We have four longterm investments that we have taken up thus far: Trina Solar (TSL), China Automotive Systems (CAAS), Nordstrom (JWN), and Green Mountain Coffee Roasters (GMCR). I have a new position that I would like to add to the list today. Once again, we are moving into the auto parts sector for today’s long term investment, but we are looking at an established American auto parts maker that has some great opportunity moving forward.

Long Term Investment: Johnson Controls Inc.

Profile: Johnson Controls Inc. is a three-pronged American auto parts maker. The company operates a building  efficiency segment, automotive experience segment, and power solutions unit. The efficiency segment that produces air conditioning, controls, and security equipment maker. The automotive experience segment designs and manufactures interior products as well as designs and manufacture cockpit, overhead, and door systems. Finally, the power solutions unit makes car batteries. The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin.

efficiency segment, automotive experience segment, and power solutions unit. The efficiency segment that produces air conditioning, controls, and security equipment maker. The automotive experience segment designs and manufactures interior products as well as designs and manufacture cockpit, overhead, and door systems. Finally, the power solutions unit makes car batteries. The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin.

Thesis

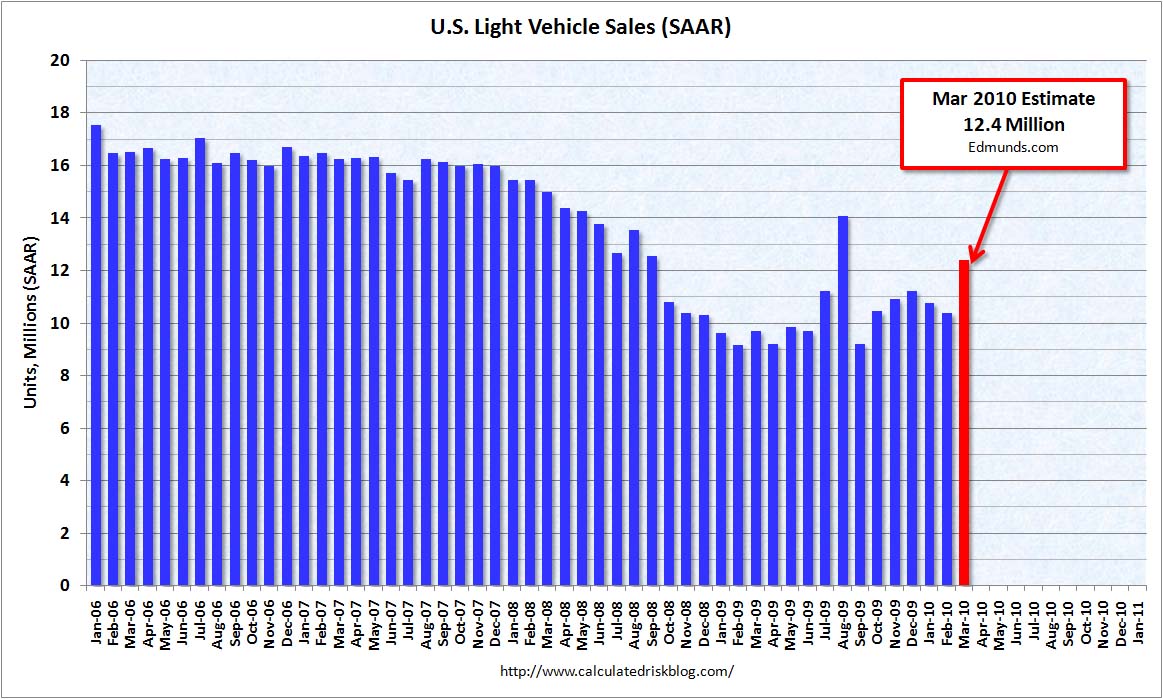

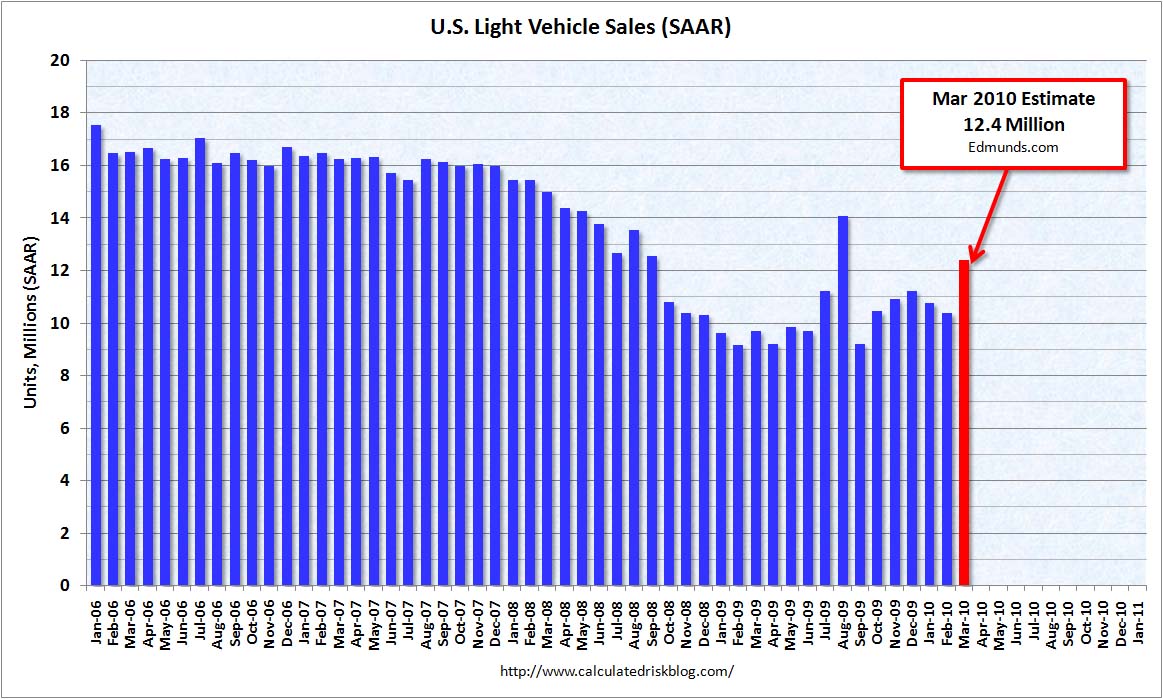

The automotive industry was crippled during the Great Recession that hurt automotive sales around the world as consumers avoided big-ticket items. Auto sales declined heavily and forced many automakers and auto parts companies to cut supplies, jobs, and take on losses. Yet, as the country creeps out of the recession, auto sales are starting to recover in 2010, and one auto parts company in the USA looks poised to take advantage of the resurgence in the American market and its positioning in the growing Chinese automotive market. Celebrating its 125th Anniversary, Johnson Controls Inc. appears poised for significant growth.

The American auto market has seen great recovery thus far in the USA. In May 2010, automotive sales rose for every company in America more than 17% besides Toyota. Chrysler rose over 30%, and Ford’s 22% was the sixth straight month of 20% rises for Ford. The annualized rate of sales in the USA is estimated now at 11.4 million, which is much greater than the

