 1/5 less. In March – May 2003, Lennar made $2.1 billion of revenue and made $160 million in profit. Revenue estimates for the coming quarter are only at $835 million. Those numbers don’t match. I see a discrepancy and undervaluation in estimates. Last quarter, the company outpaced its new home orders by 18% and saw cancellations decline. The coming quarter should show more of the same. At the end of the February, the company had more than $500  million in revenue on backlog.

million in revenue on backlog.

Further, we see housing starts up 8% in the month of May from one year ago. Companies with money to spend are able to start increasing their supply, especially with cheap land aplenty. Lennar, despite the troubles with the industry, has been able to maintain a lot of free cash flow, which will be very helpful for the company moving forward. I think a great earnings is expected, and it will help the company even more if they can deliver some great future ideas.

I am bullish on this stock for the week. Technically, the company is in the pits as residential homebuilders have not gotten much of the bull run. I think this week will be a nice one for LEN, and the company should see some great movement moving into and out of earnings.

Good luck!

Entry: We are looking to buy between 14.80 – 14.95.

Exit: We are looking to exit on a 4-6% gain.

Stop Loss: 5% on bottom.

Good Investing,

David Ristau