Getting a Grip on Reality – Reflation Dead in the Water

Courtesy of Mish

Economist Dave Rosenberg warns investors to Get a Grip on Reality.

Economist Dave Rosenberg warns investors to Get a Grip on Reality.

Double-dip risks in the U.S. have risen substantially in the past two months. While the “back end” of the economy is still performing well, as we saw in the May industrial production report, this lags the cycle. The “front end” leads the cycle and by that we mean the key guts of final sales — the consumer and housing.

We have already endured two soft retail sales reports in a row and now the weekly chain-store data for June are pointing to sub-par activity. The housing sector is going back into the tank – there is no question about it. Bank credit is back in freefall. The recovery in consumer sentiment leaves it at levels that in the past were consistent with outright recessions. Last year’s improvement in initial jobless claims not only stalled out completely, but at over 470k is consistent with stagnant to negative jobs growth. And exports, which had been a lynchpin in the past year, will feel the double-whammy from the strength in the U.S. dollar and the spreading problems overseas.

Spanish banks cannot get funding and another Chinese bank regulator has warned in the past 24 hours of the growing risks from the country’s credit excesses. A disorderly unwinding of China’s credit and property bubble may well be the principal global macro risk for the remainder of the year. Indeed, perhaps the equity market finally realized yesterday that allowing China more control to defuse an internal property and credit bubble may well be a classic case of “be careful of what you wish for.”

The Bond Cycle and Deflation

I was at an event recently where I was able to see two legends among others – Louise Yamada and Gary Shilling. Louise made the point that while secular phases in the stock market generally last between 12 and 16 years, interest rate cycles tend to be much longer – anywhere from 22 to 37 years; and she has a chart back to 1790 to prove the point! So while all we ever hear is that this secular bull market in bonds is getting long in the tooth, having started in late 1981, it may not yet be over. After all, the deleveraging part of this cycle has really only just begun and if history is any guide, it has a good 5-6 years to go – at a time when practically every measure of underlying inflation is running south of 1%.

Double Dip, Anyone?

The data suggests that we are now seeing the consumer sputter with what looks like a very weak handoff into the third quarter. The housing sector is collapsing again. The export-import data are pointing to a sudden deceleration in two-way trade flows. Commercial real estate is dead in the water. Bank credit is in freefall right now.

There is still something left in the tank as far as capex and inventory investment is concerned, but by the fourth quarter, we could well be looking at a flat or even negative GDP print.

Even if we don’t get a double-dip recession, economic growth will probably be insufficient to absorb the still-large amount of excess capacity in the system. What that means is that the U.S. unemployment rate will remain high for as far as the eye can see. It also means that inflation and interest rates will remain low for a sustained period of time, and that a stock market priced for peak earnings in 2011 could be in for some disappointment.

Yield Curve as of 2010-06-22

click on chart for sharper image

The above chart shows Weekly Closing Yields.

The chart does not reflect inflation, inflation expectations, reflation, or an improving economy. It does reflect what one would see after a reflation effort that has failed.

Yet, equities are priced not only for reflation, but for a strong reflation at that. Either stocks or the yield curve is wrong. I suggest you pay attention to the yield curve.

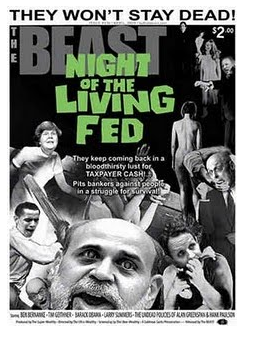

Picture credit: Jr. Deputy Accountant