10.3 million in 2010. Many estimates have US sales increasing to 20 million by 2015. Johnson Controls is at the forefront of this uptick in sales. The company supplies auto parts to every American company. Additionally, the company is working hard to break into the other growing market of China.

The Chinese industry became the leader of automotive sales in 2010, and it looks poised to continue to grow throughout the coming years. Chinese auto sales are estimated to grow 55% by 2015, according to

JDPower.com, from nearly 9 million to over 13.5 million sales. Johnson Controls has recognized the future and opportunity in China, and the company will build three to four new plants by 2015. The company wants to be able to produce 30 million batteries by 2015. The company wants to be able to take advantage of the growing Chinese market, and the company has great avenues of entry into the market with American companies GM and Ford already being in the country.

The company saw great revenue growth from 2000 – 2008, more than doubling in size from $17 billion to over $38 billion. The company took a dip in 2009 back below $30 billion but has recovered back to a TTM in 2010 of $31 billion. There is no reason to believe that the company cannot make its move back to where it was in 2008 and continue to grow on from that level. The company’s growth in China will be able to add more revenues onto the top of the 2008 levels.

One of the best signs for Johnson is that margins are starting to improve. The company saw its gross margins dip in 2009 to 12.5% from 14.5% in 2008. Yet, in 2010, margins are already breaking the 14% level again. Operating margins increased to over 3% so far in 2010 – back to 2008 levels. These increasing margins is showing some great signs that the company is really being able to recover and is back on track. Further, the company has been able to maintain free cash flow even during the recession. In fact, the company has over $1.5 billion in cash flow in 2010’s TTM. That is the highest amount of free cash flow the company has had ever. This cash flow is important for an auto supplier to be able continually research new products and open new distribution channels throughout China. As the company sees continual increase in sales volume it will need good cash flow and working capital. These two factors will help the company remain financially healthy and be able to take advantage of the cyclical nature of the automotive industry.

