Last week was another great week for us. We had a sad ending to it with a couple misses, but it was still another good week overall. This week, the market is looking to get July started in the right direction. The market is looking to start off  this week correctly with a good Monday that will be led by news from the G-20, personal spending and income, and foreign results. Our only open position left open for the week is Micron Technology (MU). We opened a position at 9.66 on Thursday, and the stock ended down about 2% on Friday. I am expecting a big day on Monday before after hours earnings, and we should get some great earnings for MU.

this week correctly with a good Monday that will be led by news from the G-20, personal spending and income, and foreign results. Our only open position left open for the week is Micron Technology (MU). We opened a position at 9.66 on Thursday, and the stock ended down about 2% on Friday. I am expecting a big day on Monday before after hours earnings, and we should get some great earnings for MU.

Let’s get to today’s plays and a weekly update from last week follows…

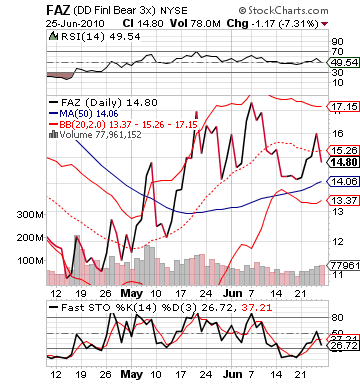

Buy Pick of the Day: Direxion Daily FInancial Bear ETF 3x (FAZ)

Analysis: The market was looking strong moving into important economic data this morning on great news that the G-20 that leaders are agreeing to work to cut budget deficits. Yet, the "air" of political candidates met nothing when it came to economic data. We got a mixed set of reports to start the week on personal income, spending, and savings. Personal income rose 0.4% from April’s levels, but economists were expecting a 0.5% increase. Personal spending did rise from April levels (0.3% vs. 0.1% expectations), but it was most likely overshadowed by a 4% increase in personal savings from April. The signs are there that people are making more money, but they are still very reluctant to put their disposable income into spending over savings.

On another sad note, Senator Robert Byrd died last night. The news is not good for the passage of the financial reform bill, and it should have a negative effect on financial stocks. The bill’s not passing is good for financials, but it will pass eventually. Now that the bill is stuck, it will most likely burden stocks. Especially after the rise financials got Friday from news that the bill would not hurt them as much, today we should see a healthy pullback. Direxion Daily Financial Bear ETF 3x (FAZ) dropped 7% on Friday in value, and with the market turning sour after the release of the economic data, FAZ now has some fuel to fire it upwards.

The market is also getting bad signs from the oil market and gold futures both being down as well. The only really solid news on the shelf is that iPhone sales are through the roof. Yet, it is no match for the macro indicators that are pointing to yet still a very slow recovery. We are moving upwards, but it is not fast. FAZ, therefore, should take hold and make a move upwards today as the market does not look strong enough to hold onto Friday’s uptick.

Technically, FAZ’s move backwards on Friday put it closer to its lower band than upper band, and it moved its RSI to just around fair valued. The stock remains oversold in the longer term, but fast stochastics had moved into the overbought category. The quick finish to the week turned fast stochastics back downwards. The ETF, therefore, is showing the signs that it was doing nicely and suffered a setback. A lot of short term buyers left it on Friday, but with the downward momentum, I expect them to return today.

Get involved early!

Entry: We are looking to buy at 14.86 – 15.00.

Exit: We are looking to gain 2-3%

Stop Loss: 3% on bottom.

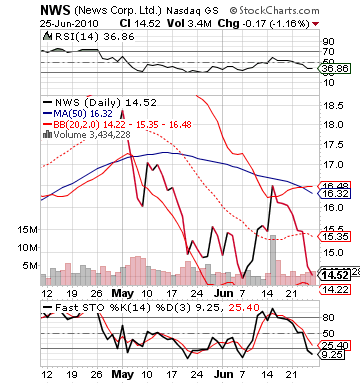

Short Sale of the Day: News Corp. (NWS)

Analysis: News Corp. (NWS) is likely to suffer a setback today after two rather bearish stories came out over the  weekend and today. For one, News Corp. owns 20th Century Fox. The company released a box-office dud this weekend in the star laden Knight and Day with Tom Cruise and Cameron Diaz. This weekend was a big one for the box-office between Toy Story 3, Grown Ups, and Knight and Day. One of the movies had to have a week showing, and it was the one that I think ran the most advertisements. Knight and Day only made $20 million in its box office premiere.

weekend and today. For one, News Corp. owns 20th Century Fox. The company released a box-office dud this weekend in the star laden Knight and Day with Tom Cruise and Cameron Diaz. This weekend was a big one for the box-office between Toy Story 3, Grown Ups, and Knight and Day. One of the movies had to have a week showing, and it was the one that I think ran the most advertisements. Knight and Day only made $20 million in its box office premiere.

