Good morning to all. Today, we are looking to get involved with two new positions. Yesterday, we entered a weekly play with Lennar Corp. (LEN) for our Play of the Week at an averaged position of 14.68. The stock closed slightly down for us, but the position will be dependent today on existing home sales news. Our other open position in Jabil Circuit Inc. (JBL) we closed at 14.10 for a gain of 4% after opening it at 13.56. We also got stopped out on a Short Sale of Tesoro (TSO) and lost just over 3% after holding this one from Thursday through Monday. It was a 1/2 day, and we are looking to make 2/2 today.

at 14.10 for a gain of 4% after opening it at 13.56. We also got stopped out on a Short Sale of Tesoro (TSO) and lost just over 3% after holding this one from Thursday through Monday. It was a 1/2 day, and we are looking to make 2/2 today.

Let’s get into today’s picks…the picture on the left is a hint of why I like today’s buy…

Buy Pick of the Day: Jabil Circuit Inc. (JBL)

Analysis: Jabil Circuit was my Midterm Pick back on Wednesday that we were able to exit yesterday for 4%. The company has great potential for some very solid earnings coming out after today’s session, and after the downward movement the stock received yesterday to fall almost to the 12.56 range where I bought, it is a place to reenter moving into the close for today. Depending on the housing data that comes out at 10 AM and the movement of the stock, this could be just a single day hold or a hold through overnight.

I originally liked JBL at the 13.60 level because I thought it was undervalued for the type of earnings I was expecting from the stock and its industry’s success. JBL produces circuit boards and electronic devices for a number of companies across many fields. The company is looking to report earnings tonight at 0.34 EPS, which would be a 750% improvement from one year .png) ago, and if hit, it will be the company’s best earnings in over two years. The company got some bullish movement to end the week and through Monday, and I think it should happen one more time today.

ago, and if hit, it will be the company’s best earnings in over two years. The company got some bullish movement to end the week and through Monday, and I think it should happen one more time today.

JBL was originally overvalued when I liked it, and I had to wait for it to come down. Now, it has come down again, and we are setting a nice entry around yesterday’s close. The stock should be able to easily move to the 14.30s at a topping point, which is over 3% from the top of my entry range. This company will get growth because investors want to buy it at this discounted price as the company moves into turning a profit from one year ago. The entire sector has been doing fairly well in 2010 as companies are looking to up their game with the help of electronics.

Like I mentioned in my previous article, the company received an upgrade back in May for a "Buy" rating based on the fact that the sector for electronics looked strong, and JBL appeared undervalued. Last night, in after hours, additionally, JBL jumped 2.5% after closing downwards. Every time this stock moves down, it gets pumped back up over the past week. We will definitely want to try and get involved at the beginning of the day if we can. If it opens outside of the range and does not fall back down into it, then we will wait towards the end of the day before getting into it, around 2 PM for an Overnight Trade.

Since JBL reported earnings in March, all eight other major printed circuit board companies reported earnings beats. And as I said before:

"The company has seen a number of new deals being brokered throughout this year, and it is expecting a rise of revenue up to 10% sequentially from Q2 to Q3. The company has its revenue estimates at $310 – $330 billion, and current EPS projections are at $320 billion. If the company can beat that then they will blow the EPS estimates out of the water. I think the stock, if it can get some dip, will definitely have some potential going into next week. The industry is looking strong, and JBL is looking for one of its best quarters in years."

Entry: We are looking to enter JBL at 13.65 – 13.80, if not reached than a 2 PM entry.

Exit: We are looking for a 2-3% gain or to hold overnight.

Stop Loss: 3% on bottom.

Short Sale of the Day: Ariba Inc. (ARBA)

Short Sale of the Day: Ariba Inc. (ARBA)

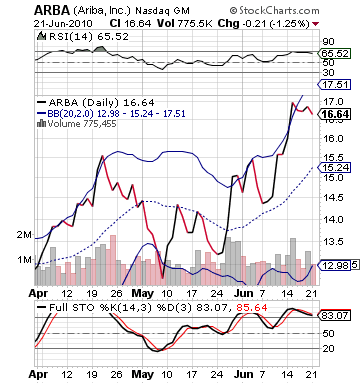

Analysis: Nothing like taking a bold step and upgrading a company after its moved just under 30% in the past four weeks. Ariba Inc., constructed a organizational tool and software for companies to manage expenses and spending and allows companies to work with other companies for supply, sourcing, and trading. They were upgraded this morning by JP Morgan (JPM). The company raised its price target on ARBA to $20 per share.

Marketwatch commented that the reason for the upgrade was because JP Morgan expects that more customers will come to Ariba in 2010, the company can charge higher fees, and has lots of room to expand. As the industry for software stabilizes and grows, ARBA could be a big hit coming out of the Recession.

This sounds like very sound reasoning to me, and it may happen. The stock, in the short term, however, is overvalued. ARBA has risen 30% in four weeks. It is overbought, overvalued, and at the top of its bollinger bands. The upgrade will take the company all the way to the top of its bands most likely as the stock saw nearly 4% gains in pre-market trading. I have put my entry range near the top of the bands with room for this one to grow out of the gate. I think it will definitely get hit back down by a market that is looking so-so to start the day with futures down, Europe scares, and questions on housing.

We want this one to get some gains to start the day before it tops out. Watch closely for a top out this morning and the 10 AM news on housing.

Entry: We are looking to short sale ARBA at 17.22 – 17.39.

Exit: We are looking to cover on a 2-3% gain on bottom.

Stop Buy: 3% on top of entry of entry.

Good Investing,

David Ristau