The latest quarter of 2010 was another bright spot for Johnson Controls. The company saw its earnings grow 222% year-over-year for the Q2 FY 2010, and the company saw its gross margins come up to 14.7%. The company increased its revenue

32% and increased its future growth. That sort of growth obviously will be tough to continue in the long term, but there is no reason to expect anything but more growth. The fact of the matter is that even slowed growth will be good for JCI. The company’s P/E is only 15.78, so good earnings will really help to move this one upwards.

Competition for Johnson Controls comes from a number of companies in Magna International, BorgWarner, and TRW. Yet, Johnson is very specialized in its three-pronged approach and has historical standings with the companies its supplies. The competition, therefore, is there, but the company has proven results with its consumers. The company has some pretty heavy competition in the battery market, and in Asia, the nation faces a number of established Asian companies.

Valuation

My fair value estimate for Johnson Controls Inc. (JCI) is $46.25 per share based on a discounted cash-flow analysis. The company had seen incredible growth in its operating income in the eight years leading up to 2006, and there is really no worry that the industry cannot continue to grow as demand continues to grow in Americas, China and other markets. Given the development of new markets, the company’s wide distribution market, and development into new markets, the company is continuing to offer growth in its revenue. My estimated available cash flow starts at $1.1 billion for this year, which is somewhat cautious against already established estimates that are at $1.5 billion.

Risk

Risk is low with Johnson Controls. The company is the leader in auto parts, and the company has a great future as recovery hits the USA. Further, as the company enters into China, the company has terrific avenues with already established

companies in which they are involved. The company will need to continue to grow its margins, reduce its short term debt, and continue to operate under its similar recipe for success it has had for the past 125 years.

Management & Stewardship

The company’s President, Chairman, and CEO is Stephen Roell. He has been with the company since 1982 and was elected CEO in 2007. Roell signicantly reduced his compensation in 2009 with the decline of the company. Roell’s position as all three leadership roles is very worrisome for me because we would like to see a seperation between the roles.

Entry: We are looking to enter at 27.35 – 27.60

Target Price: Our target entry is at 45 – 46.

Good Investing,

David Ristau

efficiency segment, automotive experience segment, and power solutions unit. The efficiency segment that produces air conditioning, controls, and security equipment maker. The automotive experience segment designs and manufactures interior products as well as designs and manufacture cockpit, overhead, and door systems. Finally, the power solutions unit makes car batteries. The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin.

efficiency segment, automotive experience segment, and power solutions unit. The efficiency segment that produces air conditioning, controls, and security equipment maker. The automotive experience segment designs and manufactures interior products as well as designs and manufacture cockpit, overhead, and door systems. Finally, the power solutions unit makes car batteries. The company was founded in 1885 and has its headquarters in Milwaukee, Wisconsin. 10.3 million in 2010. Many estimates have US sales increasing to 20 million by 2015. Johnson Controls is at the forefront of this uptick in sales. The company supplies auto parts to every American company. Additionally, the company is working hard to break into the other growing market of China.

10.3 million in 2010. Many estimates have US sales increasing to 20 million by 2015. Johnson Controls is at the forefront of this uptick in sales. The company supplies auto parts to every American company. Additionally, the company is working hard to break into the other growing market of China. 32% and increased its future growth. That sort of growth obviously will be tough to continue in the long term, but there is no reason to expect anything but more growth. The fact of the matter is that even slowed growth will be good for JCI. The company’s P/E is only 15.78, so good earnings will really help to move this one upwards.

32% and increased its future growth. That sort of growth obviously will be tough to continue in the long term, but there is no reason to expect anything but more growth. The fact of the matter is that even slowed growth will be good for JCI. The company’s P/E is only 15.78, so good earnings will really help to move this one upwards. companies in which they are involved. The company will need to continue to grow its margins, reduce its short term debt, and continue to operate under its similar recipe for success it has had for the past 125 years.

companies in which they are involved. The company will need to continue to grow its margins, reduce its short term debt, and continue to operate under its similar recipe for success it has had for the past 125 years.