That placed the movie at third place. The scary thing about the movie is that it was Tom Cruise’s worst opener since Days of Thunder (not adjusted for inflation). The movie got a "rotten" rating, and it appears to be a just terrible movie. This is a hit to NWS because the company is the parent of distribution, and it is making way under what the movie was expected. Cruise alone is estimated to have made more than $20 million for the film.

Secondly, News Corp. announced that they are now being forced out of Fiji. The company’s Fiji Times is no longer allowed to be produced as the company’s military regime is taking over media outlets that are private. The company will lose 180 jobs from the news, and there is no talk on any reimbursement for the trouble. Another red spot on the old balance sheet for News  Corp.

Corp.

These two stories along with the troubling market outlook look like two too many reason to sell off NWS today, and we want to take part.

The stock is already in a sever downward pattern ever since it got rejected by British Sky for a buyout at $11 billion. Yet, this is good for us. There is no good news, whatsoever, out there for News Corp., and its overselling should continue as it is in a steep decline. There is still room to the bottom, and it is looking to bottom out in the low 14s to high 13s, which should put us right in the money.

Entry: We are looking to short sell at 14.30 – 14.15.

Exit: Gain of 2-3% to cover.

Stop Buy: 3% on top.

Weekly Update:

We made eight positions for the week. We closed six positions, and four of those were winners.

Winners of the Week:

Lennar Corp. (LEN) – Lennar was our Play of the Week from last week. We liked this company because we were expecting some great earnings, and I thought the company would get some great buzz moving into earnings. Unfortunately, it was one of the worst weeks for a housing play as May new sales and existing home sales came out much worse than expected. We got involved at 14.68 on Monday. We saw the stock dip on Tuesday and Wednesday, but the company reported huge profits while expectations were for no profits at all for the company. We were able to regain our losses and exit for a 2.5% gain at 15.05.

Jabil Circuit (JBL) – We played Jabil twice for two great gains. We got involved with it two Thursdays ago for a sweet 4% gain, but the real success when we played this one on Tuesday to Wednesday for JBL’s earnings. We got involved at 13.80 on Tuesday, and we exited on Wednesday at 14.88 for a gain of 7.8%. The company also had exceptional earnings, hitting an EPS of 0.40 vs. the expected 0.33.

Ariba Inc. (ARBA) – A business solutions company that we short sold on Tuesday. We got involved at 17.42 and exited at 16.90 allowing us a gain of 3%. We liked the company because it was overvalued and had moved too high after an upgrade. The company moved down throughout the day.

Discover Financial Services inc. (DFS) – On Wednesday, we got into another Overnight Trade with DFS. The company was another big winner as the company reported a great quarter. We were expecting an earnings beat as the credit card industry was showing great signs of recovery. The company reported earnings at 0.33 while expectations were 0.11. We got in at 13.80 on Wednesday and exited at 14.42 on Thursday.

Losers:

We had a rough day on Thursday after DFS and LEN’s exits.

JCG – It was a rough day for the market as it dropped significantly throughout the day. I had been expecting big gains for J. Crew after the stock got an upgrade from Oppenheimer. Yet, it was a bad day for the market, and we we got stopped out for a 3% loss. We got involved at 39.75.

ERY – Another mistake for the day. We got involved at 11, and we were short selling. The stock moved up as oil moved down on Thursday. We got a 3% loss on the short.

Long Term Investments:

Johnson Controls – We entered on Friday at 27.56, and the stock is up 1% already.

Trina Solar – Entry: 17.56, Current Position: 18.33

Green Mountain Coffee Roasters – Entry: 24.05, Current Position: 27.21

Nordstrom – Entry: 38.65, Current Postion: 35.54

China Automotive – Entry: 18.30, Current Position: 19.17

Good Investing,

David Ristau